problem 5.6 the other part

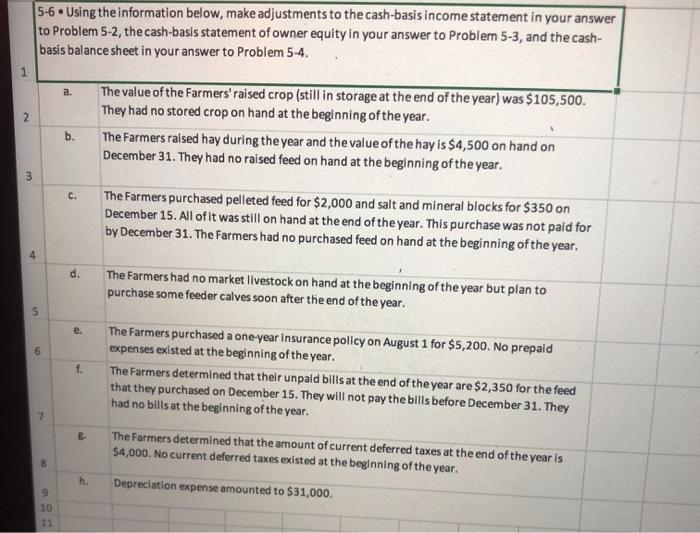

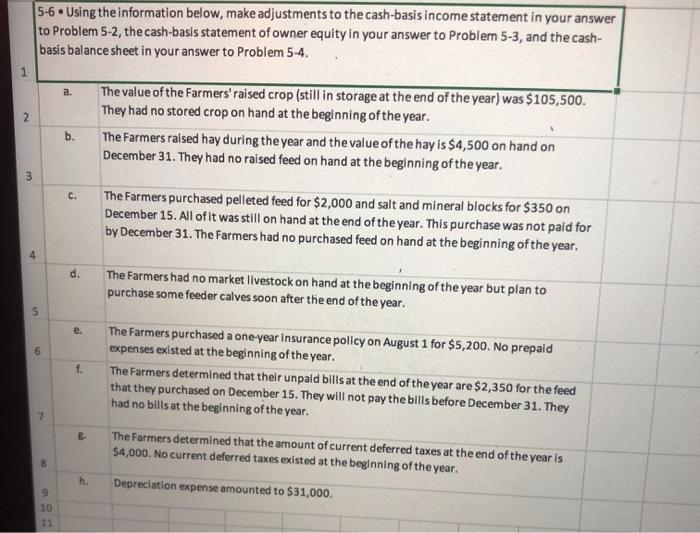

a. 5-7. Using the answers to Problem 5-6 and the market value information below, prepare market-based financial statements. The Farmers purchased pelleted feed for $2,000 and salt and mineral blocks for$350 on December 15. All of it was still on hand at the end of the year. The market value of the pelleted feed was $2,500 at the end of the year. The market value of the salt and mineral blocks was similar to the purchase price of $350. The Farmers had no purchased feed on hand at the beginning of the year. 2 b. The market values of the Farmers' non-current assets were as follows at the end of the year: 3 4 5 6 7 B 9 C. The Farmers determined that $5,290 is the amount of the second component of non-current deferred taxes at the end of the year. Non-current deferred taxes did not exist at the beginning of the year 10 5-6. Using the information below, make adjustments to the cash-basis income statement in your answer to Problem 5-2, the cash-basis statement of owner equity in your answer to Problem 5-3, and the cash- basis balance sheet in your answer to Problem 5-4. a. N The value of the Farmers'raised crop (still in storage at the end of the year) was $105,500. They had no stored crop on hand at the beginning of the year. The Farmers raised hay during the year and the value of the hay is $4,500 on hand on December 31. They had no raised feed on hand at the beginning of the year. b. 3 C. The Farmers purchased pelleted feed for $2,000 and salt and mineral blocks for $350 on December 15. All of it was still on hand at the end of the year. This purchase was not paid for by December 31. The Farmers had no purchased feed on hand at the beginning of the year. 4 d. The Farmers had no market livestock on hand at the beginning of the year but plan to purchase some feeder calves soon after the end of the year. 5 e. 6 f. The Farmers purchased a one-year insurance policy on August 1 for $5,200. No prepaid expenses existed at the beginning of the year. The Farmers determined that their unpaid bills at the end of the year are $2,350 for the feed that they purchased on December 15. They will not pay the bills before December 31. They had no bills at the beginning of the year. The Farmers determined that the amount of current deferred taxes at the end of the year is $4,000. No current deferred taxes existed at the beginning of the year. 5 h. Depreciation expense amounted to $31,000. 9 10 a. 5-7. Using the answers to Problem 5-6 and the market value information below, prepare market-based financial statements. The Farmers purchased pelleted feed for $2,000 and salt and mineral blocks for$350 on December 15. All of it was still on hand at the end of the year. The market value of the pelleted feed was $2,500 at the end of the year. The market value of the salt and mineral blocks was similar to the purchase price of $350. The Farmers had no purchased feed on hand at the beginning of the year. 2 b. The market values of the Farmers' non-current assets were as follows at the end of the year: 3 4 5 6 7 B 9 C. The Farmers determined that $5,290 is the amount of the second component of non-current deferred taxes at the end of the year. Non-current deferred taxes did not exist at the beginning of the year 10 5-6. Using the information below, make adjustments to the cash-basis income statement in your answer to Problem 5-2, the cash-basis statement of owner equity in your answer to Problem 5-3, and the cash- basis balance sheet in your answer to Problem 5-4. a. N The value of the Farmers'raised crop (still in storage at the end of the year) was $105,500. They had no stored crop on hand at the beginning of the year. The Farmers raised hay during the year and the value of the hay is $4,500 on hand on December 31. They had no raised feed on hand at the beginning of the year. b. 3 C. The Farmers purchased pelleted feed for $2,000 and salt and mineral blocks for $350 on December 15. All of it was still on hand at the end of the year. This purchase was not paid for by December 31. The Farmers had no purchased feed on hand at the beginning of the year. 4 d. The Farmers had no market livestock on hand at the beginning of the year but plan to purchase some feeder calves soon after the end of the year. 5 e. 6 f. The Farmers purchased a one-year insurance policy on August 1 for $5,200. No prepaid expenses existed at the beginning of the year. The Farmers determined that their unpaid bills at the end of the year are $2,350 for the feed that they purchased on December 15. They will not pay the bills before December 31. They had no bills at the beginning of the year. The Farmers determined that the amount of current deferred taxes at the end of the year is $4,000. No current deferred taxes existed at the beginning of the year. 5 h. Depreciation expense amounted to $31,000. 9 10

problem 5.6 the other part

problem 5.6 the other part