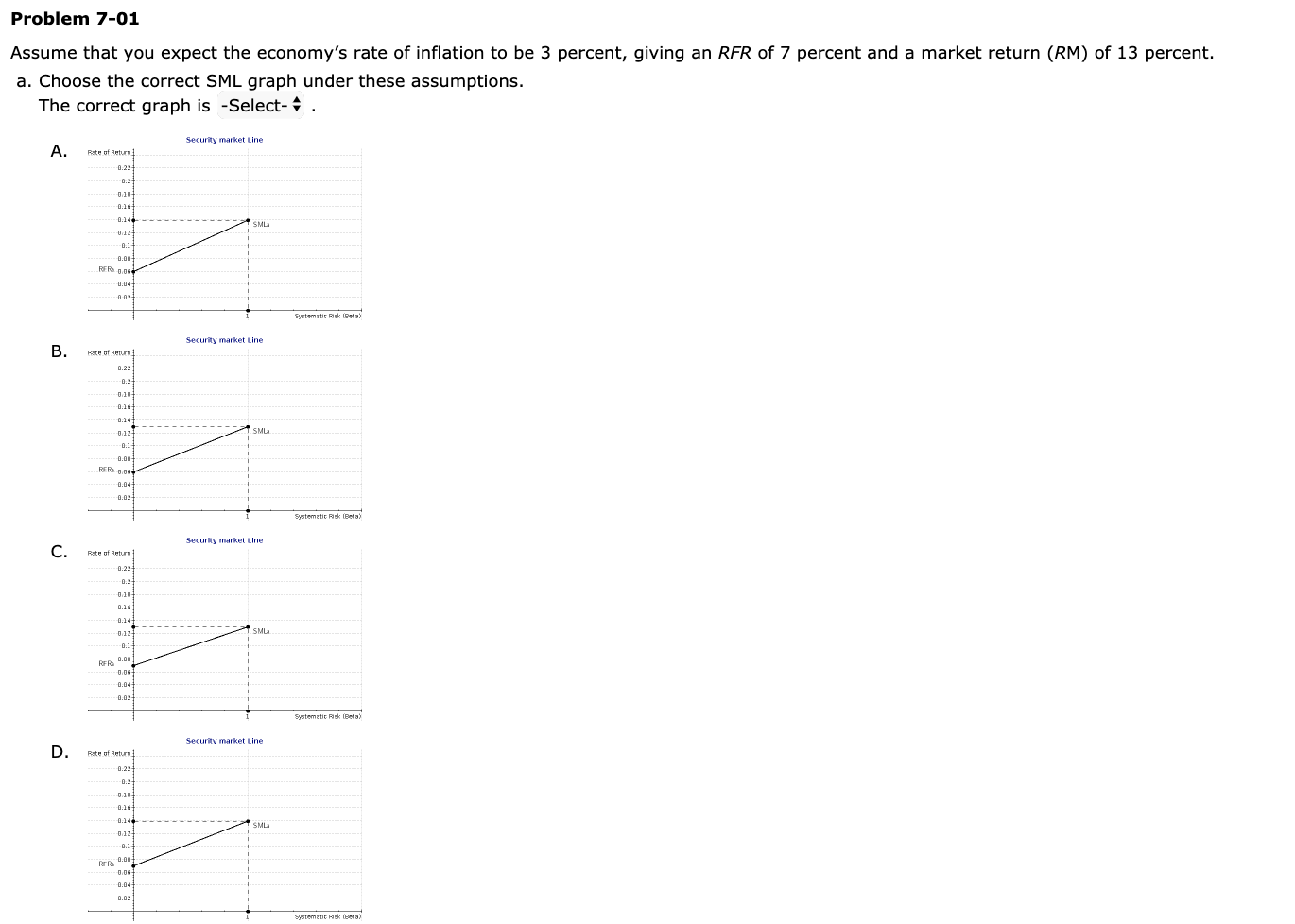

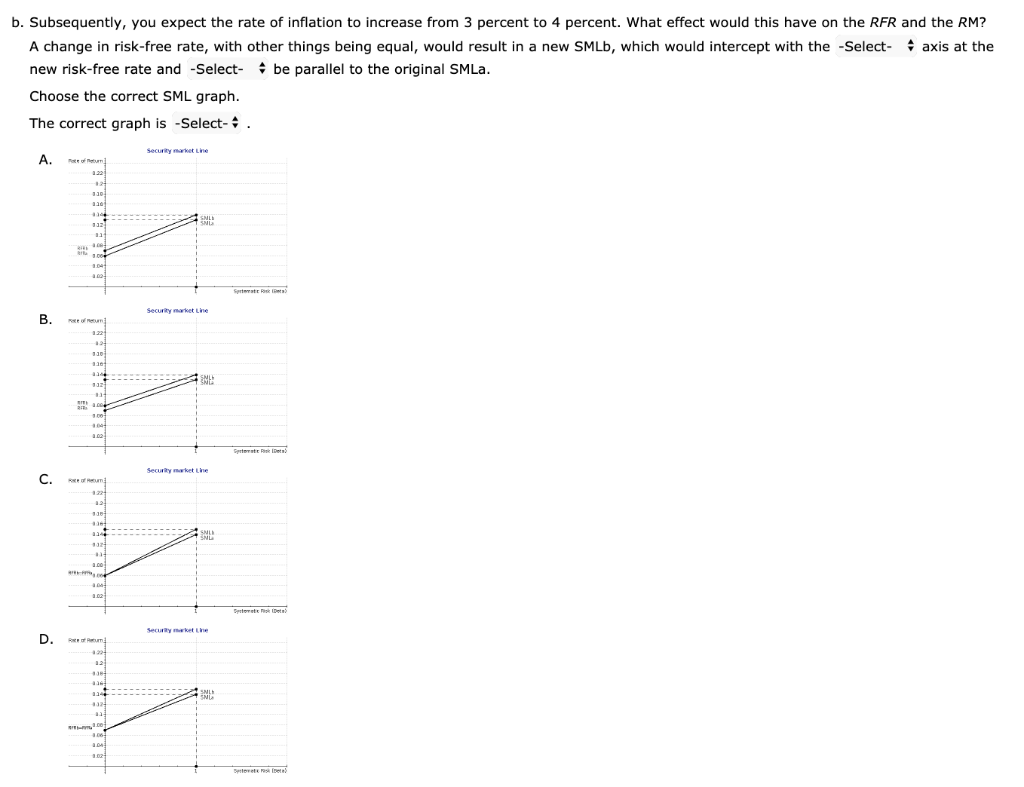

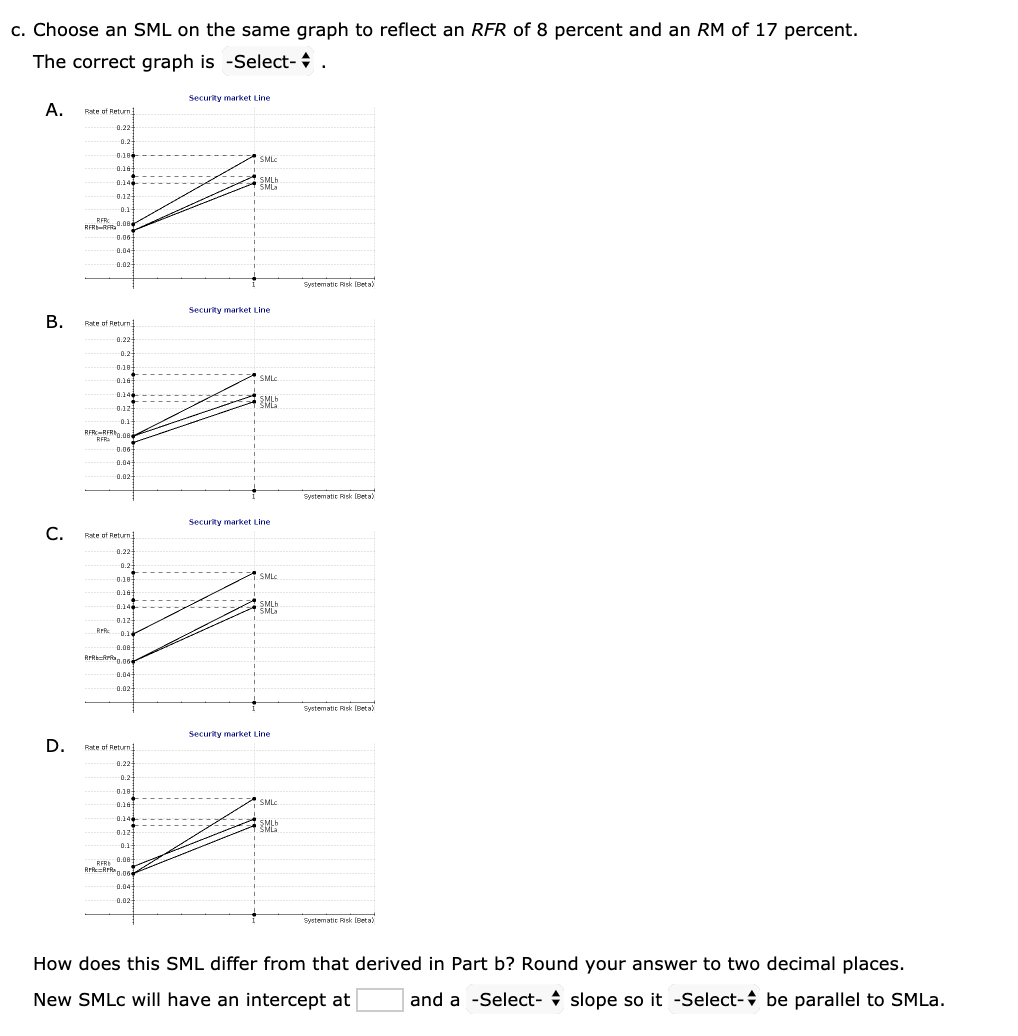

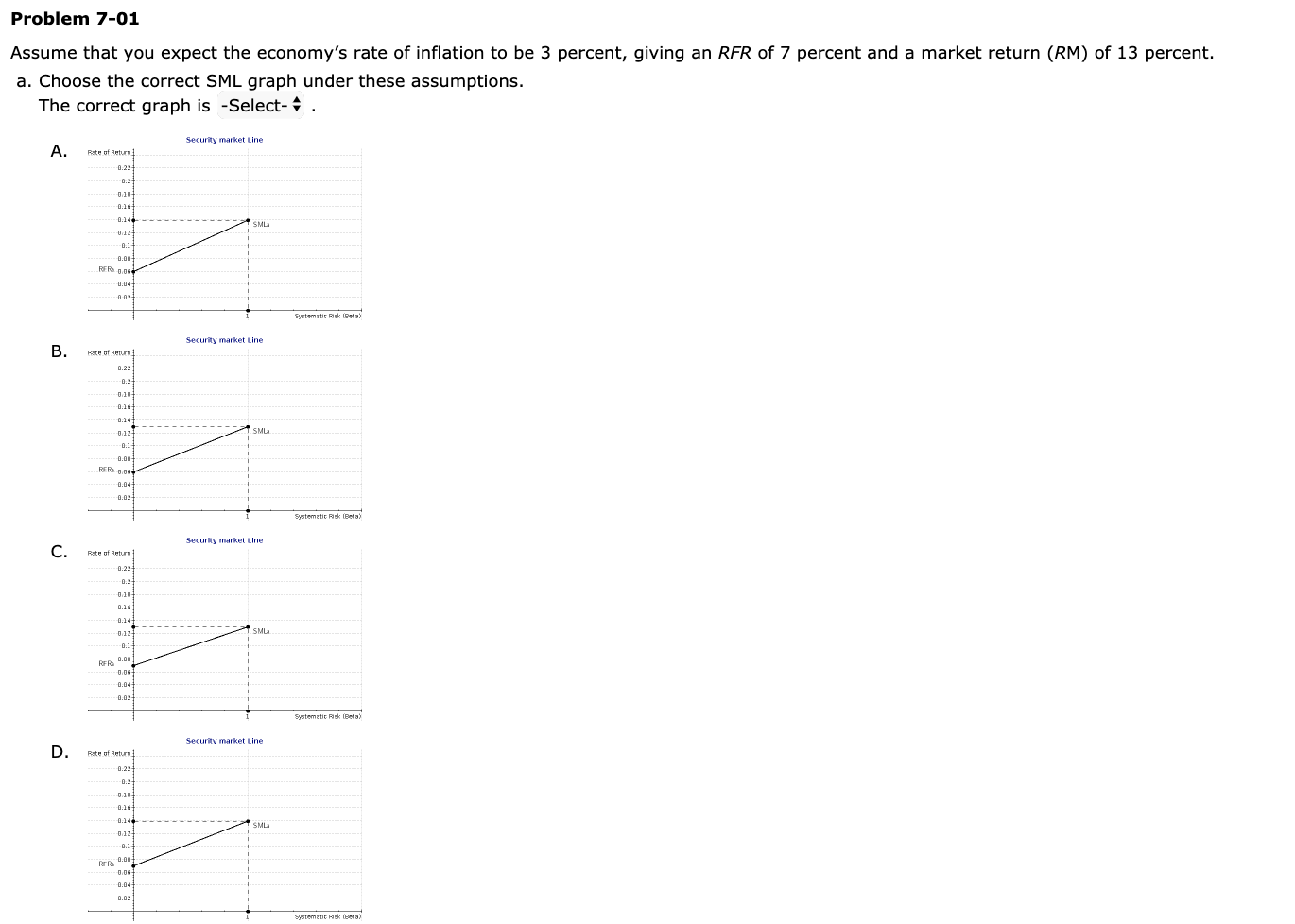

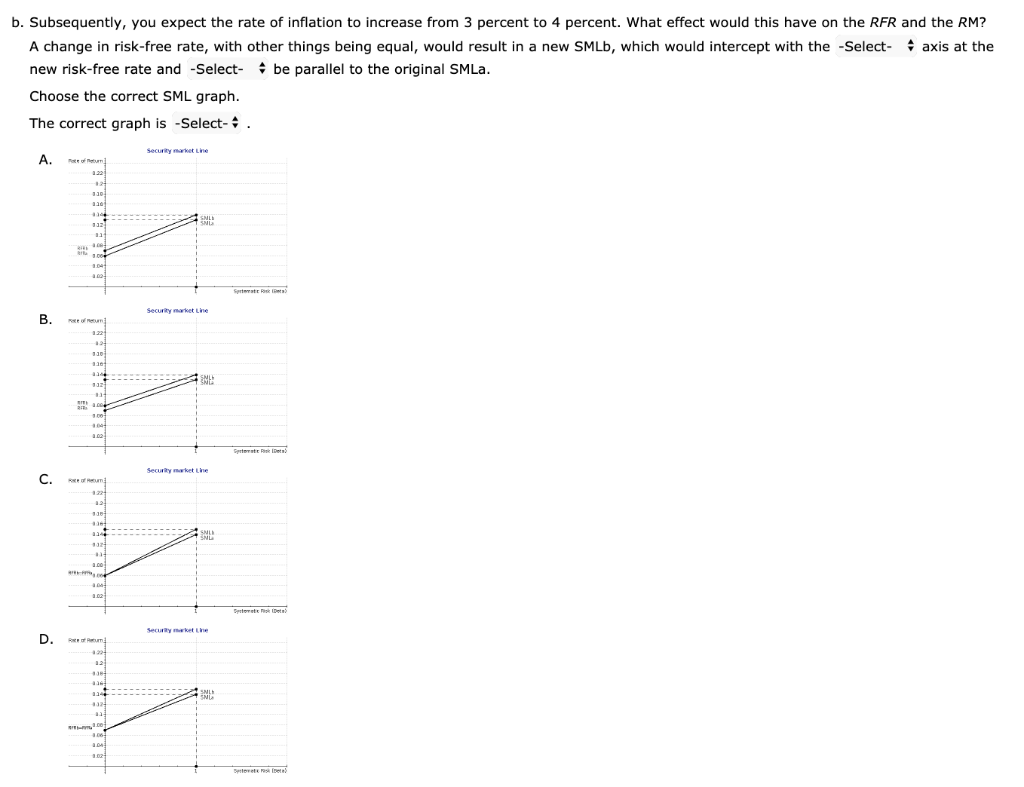

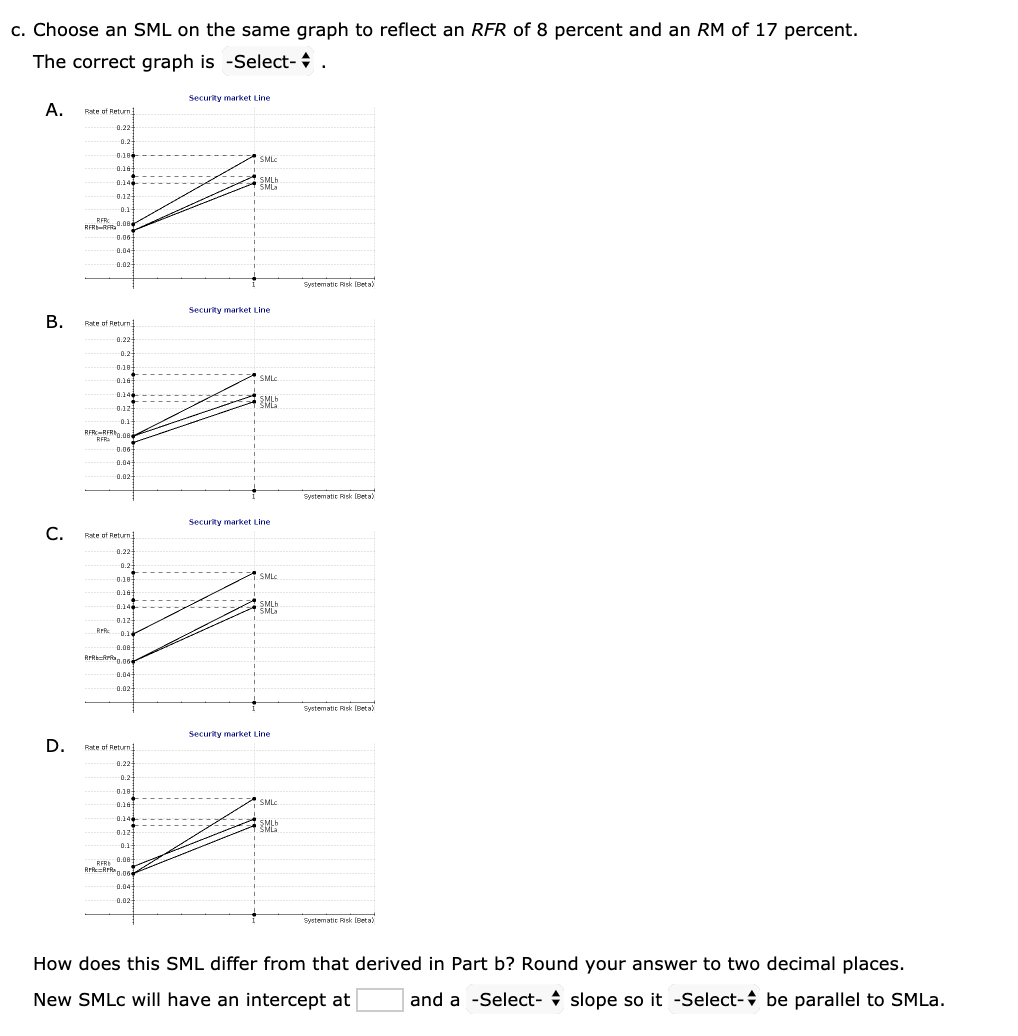

Problem 7-01 Assume that you expect the economy's rate of inflation to be 3 percent, giving an RFR of 7 percent and a market return (RM) of 13 percent. a. Choose the correct SML graph under these assumptions. The correct graph is -Select- : . Security market Line A. Rate of Return 0.22 0.14 -0.007 FR056 0.00+ - 