Question: Problem 7: Calculating Future Values. You are scheduled to receive $17,000 in 3 years. When you receive it, you will invest it for nine more

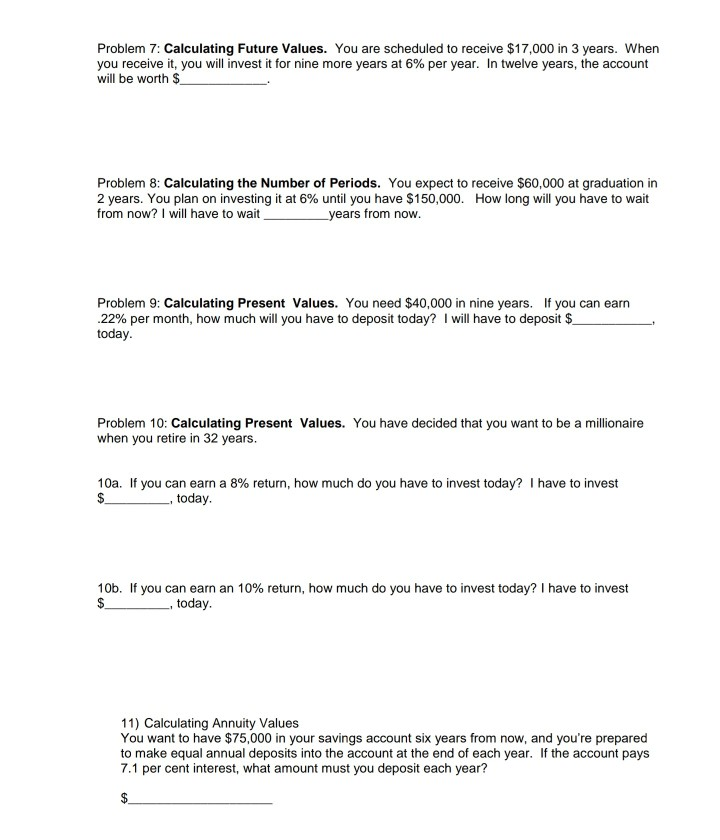

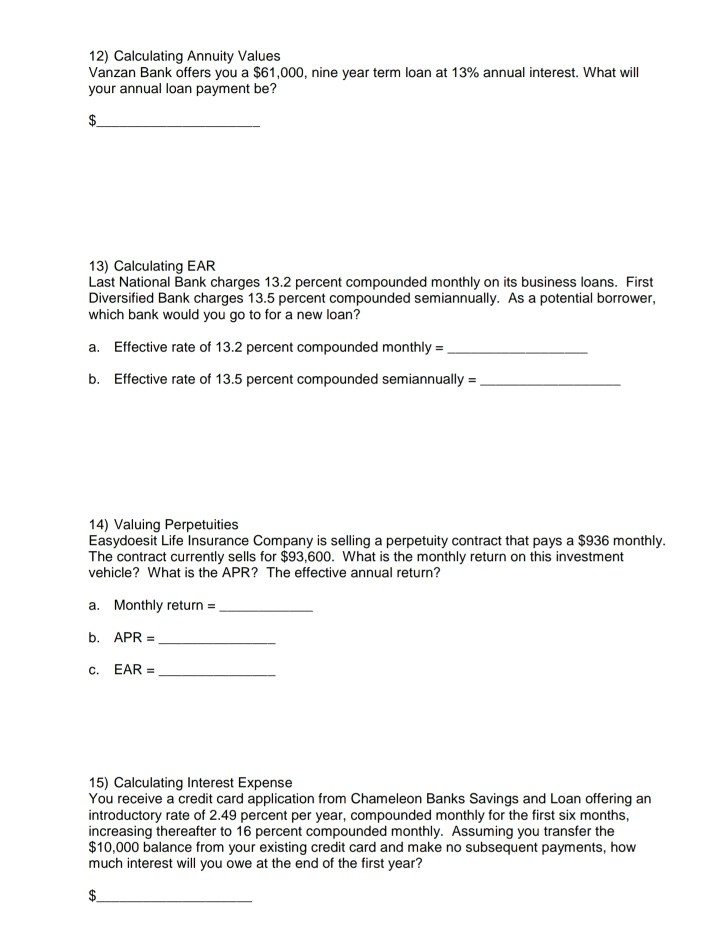

Problem 7: Calculating Future Values. You are scheduled to receive $17,000 in 3 years. When you receive it, you will invest it for nine more years at 6% per year. In twelve years, the account will be worth $ Problem 8: Calculating the Number of Periods. You expect to receive $60,000 at graduation in 2 years. You plan on investing it at 6% until you have $150,000. How long will you have to wait from now? I will have to wait _years from now. Problem 9: Calculating Present Values. You need $40,000 in nine years. If you can earn .22% per month, how much will you have to deposit today? I will have to deposit $ today. Problem 10: Calculating Present Values. You have decided that you want to be a millionaire when you retire in 32 years. 10a. If you can earn a 8% return, how much do you have to invest today? I have to invest $ _, today. 10b. If you can earn an 10% return, how much do you have to invest today? I have to invest $ today. 11) Calculating Annuity Values You want to have $75,000 in your savings account six years from now, and you're prepared to make equal annual deposits into the account at the end of each year. If the account pays 7.1 per cent interest, what amount must you deposit each year? 12) Calculating Annuity Values Vanzan Bank offers you a $61,000, nine year term loan at 13% annual interest. What will your annual loan payment be? 13) Calculating EAR Last National Bank charges 13.2 percent compounded monthly on its business loans. First Diversified Bank charges 13.5 percent compounded semiannually. As a potential borrower, which bank would you go to for a new loan? a. Effective rate of 13.2 percent compounded monthly = b. Effective rate of 13.5 percent compounded semiannually = 14) Valuing Perpetuities Easydoesit Life Insurance Company is selling a perpetuity contract that pays a $936 monthly. The contract currently sells for $93,600. What is the monthly return on this investment vehicle? What is the APR? The effective annual return? a. Monthly return = b. APR = c. EAR = 15) Calculating Interest Expense You receive a credit card application from Chameleon Banks Savings and Loan offering an introductory rate of 2.49 percent per year, compounded monthly for the first six months, increasing thereafter to 16 percent compounded monthly. Assuming you transfer the $10,000 balance from your existing credit card and make no subsequent payments, how much interest will you owe at the end of the first year? $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts