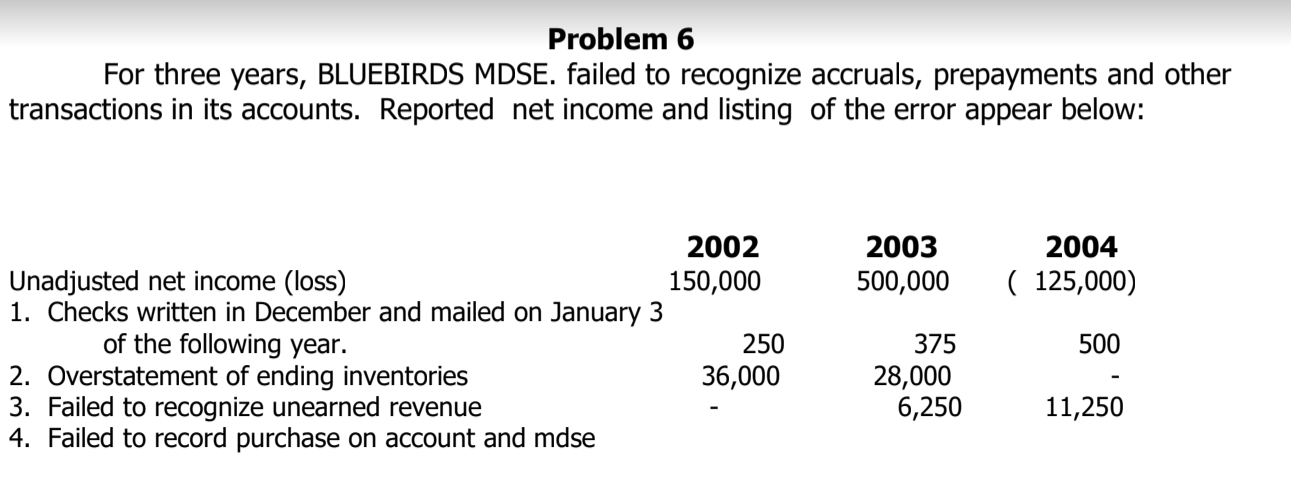

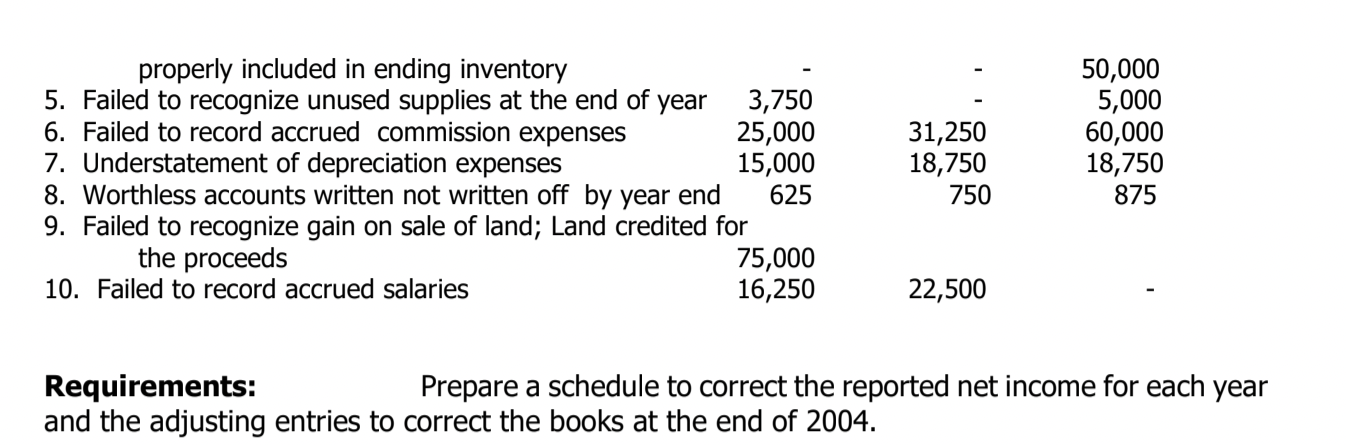

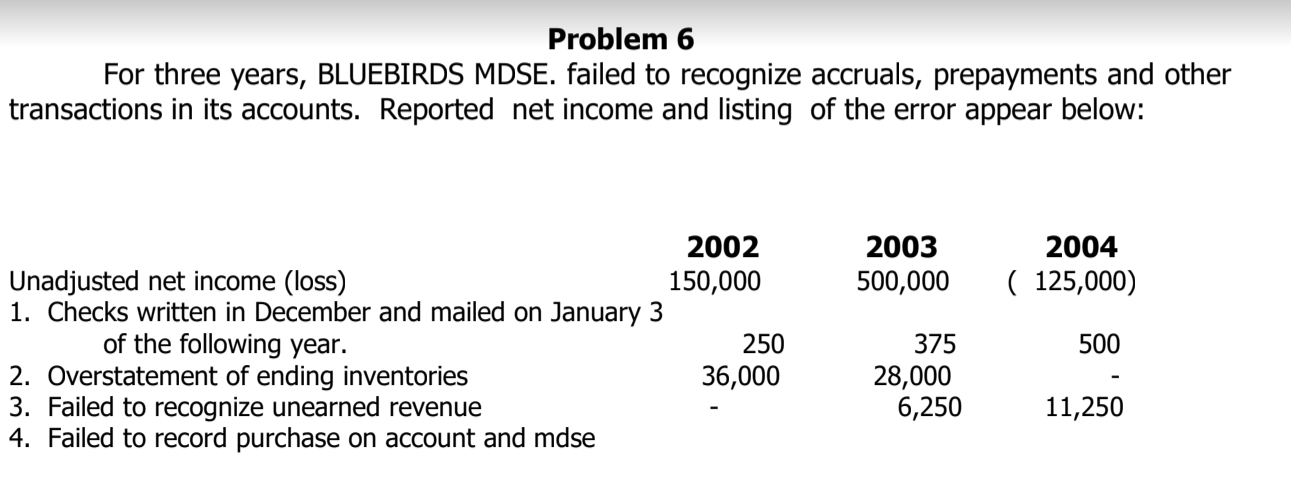

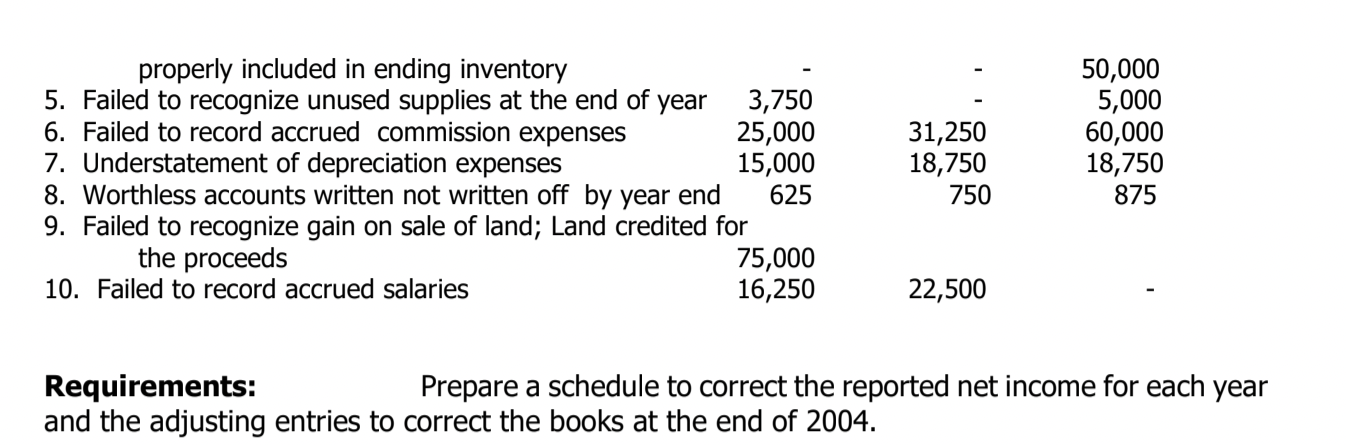

Problem 6 For three years, BLUEBIRDS MDSE. failed to recognize accruals, prepayments and other transactions in its accounts. Reported net income and listing of the error appear below: 2003 500,000 2004 ( 125,000) 2002 Unadjusted net income (loss) 150,000 1. Checks written in December and mailed on January 3 of the following year. 250 2. Overstatement of ending inventories 36,000 3. Failed to recognize unearned revenue 4. Failed to record purchase on account and mdse 500 375 28,000 6,250 11,250 properly included in ending inventory 5. Failed to recognize unused supplies at the end of year 3,750 6. Failed to record accrued commission expenses 25,000 7. Understatement of depreciation expenses 15,000 8. Worthless accounts written not written off by year end 625 9. Failed to recognize gain on sale of land; Land credited for the proceeds 75,000 10. Failed to record accrued salaries 16,250 31,250 18,750 750 50,000 5,000 60,000 18,750 875 22,500 Requirements: Prepare a schedule to correct the reported net income for each year and the adjusting entries to correct the books at the end of 2004. Problem 6 For three years, BLUEBIRDS MDSE. failed to recognize accruals, prepayments and other transactions in its accounts. Reported net income and listing of the error appear below: 2003 500,000 2004 ( 125,000) 2002 Unadjusted net income (loss) 150,000 1. Checks written in December and mailed on January 3 of the following year. 250 2. Overstatement of ending inventories 36,000 3. Failed to recognize unearned revenue 4. Failed to record purchase on account and mdse 500 375 28,000 6,250 11,250 properly included in ending inventory 5. Failed to recognize unused supplies at the end of year 3,750 6. Failed to record accrued commission expenses 25,000 7. Understatement of depreciation expenses 15,000 8. Worthless accounts written not written off by year end 625 9. Failed to recognize gain on sale of land; Land credited for the proceeds 75,000 10. Failed to record accrued salaries 16,250 31,250 18,750 750 50,000 5,000 60,000 18,750 875 22,500 Requirements: Prepare a schedule to correct the reported net income for each year and the adjusting entries to correct the books at the end of 2004