Answered step by step

Verified Expert Solution

Question

1 Approved Answer

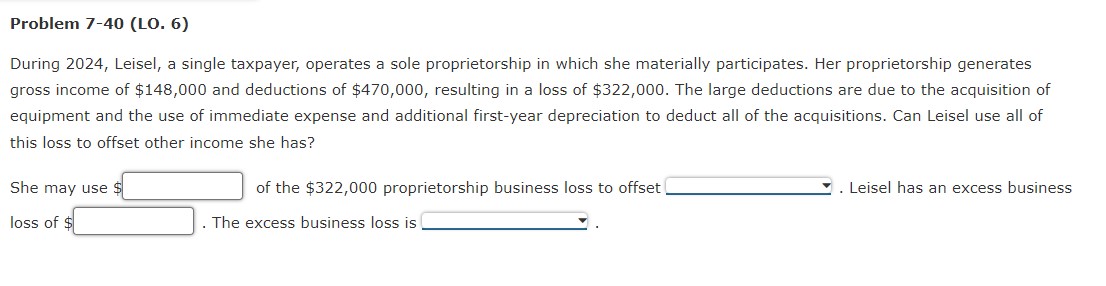

Problem 7 - 4 0 ( LO . 6 ) During 2 0 2 4 , Leisel, a single taxpayer, operates a sole proprietorship in

Problem LO

During Leisel, a single taxpayer, operates a sole proprietorship in which she materially participates. Her proprietorship generates

gross income of $ and deductions of $ resulting in a loss of $ The large deductions are due to the acquisition of

equipment and the use of immediate expense and additional firstyear depreciation to deduct all of the acquisitions. Can Leisel use all of

this loss to offset other income she has?

She may use $

of the $ proprietorship business loss to offset

Leisel has an excess business

loss of

The excess business loss is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started