0.027 Systematit Risk (Beta) Security market Line Rate of Return 1 0.18+ 0.164 0.14 0.125 0.087 RERS 0.064 0.04+ 0.187 0.14 RFR 0.00 0.047 D. Rate of Return 0.14 0.127 RFR 0.00 0.04 -0.021 Systematisk (Beta) b. Subsequently, you expect the rate of inflation to increase from 3 percent to 4 percent. What effect would this have on the RFR and the RM? A change in risk-free rate, with other things being equal, would result in a new SMLb, which would intercept with the -Select- axis at the new risk-free rate and -Select- be parallel to the original SMLa. Choose the correct SML graph. The correct graph is -Select- . A. Reed c. Choose an SML on the same graph to reflect an RFR of 8 percent and an RM of 17 percent. The correct graph is -Select- . Security market Line A. Rate of Return 0.227 012- 0.16+ SMLC 0.144 0.127 RFR 0.00 0.067 0.04+ Security market Line B. Rate of Return 0.227 0.144 Security market Line Rate of Return 0.221 0.21 0.10+ 0.14 0.12 0.14 -0.007 0.047 Systematisk (Beta) Security market Line D. Rate of Return 0227 0.167 0.14 0.127 Systematisk (Beta) How does this SML differ from that derived in Part b? Round