Question: PROBLEM 6 - 3 Discontinued Operations CHECK 2 0 1 2 Income from continuing operations, ( $ 1 6 7 ) The

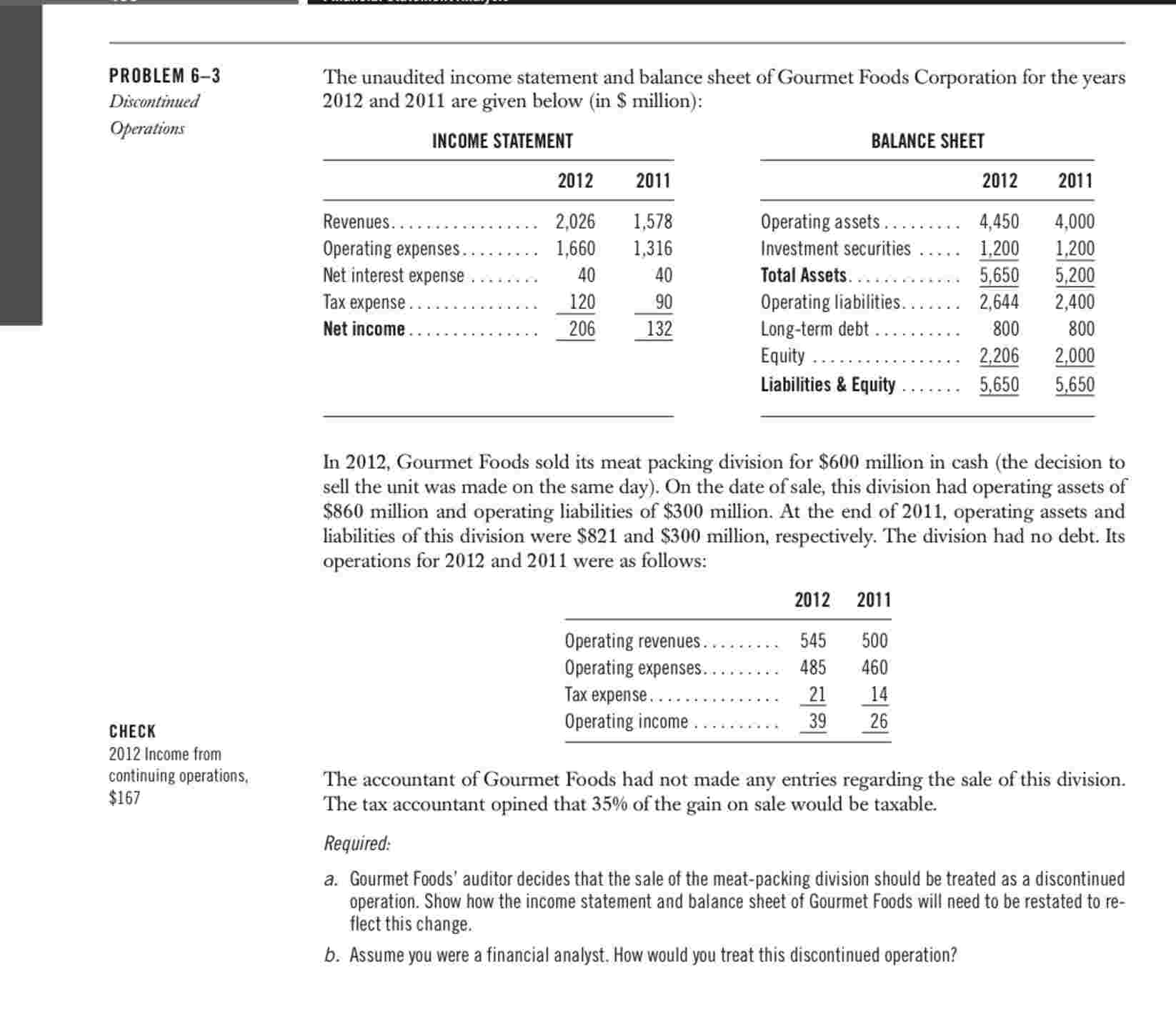

PROBLEM Discontinued Operations CHECK Income from continuing operations, $ The unaudited income statement and balance sheet of Gourmet Foods Corporation for the years and are given below in $ million: BALANCE SHEET In Gourmet Foods sold its meat packing division for $ million in cash the decision to sell the unit was made on the same day On the date of sale, this division had operating assets of $ million and operating liabilities of $ million. At the end of operating assets and liabilities of this division were $ and $ million, respectively. The division had no debt. Its operations for and were as follows: The accountant of Gourmet Foods had not made any entries regarding the sale of this division. The tax accountant opined that of the gain on sale would be taxable. Required: a Gourmet Foods' auditor decides that the sale of the meatpacking division should be treated as a discontinued operation. Show how the income statement and balance sheet of Gourmet Foods will need to be restated to reflect this change. b Assume you were a financial analyst. How would you treat this discontinued operation?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock