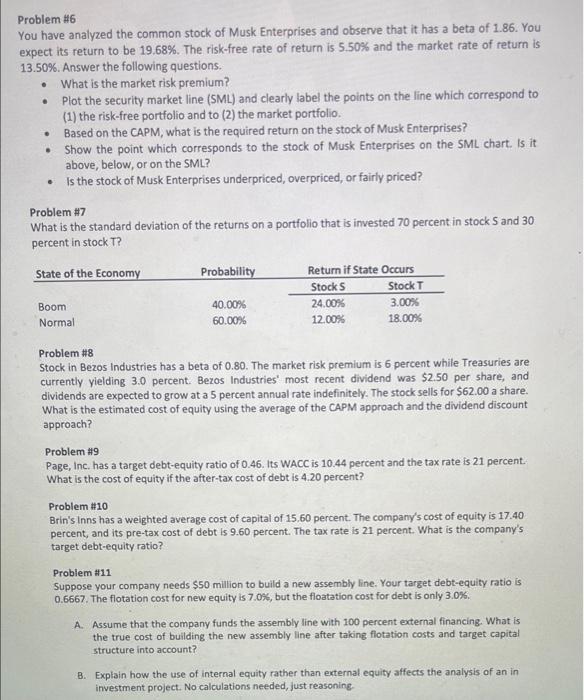

Problem #6 You have analyzed the common stock of Musk Enterprises and observe that it has a beta of 1.86. You expect its return to be 19.68 %. The risk-free rate of return is 5.50% and the market rate of return is 13.50%. Answer the following questions. What is the market risk premium? Plot the security market line (SML) and clearly label the points on the line which correspond to (1) the risk-free portfolio and to (2) the market portfolio. Based on the CAPM, what is the required return on the stock of Musk Enterprises? Show the point which corresponds to the stock of Musk Enterprises on the SML chart. Is it above, below, or on the SML? Is the stock of Musk Enterprises underpriced, overpriced, or fairly priced? Problem #7 What is the standard deviation of the returns on a portfolio that is invested 70 percent in stock 5 and 30 percent in stock T? State of the Economy Probability Return if State Occurs Stock S Stock T Boom 40.00% 24.00% 3.00% Normal 60.00% 12.00% 18.00% Problem #8 Stock in Bezos Industries has a beta of 0.80. The market risk premium is 6 percent while Treasuries are currently yielding 3.0 percent. Bezos Industries' most recent dividend was $2.50 per share, and dividends are expected to grow at a 5 percent annual rate indefinitely. The stock sells for $62.00 a share. What is the estimated cost of equity using the average of the CAPM approach and the dividend discount approach? Problem #9 Page, Inc. has a target debt-equity ratio of 0.46. Its WACC is 10.44 percent and the tax rate is 21 percent. What is the cost of equity if the after-tax cost of debt is 4.20 percent? Problem # 10 Brin's Inns has a weighted average cost of capital of 15.60 percent. The company's cost of equity is 17.40 percent, and its pre-tax cost of debt is 9.60 percent. The tax rate is 21 percent. What is the company's target debt-equity ratio? Problem # 11 Suppose your company needs $50 million to build a new assembly line. Your target debt-equity ratio is 0.6667. The flotation cost for new equity is 7.0%, but the floatation cost for debt is only 3.0%. A. Assume that the company funds the assembly line with 100 percent external financing. What is the true cost of building the new assembly line after taking flotation costs and target capital structure into account? B. Explain how the use of internal equity rather than external equity affects the analysis of an in investment project. No calculations needed, just reasoning. Problem #6 You have analyzed the common stock of Musk Enterprises and observe that it has a beta of 1.86. You expect its return to be 19.68 %. The risk-free rate of return is 5.50% and the market rate of return is 13.50%. Answer the following questions. What is the market risk premium? Plot the security market line (SML) and clearly label the points on the line which correspond to (1) the risk-free portfolio and to (2) the market portfolio. Based on the CAPM, what is the required return on the stock of Musk Enterprises? Show the point which corresponds to the stock of Musk Enterprises on the SML chart. Is it above, below, or on the SML? Is the stock of Musk Enterprises underpriced, overpriced, or fairly priced? Problem #7 What is the standard deviation of the returns on a portfolio that is invested 70 percent in stock 5 and 30 percent in stock T? State of the Economy Probability Return if State Occurs Stock S Stock T Boom 40.00% 24.00% 3.00% Normal 60.00% 12.00% 18.00% Problem #8 Stock in Bezos Industries has a beta of 0.80. The market risk premium is 6 percent while Treasuries are currently yielding 3.0 percent. Bezos Industries' most recent dividend was $2.50 per share, and dividends are expected to grow at a 5 percent annual rate indefinitely. The stock sells for $62.00 a share. What is the estimated cost of equity using the average of the CAPM approach and the dividend discount approach? Problem #9 Page, Inc. has a target debt-equity ratio of 0.46. Its WACC is 10.44 percent and the tax rate is 21 percent. What is the cost of equity if the after-tax cost of debt is 4.20 percent? Problem # 10 Brin's Inns has a weighted average cost of capital of 15.60 percent. The company's cost of equity is 17.40 percent, and its pre-tax cost of debt is 9.60 percent. The tax rate is 21 percent. What is the company's target debt-equity ratio? Problem # 11 Suppose your company needs $50 million to build a new assembly line. Your target debt-equity ratio is 0.6667. The flotation cost for new equity is 7.0%, but the floatation cost for debt is only 3.0%. A. Assume that the company funds the assembly line with 100 percent external financing. What is the true cost of building the new assembly line after taking flotation costs and target capital structure into account? B. Explain how the use of internal equity rather than external equity affects the analysis of an in investment project. No calculations needed, just reasoning