a. Southwick Company uses a job order costing system. On November 1, $15,000 of direct materials and $3,500 of indirect materials were requisitioned for

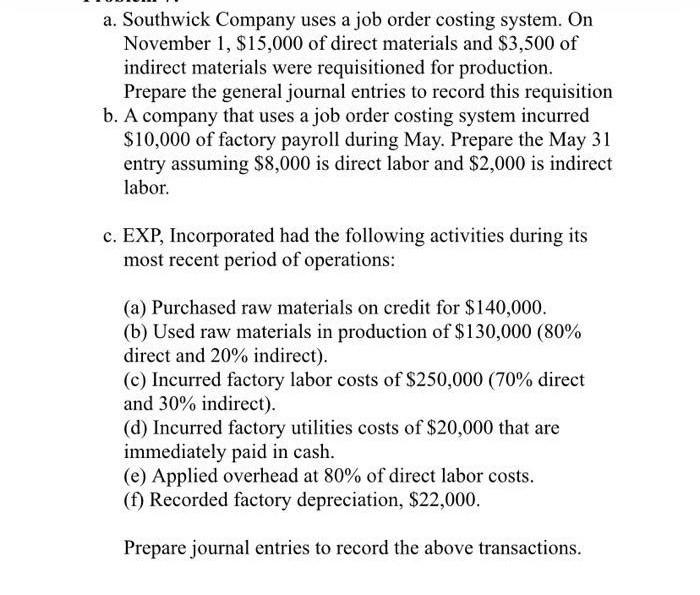

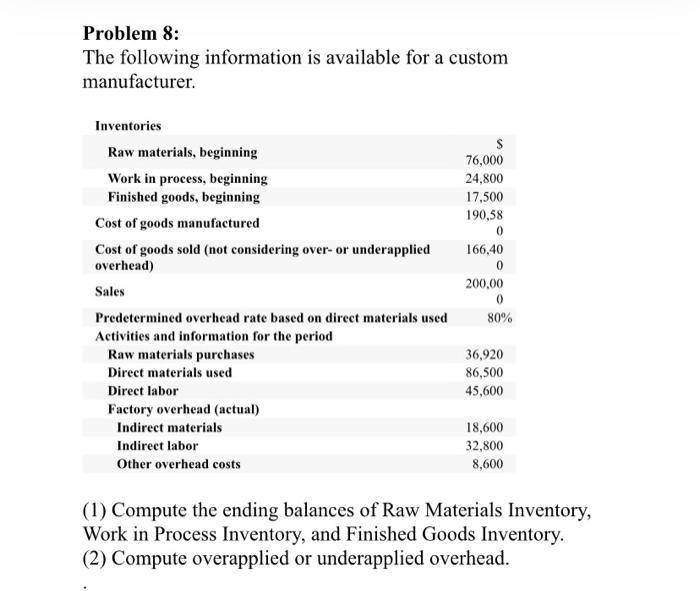

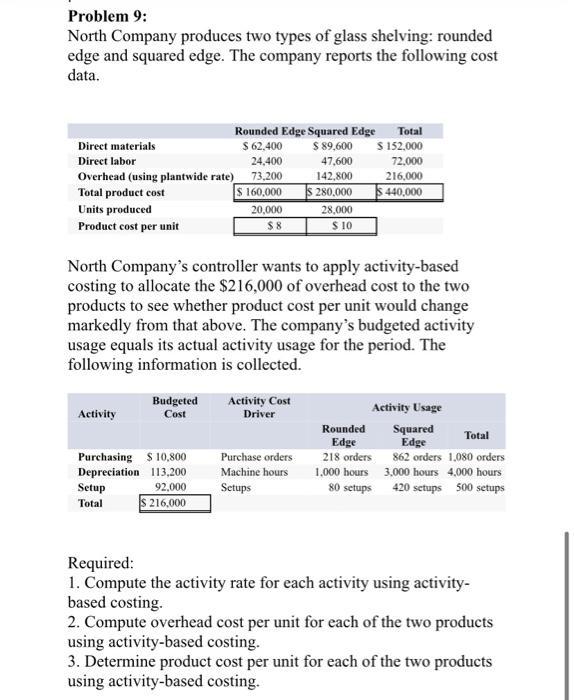

a. Southwick Company uses a job order costing system. On November 1, $15,000 of direct materials and $3,500 of indirect materials were requisitioned for production. Prepare the general journal entries to record this requisition b. A company that uses a job order costing system incurred $10,000 of factory payroll during May. Prepare the May 31 entry assuming $8,000 is direct labor and $2,000 is indirect labor. c. EXP, Incorporated had the following activities during its most recent period of operations: (a) Purchased raw materials on credit for $140,000. (b) Used raw materials in production of $130,000 (80% direct and 20% indirect). (c) Incurred factory labor costs of $250,000 (70% direct and 30% indirect). (d) Incurred factory utilities costs of $20,000 that are immediately paid in cash. (e) Applied overhead at 80% of direct labor costs. (f) Recorded factory depreciation, $22,000. Prepare journal entries to record the above transactions. Problem 8: The following information is available for a custom manufacturer. Inventories Raw materials, beginning Work in process, beginning Finished goods, beginning Cost of goods manufactured Cost of goods sold (not considering over- or underapplied overhead) Sales Predetermined overhead rate based on direct materials used Activities and information for the period Raw materials purchases Direct materials used Direct labor Factory overhead (actual) Indirect materials Indirect labor Other overhead costs 76,000 24,800 17,500 190,58 0 166,40 0 200,00 0 80% 36,920 86,500 45,600 18,600 32,800 8,600 (1) Compute the ending balances of Raw Materials Inventory, Work in Process Inventory, and Finished Goods Inventory. (2) Compute overapplied or underapplied overhead. Problem 9: North Company produces two types of glass shelving: rounded edge and squared edge. The company reports the following cost data. Direct materials Direct labor Overhead (using plantwide rate) Total product cost Units produced Product cost per unit Activity Rounded Edge Squared Edge Total $ 62,400 $ 89,600 $ 152,000 47,600 72,000 142,800 216,000 $ 280,000 $440,000 North Company's controller wants to apply activity-based costing to allocate the $216,000 of overhead cost to the two products to see whether product cost per unit would change markedly from that above. The company's budgeted activity usage equals its actual activity usage for the period. The following information is collected. Budgeted Cost Purchasing $10,800 Depreciation 113,200 92,000 $ 216,000 Setup Total 24,400 73,200 $ 160,000 20,000 $8 Activity Cost Driver 28,000 $ 10 Purchase orders Machine hours Setups Activity Usage Squared Edge Rounded Edge 218 orders 1,000 hours 80 setups Total 862 orders 1,080 orders 3,000 hours 4,000 hours 420 setups 500 setups Required: 1. Compute the activity rate for each activity using activity- based costing. 2. Compute overhead cost per unit for each of the two products using activity-based costing. 3. Determine product cost per unit for each of the two products using activity-based costing.

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a General Journal Entries for Requisition of Direct and Indirect Materials Date November 1 1 To record the requisition of direct materials Debit Work in Process Inventory Direct Materials 15000 Credit ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started