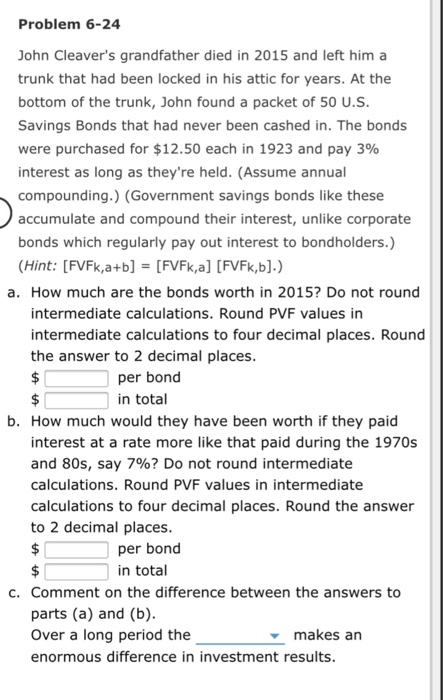

Problem 6-24 John Cleaver's grandfather died in 2015 and left him a trunk that had been locked in his attic for years. At the bottom of the trunk, John found a packet of 50 U.S. Savings Bonds that had never been cashed in. The bonds were purchased for $12.50 each in 1923 and pay 3% interest as long as they're held. (Assume annual compounding.) (Government savings bonds like these accumulate and compound their interest, unlike corporate bonds which regularly pay out interest to bondholders.) (Hint: [FVFk,a+b] = [FVFk,a] (FVFK,b].) a. How much are the bonds worth in 2015? Do not round intermediate calculations. Round PVF values in intermediate calculations to four decimal places. Round the answer to 2 decimal places. per bond in total b. How much would they have been worth if they paid interest at a rate more like that paid during the 1970s and 80s, say 7%? Do not round intermediate calculations. Round PVF values in intermediate calculations to four decimal places. Round the answer to 2 decimal places. per bond in total C. Comment on the difference between the answers to parts (a) and (b). Over a long period the makes an enormous difference in investment results. Problem 6-24 John Cleaver's grandfather died in 2015 and left him a trunk that had been locked in his attic for years. At the bottom of the trunk, John found a packet of 50 U.S. Savings Bonds that had never been cashed in. The bonds were purchased for $12.50 each in 1923 and pay 3% interest as long as they're held. (Assume annual compounding.) (Government savings bonds like these accumulate and compound their interest, unlike corporate bonds which regularly pay out interest to bondholders.) (Hint: [FVFk,a+b] = [FVFk,a] (FVFK,b].) a. How much are the bonds worth in 2015? Do not round intermediate calculations. Round PVF values in intermediate calculations to four decimal places. Round the answer to 2 decimal places. per bond in total b. How much would they have been worth if they paid interest at a rate more like that paid during the 1970s and 80s, say 7%? Do not round intermediate calculations. Round PVF values in intermediate calculations to four decimal places. Round the answer to 2 decimal places. per bond in total C. Comment on the difference between the answers to parts (a) and (b). Over a long period the makes an enormous difference in investment results