Answered step by step

Verified Expert Solution

Question

1 Approved Answer

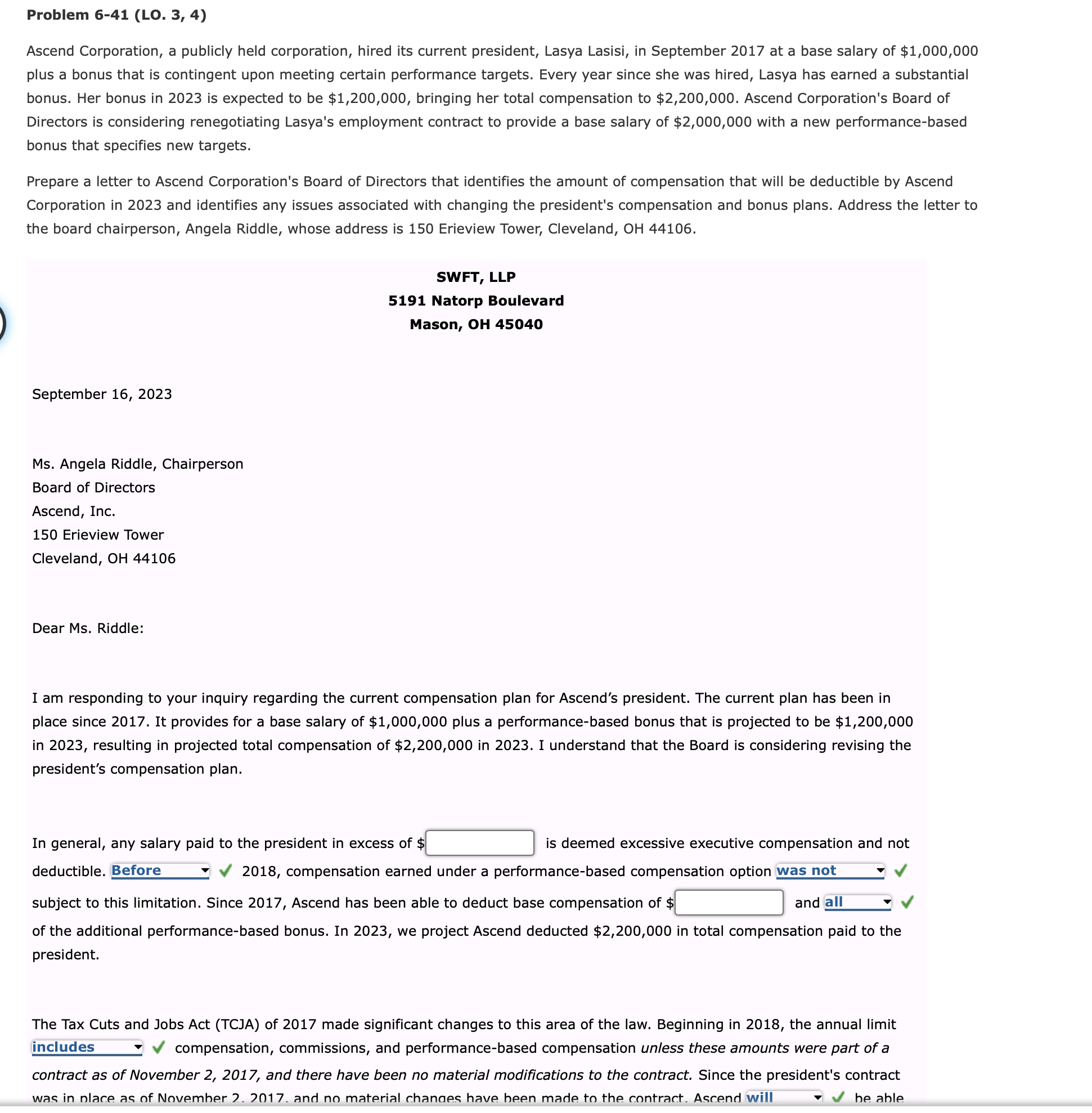

Problem 6 - 4 1 ( LO . 3 , 4 ) Ascend Corporation, a publicly held corporation, hired its current president, Lasya Lasisi, in

Problem LO

Ascend Corporation, a publicly held corporation, hired its current president, Lasya Lasisi, in September at a base salary of $

plus a bonus that is contingent upon meeting certain performance targets. Every year since she was hired, Lasya has earned a substantial

bonus. Her bonus in is expected to be $ bringing her total compensation to $ Ascend Corporation's Board of

Directors is considering renegotiating Lasya's employment contract to provide a base salary of $ with a new performancebased

bonus that specifies new targets.

Prepare a letter to Ascend Corporation's Board of Directors that identifies the amount of compensation that will be deductible by Ascend

Corporation in and identifies any issues associated with changing the president's compensation and bonus plans. Address the letter to

the board chairperson, Angela Riddle, whose address is Erieview Tower, Cleveland, OH

SWFT LLP

Natorp Boulevard

Mason, OH

September

Ms Angela Riddle, Chairperson

Board of Directors

Ascend, Inc.

Erieview Tower

Cleveland,

Dear Ms Riddle:

I am responding to your inquiry regarding the current compensation plan for Ascend's president. The current plan has been in

place since It provides for a base salary of $ plus a performancebased bonus that is projected to be $

in resulting in projected total compensation of $ in I understand that the Board is considering revising the

president's compensation plan.

In general, any salary paid to the president in excess of $

is deemed excessive executive compensation and not

deductible.

compensation earned under a performancebased compensation option

was not

subject to this limitation Since Ascend has been able to deduct base compensation of $

and

of the additional performancebased bonus. In we project Ascend deducted $ in total compensation paid to the

president.

The Tax Cuts and Jobs Act TCJA of made significant changes to this area of the law. Beginning in the annual limit

compensation, commissions, and performancebased compensation unless these amounts were part of a

contract as of November and there have been no material modifications to the contract. Since the president's contract

was in nlace as of November and no material chanqes have been made to the contract. Ascend will he able

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started