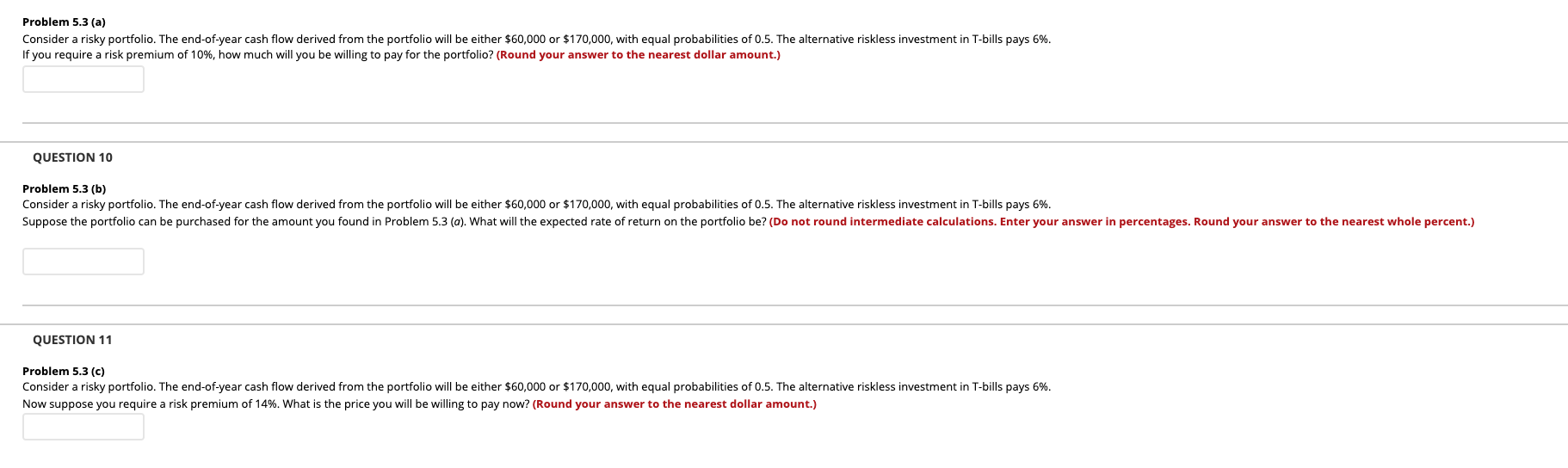

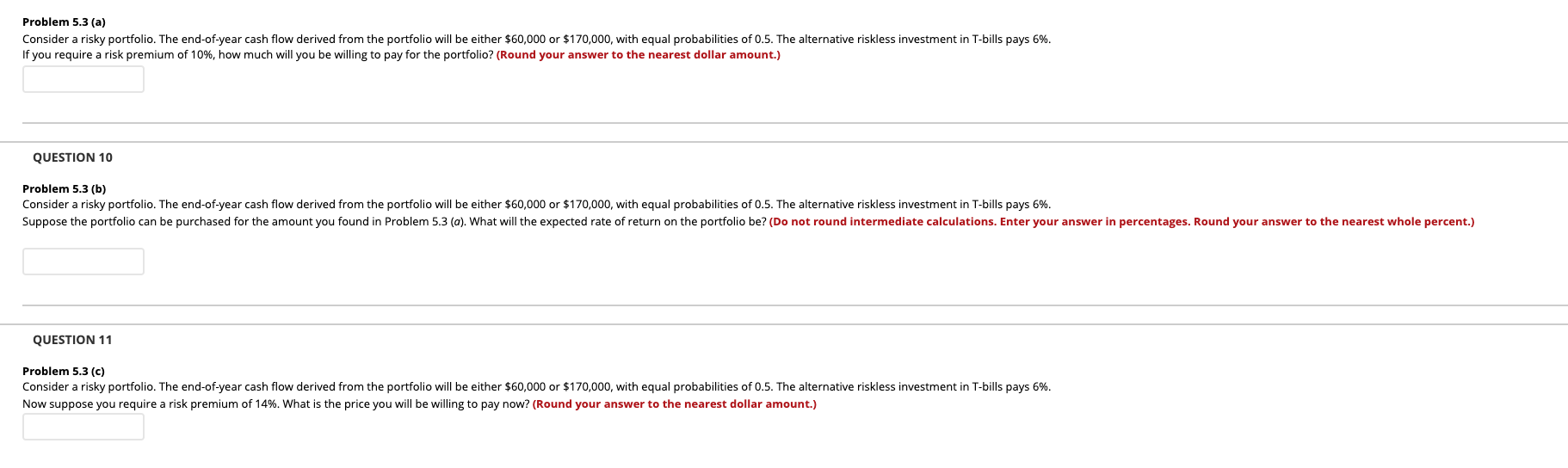

Problem 5.3 (a) Consider a risky portfolio. The end-of-year cash flow derived from the portfolio will be either $60,000 or $170,000, with equal probabilities of 0.5. The alternative riskless investment in T-bills pays 6%. If you require a risk premium of 10%, how much will you be willing to pay for the portfolio? (Round your answer to the nearest dollar amount.) QUESTION 10 Problem 5.3 (b) Consider a risky portfolio. The end-of-year cash flow derived from the portfolio will be either $60,000 or $170,000, with equal probabilities of 0.5. The alternative riskless investment in T-bills pays 6%. Suppose the portfolio can be purchased for the amount you found in Problem 5.3 (a). What will the expected rate of return on the portfolio be? (Do not round intermediate calculations. Enter your answer in percentages. Round your answer to the nearest whole percent.) QUESTION 11 Problem 5.3 (c) Consider a risky portfolio. The end-of-year cash flow derived from the portfolio will be either $60,000 or $170,000, with equal probabilities of 0.5. The alternative riskless investment in T-bills pays 6%. Now suppose you require a risk premium of 14%. What is the price you will be willing to pay now? (Round your answer to the nearest dollar amount.) Problem 5.3 (a) Consider a risky portfolio. The end-of-year cash flow derived from the portfolio will be either $60,000 or $170,000, with equal probabilities of 0.5. The alternative riskless investment in T-bills pays 6%. If you require a risk premium of 10%, how much will you be willing to pay for the portfolio? (Round your answer to the nearest dollar amount.) QUESTION 10 Problem 5.3 (b) Consider a risky portfolio. The end-of-year cash flow derived from the portfolio will be either $60,000 or $170,000, with equal probabilities of 0.5. The alternative riskless investment in T-bills pays 6%. Suppose the portfolio can be purchased for the amount you found in Problem 5.3 (a). What will the expected rate of return on the portfolio be? (Do not round intermediate calculations. Enter your answer in percentages. Round your answer to the nearest whole percent.) QUESTION 11 Problem 5.3 (c) Consider a risky portfolio. The end-of-year cash flow derived from the portfolio will be either $60,000 or $170,000, with equal probabilities of 0.5. The alternative riskless investment in T-bills pays 6%. Now suppose you require a risk premium of 14%. What is the price you will be willing to pay now? (Round your answer to the nearest dollar amount.)