Answered step by step

Verified Expert Solution

Question

1 Approved Answer

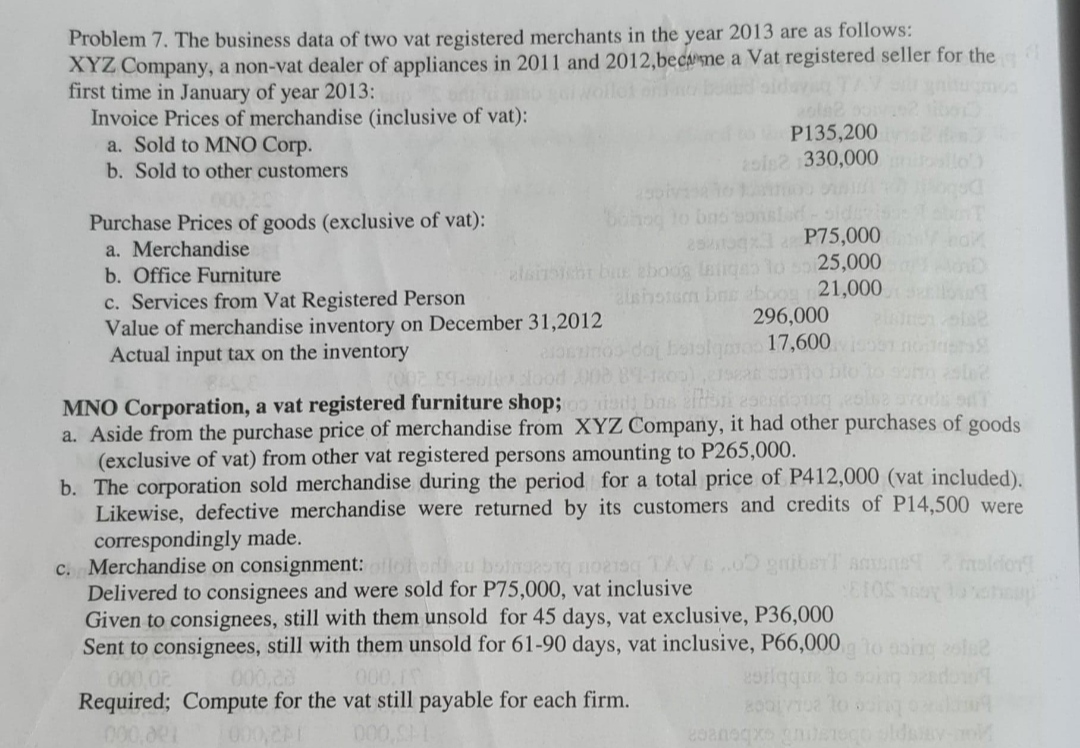

Problem 7. The business data of two vat registered merchants in the year 2013 are as follows: XYZ Company, a non-vat dealer of appliances

Problem 7. The business data of two vat registered merchants in the year 2013 are as follows: XYZ Company, a non-vat dealer of appliances in 2011 and 2012, became a Vat registered seller for the first time in January of year 2013: 19 Invoice Prices of merchandise (inclusive of vat): a. Sold to MNO Corp. b. Sold to other customers Purchase Prices of goods (exclusive of vat): a. Merchandise b. Office Furniture c. Services from Vat Registered Person Value of merchandise inventory on December 31,2012 Actual input tax on the inventory boho to bas 25 P75,000 alsitsicht but aboog latiqas to so25,000 alshstum bns eboog 21,000 296,000 17,600 P135,200 25182 1330,000 000.02 000.28 000.IT Required; Compute for the vat still payable for each firm. 000,24 000 4 (002 89-sule do MNO Corporation, a vat registered furniture shop; 0o da bas eli eserdang a. Aside from the purchase price of merchandise from XYZ Company, it had other purchases of goods (exclusive of vat) from other vat registered persons amounting to P265,000. b. The corporation sold merchandise during the period for a total price of P412,000 (vat included). Likewise, defective merchandise were returned by its customers and credits of P14,500 were correspondingly made. c. Merchandise on consignment: ollohen zu boing 021 Delivered to consignees and were sold for P75,000, vat inclusive Given to consignees, still with them unsold for 45 days, vat exclusive, P36,000 Sent to consignees, still with them unsold for 61-90 days, vat inclusive, P66,000 g to sing 2012 soilqque to soiag zoanoqxo gniloqoldalav-ol griber Avens 2 moldor

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the VAT payable for each firm we need to calculate the output tax VAT collected on sales ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started