Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 7 Consider a process for the production of a specialty chemical. The land is purchased for $40 MM. The FCI is spent over the

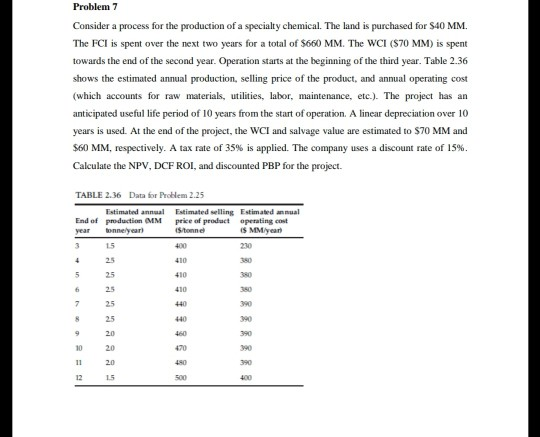

Problem 7 Consider a process for the production of a specialty chemical. The land is purchased for $40 MM. The FCI is spent over the next two years for a total of $660 MM. The WCI ($70 MM) is spent towards the end of the second year. Operation starts at the beginning of the third year. Table 2.36 shows the estimated annual production, selling price of the product, and annual operating cost (which accounts for raw materials, utilities, labor, maintenance, etc.). The project has an anticipated useful life period of 10 years from the start of operation. A linear depreciation over 10 years is used. At the end of the project, the WCI and salvage value are estimated to $70 MM and $60 MM, respectively. A tax rate of 35% is applied. The company uses a discount rate of 15%. Calculate the NPV, DCF ROI, and discounted PBP for the project. TABLE 2.36 Data for Problem 2.25 Estimated annual End of pmduction MM year tonnelyear) Estimated selling Estimated annual peice of product aperating cost s MM/year stonne 3 15 400 230 25 4 410 380 5 25 410 380 25 6 410 380 25 7 440 390 25 440 390 20 460 390 10 20 470 390 20 480 390 12 15 500 400 Problem 7 Consider a process for the production of a specialty chemical. The land is purchased for $40 MM. The FCI is spent over the next two years for a total of $660 MM. The WCI ($70 MM) is spent towards the end of the second year. Operation starts at the beginning of the third year. Table 2.36 shows the estimated annual production, selling price of the product, and annual operating cost (which accounts for raw materials, utilities, labor, maintenance, etc.). The project has an anticipated useful life period of 10 years from the start of operation. A linear depreciation over 10 years is used. At the end of the project, the WCI and salvage value are estimated to $70 MM and $60 MM, respectively. A tax rate of 35% is applied. The company uses a discount rate of 15%. Calculate the NPV, DCF ROI, and discounted PBP for the project. TABLE 2.36 Data for Problem 2.25 Estimated annual End of pmduction MM year tonnelyear) Estimated selling Estimated annual peice of product aperating cost s MM/year stonne 3 15 400 230 25 4 410 380 5 25 410 380 25 6 410 380 25 7 440 390 25 440 390 20 460 390 10 20 470 390 20 480 390 12 15 500 400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started