your answer to two decimal places. New SMLC will have an intercept at and a -Select- 4 slope so it -Select- be parallel to SMLa. Problem 7-01 Assume that you expect the economy's rate of inflation to be 3 percent, giving an RFR of 7 percent and a market return (RM) of 13 percent. a. Choose the correct SML graph under these assumptions. The correct graph is -Select- : . Security market Line A. Rate of Return 0.22 0.14 -0.007 FR056 0.00+ - 0.027 Systematit Risk (Beta) Security market Line Rate of Return 1 0.18+ 0.164 0.14 0.125 0.087 RERS 0.064 0.04+ 0.187 0.14 RFR 0.00 0.047 D. Rate of Return 0.14 0.127 RFR 0.00 0.04 -0.021 Systematisk (Beta) b. Subsequently, you expect the rate of inflation to increase from 3 percent to 4 percent. What effect would this have on the RFR and the RM? A change in risk-free rate, with other things being equal, would result in a new SMLb, which would intercept with the -Select- axis at the new risk-free rate and -Select- be parallel to the original SMLa. Choose the correct SML graph. The correct graph is -Select- . A. Reed c. Choose an SML on the same graph to reflect an RFR of 8 percent and an RM of 17 percent. The correct graph is -Select- . Security market Line A. Rate of Return 0.227 012- 0.16+ SMLC 0.144 0.127 RFR 0.00 0.067 0.04+ Security market Line B. Rate of Return 0.227 0.144 Security market Line Rate of Return 0.221 0.21 0.10+ 0.14 0.12 0.14 -0.007 0.047 Systematisk (Beta) Security market Line D. Rate of Return 0227 0.167 0.14 0.127 Systematisk (Beta) How does this SML differ from that derived in Part b? Round your answer to two decimal places. New SMLC will have an intercept at and a -Select- 4 slope so it -Select- be parallel to SMLa