Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 6.13 Casper Landsten -- UIA Casper Landsten, using the same values and assumptions as in the previous question, now decides to seek the

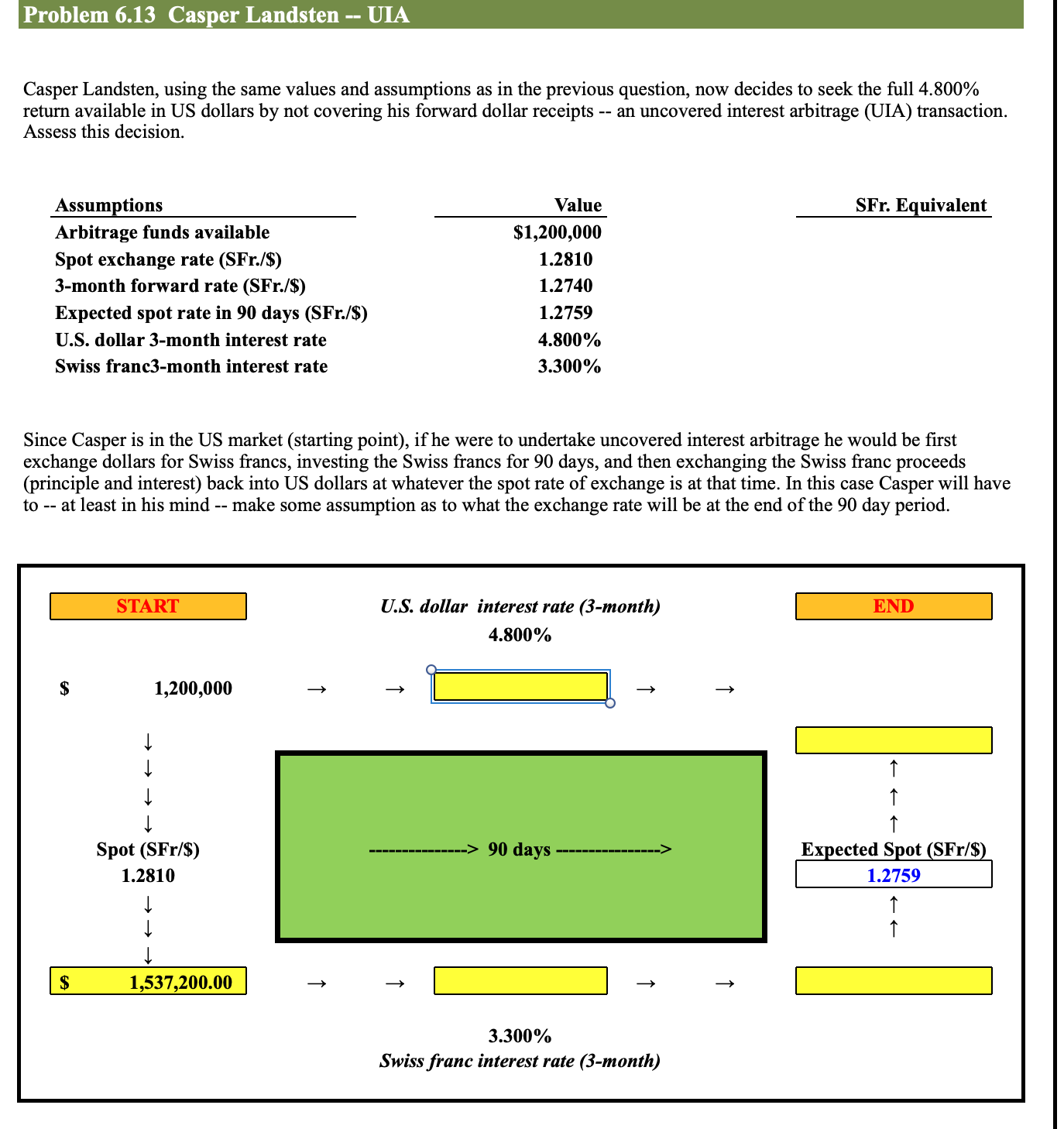

Problem 6.13 Casper Landsten -- UIA Casper Landsten, using the same values and assumptions as in the previous question, now decides to seek the full 4.800% return available in US dollars by not covering his forward dollar receipts -- an uncovered interest arbitrage (UIA) transaction. Assess this decision. Assumptions Arbitrage funds available Value $1,200,000 Spot exchange rate (SFr./$) 1.2810 3-month forward rate (SFr./$) 1.2740 Expected spot rate in 90 days (SFr./$) 1.2759 U.S. dollar 3-month interest rate 4.800% Swiss franc3-month interest rate 3.300% SFr. Equivalent Since Casper is in the US market (starting point), if he were to undertake uncovered interest arbitrage he would be first exchange dollars for Swiss francs, investing the Swiss francs for 90 days, and then exchanging the Swiss franc proceeds (principle and interest) back into US dollars at whatever the spot rate of exchange is at that time. In this case Casper will have to -- at least in his mind -- make some assumption as to what the exchange rate will be at the end of the 90 day period. $ START 1,200,000 Spot (SFr/$) 1.2810 $ 1,537,200.00 U.S. dollar interest rate (3-month) 4.800% 90 days 3.300% > Swiss franc interest rate (3-month) END Expected Spot (SFr/$) 1.2759

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started