Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 5-A Accounting Principles I (ACC 111) Accounting for Merchandising Businesses (Chapter 5) Homework Problems Calculating Merchandise Income Statement Amounts The following data was

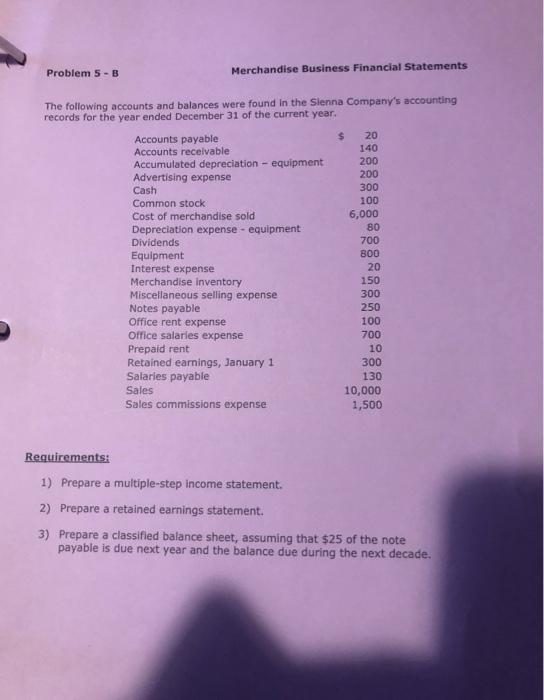

Problem 5-A Accounting Principles I (ACC 111) Accounting for Merchandising Businesses (Chapter 5) Homework Problems Calculating Merchandise Income Statement Amounts The following data was taken from the accounting records of Cornflower Company for the month ended December 31 of the current year. Merchandise Inventory, December 1 Merchandise inventory, December 31 Purchases Purchases returns Purchases discounts Sales Freight-in $ 9,000 5,000 87,000 3,000 1,000 200,000 2,000 Requirements: 5) Calculate Cornflower's cost of merchandise purchased for December. 6) Calculate Cornflower's cost of merchandise sold for December. 7) Calculate Cornflower's gross profit for December. Problem 5-B Merchandise Business Financial Statements The following accounts and balances were found in the Sienna Company's accounting records for the year ended December 31 of the current year. Accounts payable Accounts receivable Accumulated depreciation - equipment Advertising expense Cash Common stock Cost of merchandise sold Depreciation expense equipment Dividends Equipment Interest expense Merchandise inventory Miscellaneous selling expense Notes payable Office rent expense Office salaries expense Prepaid rent Retained earnings, January 1 Salaries payable Sales Sales commissions expense $ 20 140 200 200 300 100 6,000 80 700 800 20 150 300 250 100 700 10 300 130 10,000 1,500 Requirements: 1) Prepare a multiple-step income statement. 2) Prepare a retained earnings statement. 3) Prepare a classified balance sheet, assuming that $25 of the note payable is due next year and the balance due during the next decade.

Step by Step Solution

★★★★★

3.53 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Answer Explanation 5B 5A 5 CALACULATION OF MERCHAN...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started