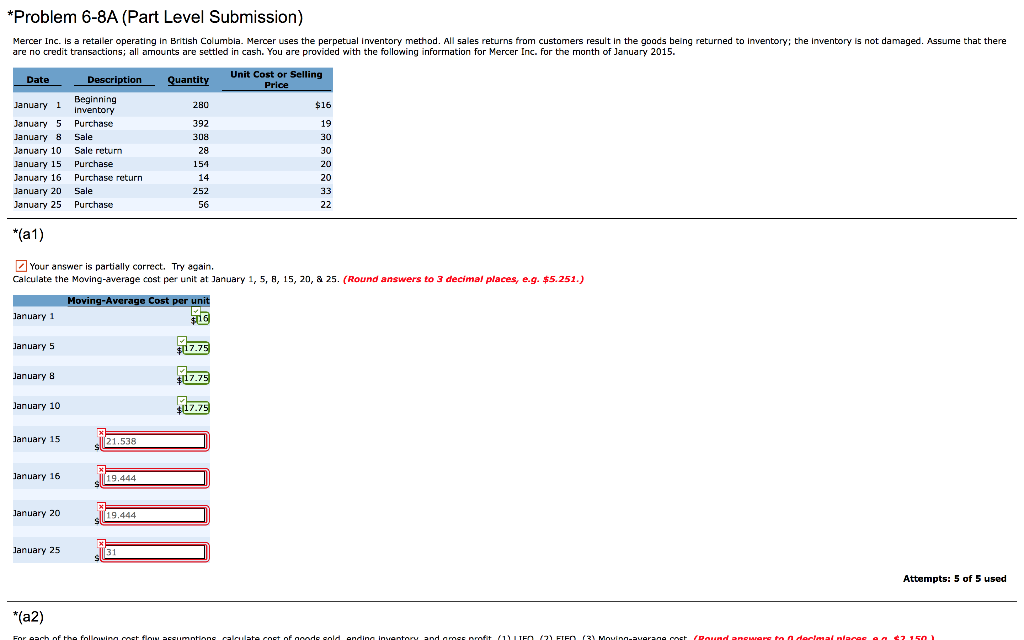

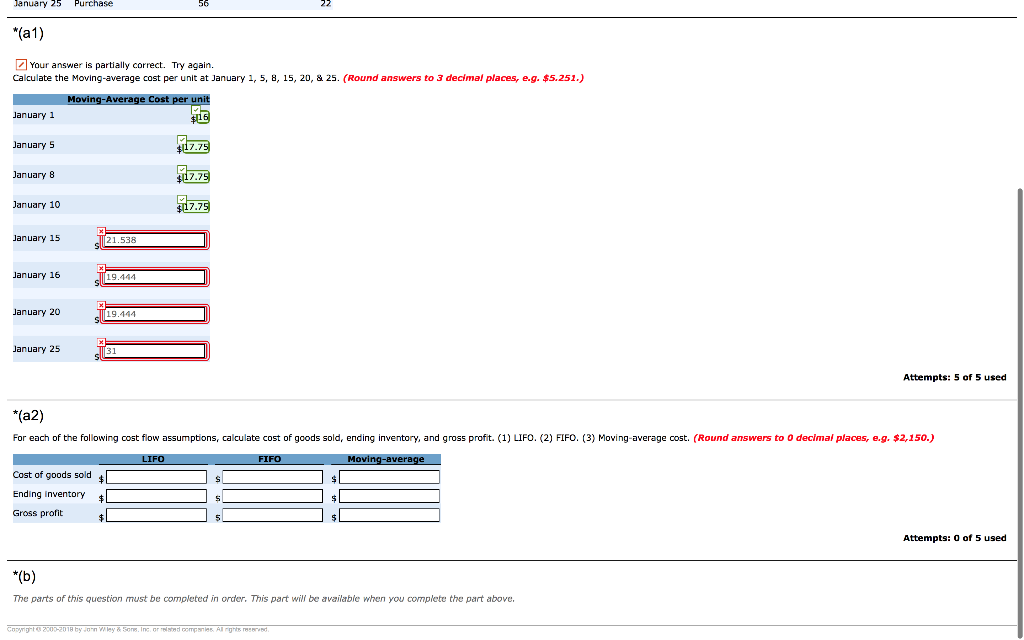

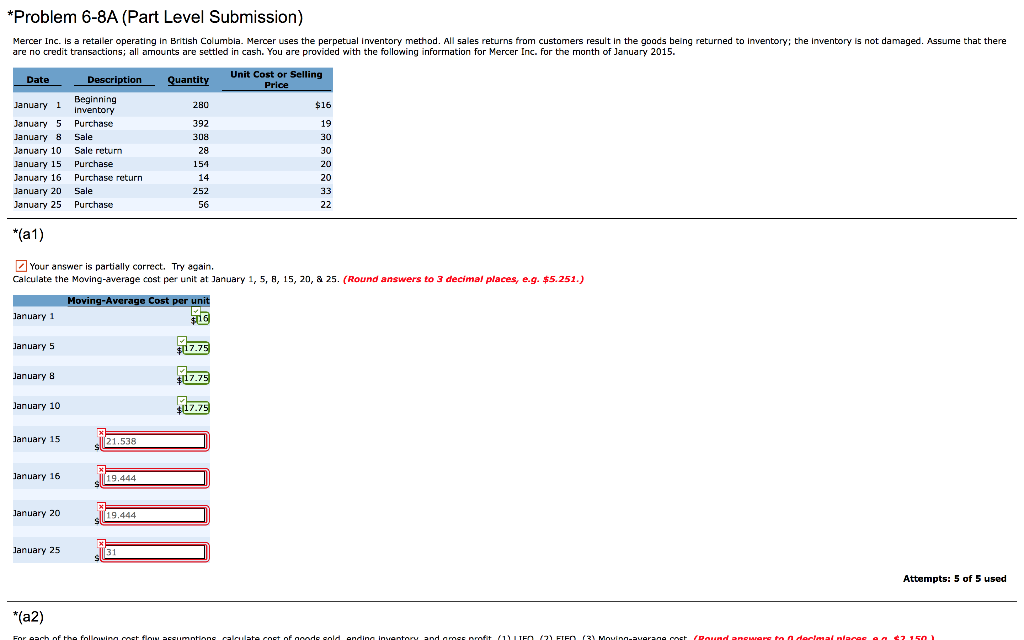

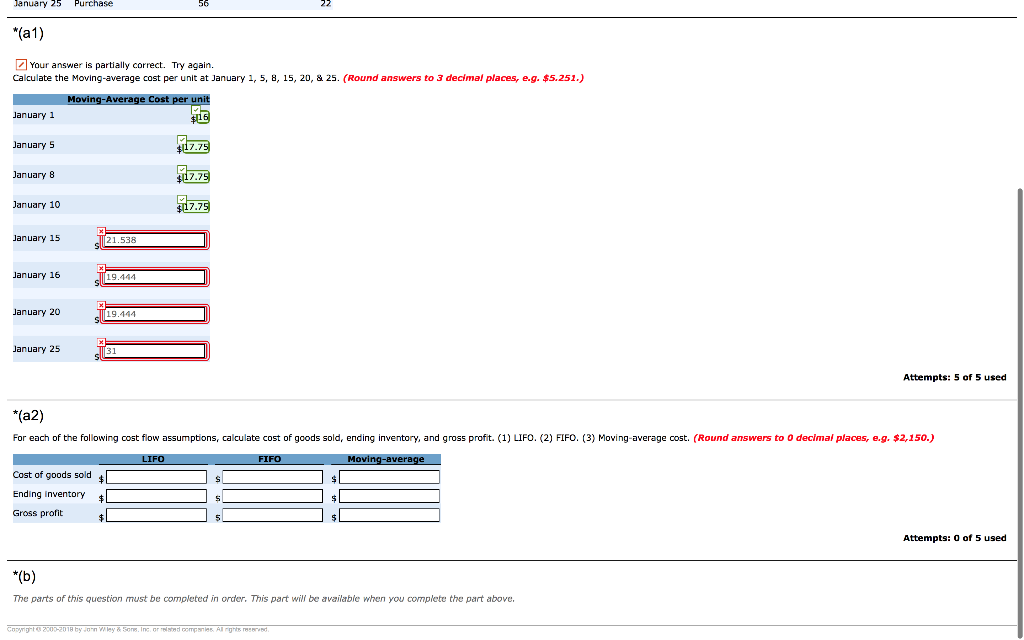

*Problem 6-8A (Part Level Submission) Mercer Inc. is a retailer operating in British Columbia. Mercer uses the perpetual Inventory method. All sales returns from customers result in the goods being returned to inventory; the inventory is not damaged. Assume that thene are no credit transactions; all amounts are settled in cash. You are provided with the following information for Mercer Inc. for the onth of Janu ry 2015. Unit Cost or Selling Price Quantity Date Descri ption Beginning $16 19 30 30 20 20 January1 January 5 Purchase January 8 Sale January 10 Sale return January 15 Purchase January 16 Purchase return January 20 Sale January 25 Purchase 280 392 308 28 154 14 252 56 *(a1) Your answer is partially correct. Try again. Calculate the Moving-average cost per unit at January 1, 5, B, 15, 2D, & 25. (Round answers to 3 decimal places, e.g. $5.251.) Moving-Average Cost per unit anuary 1 anuary 5 7.7 January 8 7.7 January 10 lanuary 15 21.538 lanuary 16 19.444 anuary 20 19.444 lanuary 25 Attempts: 5 of 5 used *(a2) anuary 25 Purchase "(a1) Your answer is partially correct. Try again. 