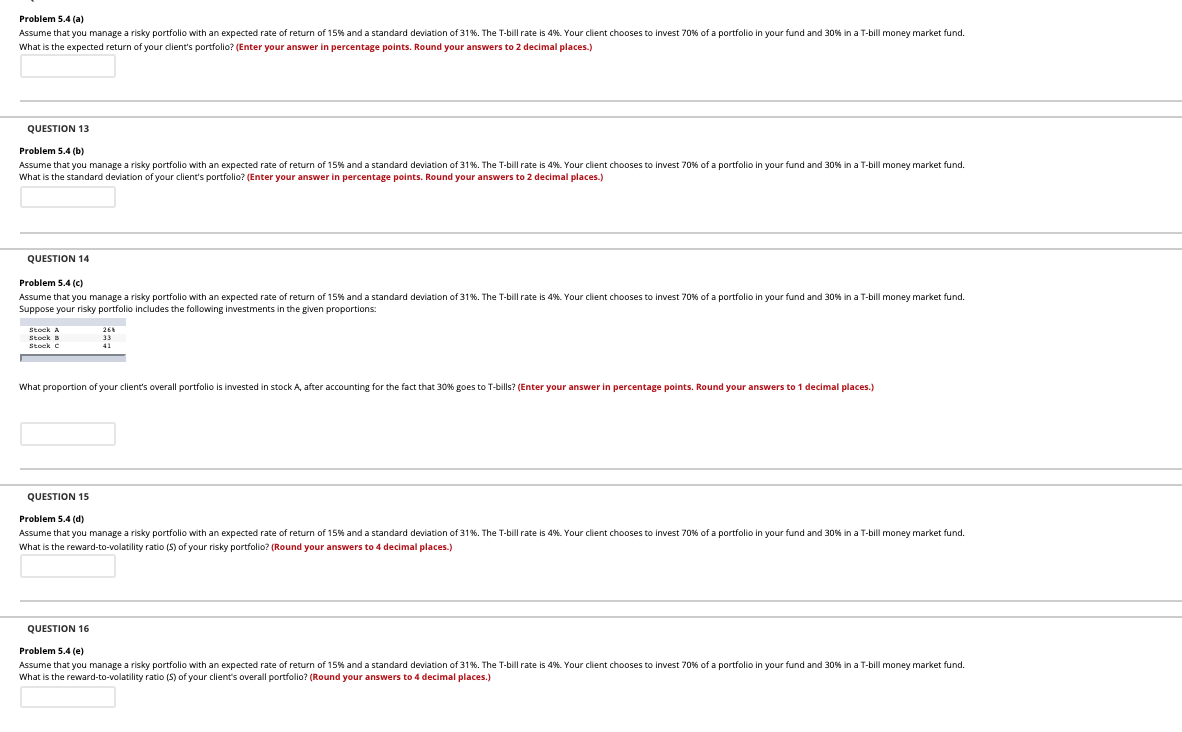

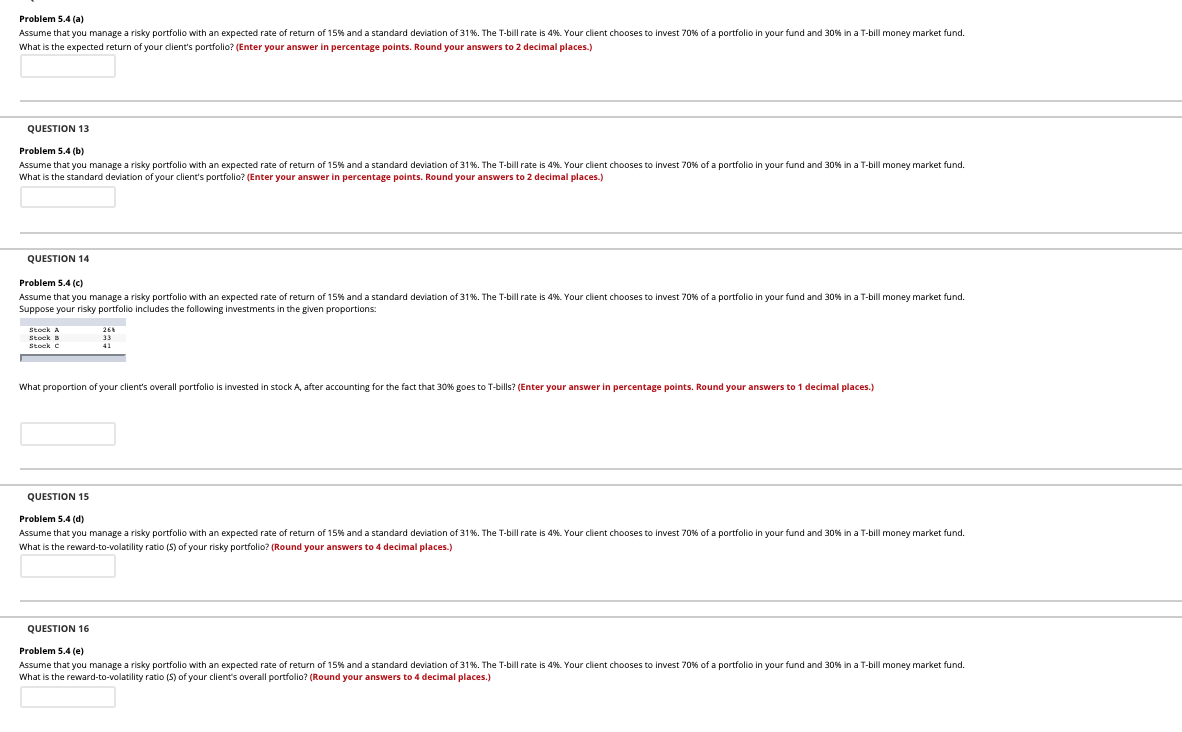

Problem 5.4 (a) Assume that you manage a risky portfolio with an expected rate of return of 15% and a standard deviation of 31%. The T-bill rate is 4%. Your client chooses to invest 70% of a portfolio in your fund and 30% in a T-bill money market fund. What is the expected return of your client's portfolio? (Enter your answer in percentage points. Round your answers to 2 decimal places.) QUESTION 13 Problem 5.4 (b) Assume that you manage a risky portfolio with an expected rate of return of 15% and a standard deviation of 31%. The T-bill rate is 4%. Your client chooses to invest 70% of a portfolio in your fund and 30% in a T-bill money market fund. What is the standard deviation of your client's portfolio? (Enter your answer in percentage points. Round your answers to 2 decimal places.) QUESTION 14 Problem 5.4(c) Assume that you manage a risky portfolio with an expected rate of return of 15% and a standard deviation of 31%. The T-bill rate is 4%. Your client chooses to invest 70% of a portfolio in your fund and 30% in a T-bill money market fund. Suppose your risky portfolio Includes the following investments in the given proportions: Steek A Steek 3 Steek c 35 What proportion of your client's overall portfolio is invested in stock A, after accounting for the fact that 30% goes to T-bills? (Enter your answer in percentage points. Round your answers to 1 decimal places.) QUESTION 15 Problem 5.4 (d) Assume that you manage a risky portfolio with an expected rate of return of 15% and a standard deviation of 31%. The T-bill rate is 4%. Your client chooses to invest 70% of a portfolio in your fund and 30% in a T-bill money market fund. What is the reward-to-volatility ratio (s) of your risky portfolio? (Round your answers to 4 decimal places.) QUESTION 16 Problem 5.4(e) Assume that you manage a risky portfolio with an expected rate of return of 15% and a standard deviation of 31%. The T-bill rate is 4%. Your client chooses to invest 70% of a portfolio in your fund and 30% in a T-bill money market fund. What is the reward-to-volatility ratio (s) of your client's overall portfolio? (Round your answers to 4 decimal places.)