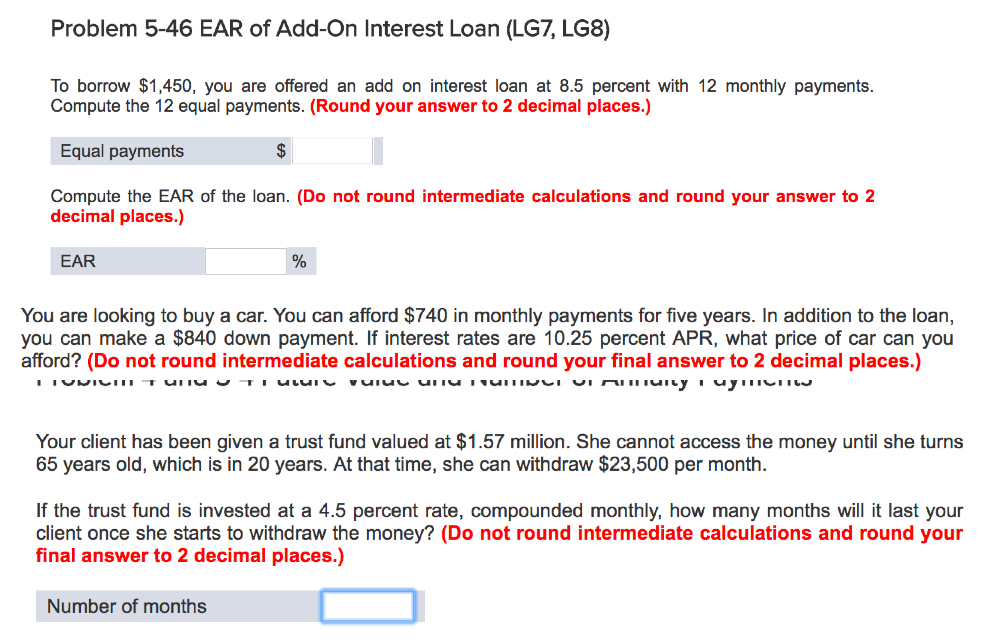

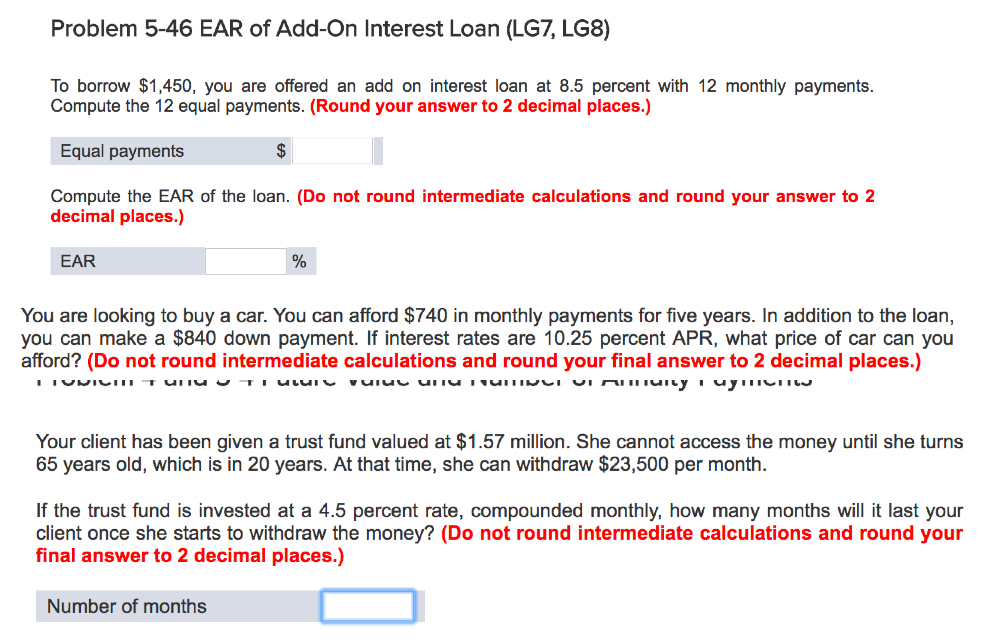

Problem 5-46 EAR of Add-On Interest Loan (LG7, LG8) To borrow $1,450, you are offered an add on interest loan at 8.5 percent with 12 monthly payments. Compute the 12 equal payments. (Round your answer to 2 decimal places.) Equal payments Compute the EAR of the loan. (Do not round intermediate calculations and round your answer to 2 decimal places.) You are looking to buy a car. You can afford $740 in monthly payments for five years. In addition to the loan, you can make a $840 down payment. If interest rates are 10.25 percent APR, what price of car can you afford? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Your client has been given a trust fund valued at $1.57 million. She cannot access the money until she turns 65 years old, which is in 20 years. At that time, she can withdraw $23,500 per month. If the trust fund is invested at a 4.5 percent rate, compounded monthly, how many months will it last your client once she starts to withdraw the money? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Number of months Problem 5-46 EAR of Add-On Interest Loan (LG7, LG8) To borrow $1,450, you are offered an add on interest loan at 8.5 percent with 12 monthly payments. Compute the 12 equal payments. (Round your answer to 2 decimal places.) Equal payments Compute the EAR of the loan. (Do not round intermediate calculations and round your answer to 2 decimal places.) You are looking to buy a car. You can afford $740 in monthly payments for five years. In addition to the loan, you can make a $840 down payment. If interest rates are 10.25 percent APR, what price of car can you afford? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Your client has been given a trust fund valued at $1.57 million. She cannot access the money until she turns 65 years old, which is in 20 years. At that time, she can withdraw $23,500 per month. If the trust fund is invested at a 4.5 percent rate, compounded monthly, how many months will it last your client once she starts to withdraw the money? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Number of months