56 Calculate the Moving-average cost per unit at January 1, 5, 8, 15, 20, & 25. (Round answers to 3 declmal places, e.g. $5.251.) ra January 1 January 5 7.7 $1779 u7.75 January 8 January 10 January 15 21.538 January 16 19.144 January 20 January 25 Attempts: 5 of 5 used "(a2) For each of the following cost flow assumptions, calculate cost of goods sold, ending inventory, and gross profit. (1) LIFO. (2) FIFO. (3) Moving-average cost. (Round answers to 0 decimal places, e.g. $2,150.) Cost of goods sold 4 Ending inventory Gross profit Attempts: 0 of 5 used The parts of this question must be completed in order. This part will be availabie when you complete the part above. *Problem 6-8A (Part Level Submission) Mercer Inc. is a retailer operating in British Columbia. Mercer uses the perpetual Inventory method. All sales returns from customers result in the goods being returned to inventory; the inventory is not damaged. Assume that thene are no credit transactions; all amounts are settled in cash. You are provided with the following information for Mercer Inc. for the onth of Janu ry 2015. Unit Cost or Selling Price Quantity Date Descri ption Beginning $16 19 30 30 20 20 January1 January 5 Purchase January 8 Sale January 10 Sale return January 15 Purchase January 16 Purchase return January 20 Sale January 25 Purchase 280 392 308 28 154 14 252 56 *(a1) Your answer is partially correct. Try again. Calculate the Moving-average cost per unit at January 1, 5, B, 15, 2D, & 25. (Round answers to 3 decimal places, e.g. $5.251.) Moving-Average Cost per unit anuary 1 anuary 5 7.7 January 8 7.7 January 10 lanuary 15 21.538 lanuary 16 19.444 anuary 20 19.444 lanuary 25 Attempts: 5 of 5 used *(a2) anuary 25 Purchase "(a1) Your answer is partially correct. Try again. 56 Calculate the Moving-average cost per unit at January 1, 5, 8, 15, 20, & 25. (Round answers to 3 declmal places, e.g. $5.251.) ra January 1 January 5 7.7 $1779 u7.75 January 8 January 10 January 15 21.538 January 16 19.144 January 20 January 25 Attempts: 5 of 5 used "(a2) For each of the following cost flow assumptions, calculate cost of goods sold, ending inventory, and gross profit. (1) LIFO. (2) FIFO. (3) Moving-average cost. (Round answers to 0 decimal places, e.g. $2,150.) Cost of goods sold 4 Ending inventory Gross profit Attempts: 0 of 5 used The parts of this question must be completed in order. This part will be availabie when you complete the part above