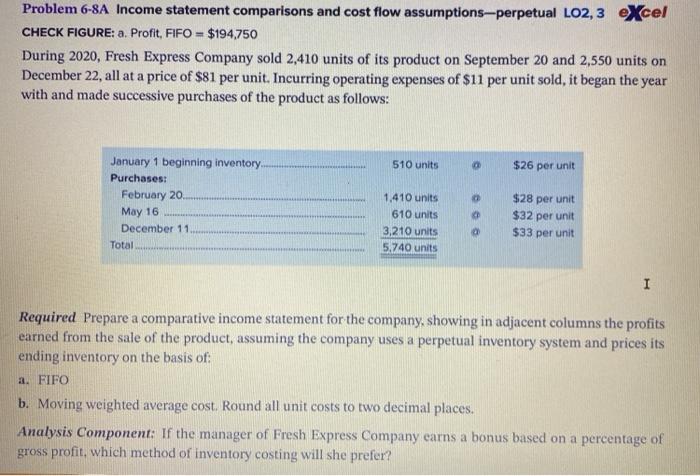

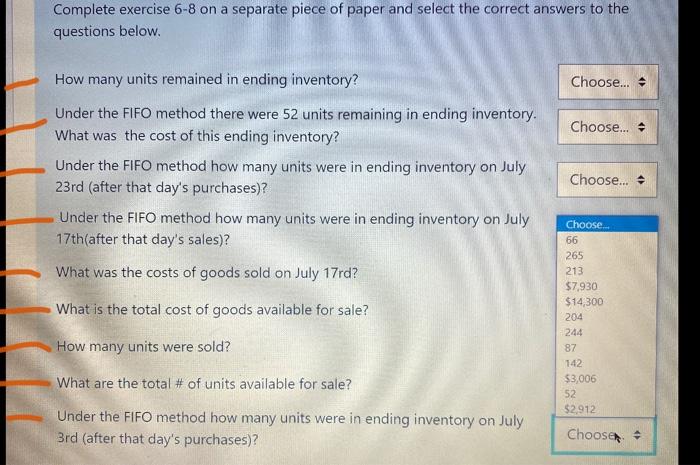

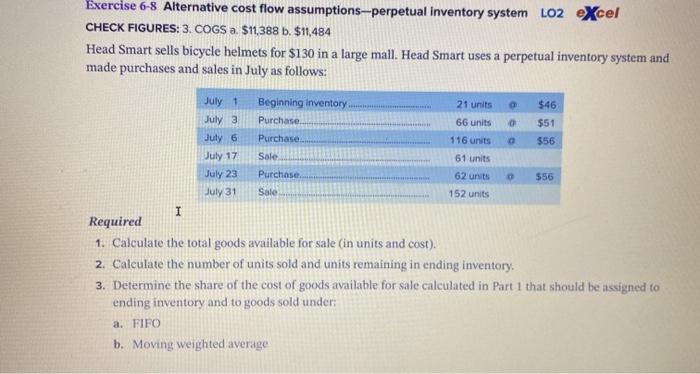

Problem 6-8A Income statement comparisons and cost flow assumptions-perpetual LO2, 3 eXcel CHECK FIGURE: a. Profit, FIFO - $194,750 During 2020, Fresh Express Company sold 2,410 units of its product on September 20 and 2,550 units on December 22, all at a price of $81 per unit. Incurring operating expenses of $11 per unit sold, it began the year with and made successive purchases of the product as follows: 510 units $26 per unit January 1 beginning inventory Purchases: February 20 May 16 December 11 Total 1.410 units 610 units 3,210 units 5.740 units $28 per unit $32 per unit $33 per unit I Required Prepare a comparative income statement for the company, showing in adjacent columns the profits earned from the sale of the product, assuming the company uses a perpetual inventory system and prices its ending inventory on the basis of a. FIFO b. Moving weighted average cost. Round all unit costs to two decimal places. Analysis Component: If the manager of Fresh Express Company earns a bonus based on a percentage of gross profit, which method of inventory costing will she prefer? Complete exercise 6-8 on a separate piece of paper and select the correct answers to the questions below. Choose... Choose... How many units remained in ending inventory? Under the FIFO method there were 52 units remaining in ending inventory. What was the cost of this ending inventory? Under the FIFO method how many units were in ending inventory on July 23rd (after that day's purchases)? Under the FIFO method how many units were in ending inventory on July 17th(after that day's sales)? What was the costs of goods sold on July 17rd? Choose... What is the total cost of goods available for sale? Choose... 66 265 213 $7,930 $14,300 204 244 87 742 $3,006 52 $2.912 How many units were sold? What are the total # of units available for sale? Under the FIFO method how many units were in ending inventory on July 3rd (after that day's purchases)? Chooser + Exercise 6-8 Alternative cost flow assumptions-perpetual inventory system LO2 eXcel CHECK FIGURES: 3. COGS a. $11,388 b. $11,484 Head Smart sells bicycle helmets for $130 in a large mall. Head Smart uses a perpetual inventory system and made purchases and sales in July as follows: 21 units o $46 66 units Beginning inventory Purchase Purchase Sale $51 $56 July 1 July 3 July 6 July 17 July 23 July 31 116 units 61 units Purchase 556 62 units 152 units Sale I Required 1. Calculate the total goods available for sale (in units and cost). 2. Calculate the number of units sold and units remaining in ending inventory. 3. Determine the share of the cost of goods available for sale calculated in Part 1 that should be assigned to ending inventory and to goods sold under: a. FIFO b. Moving weighted average