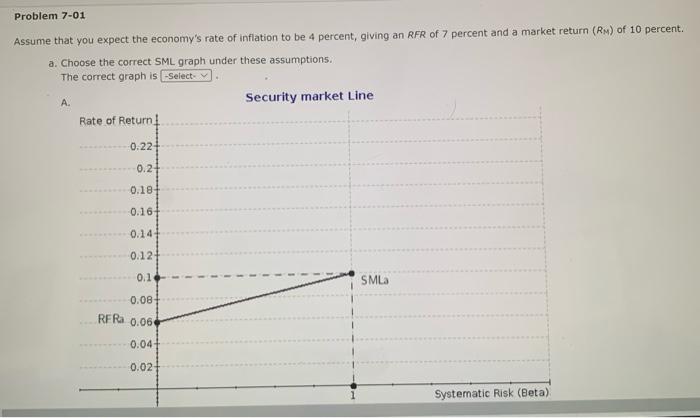

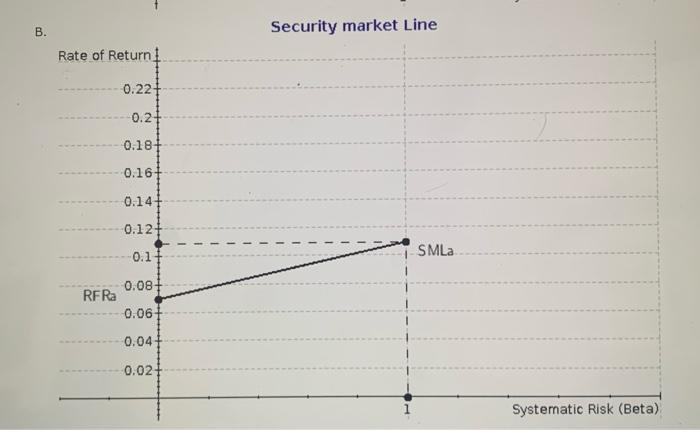

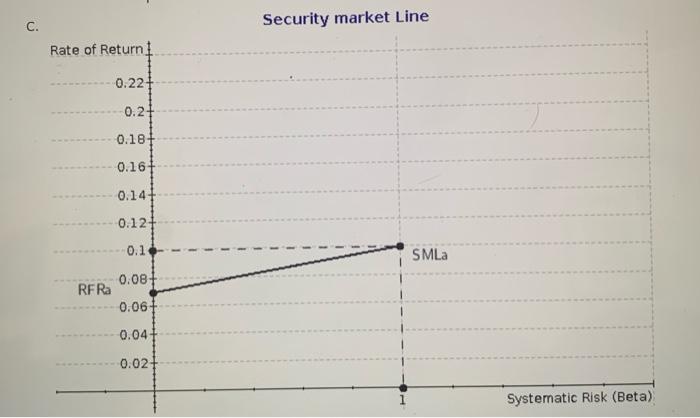

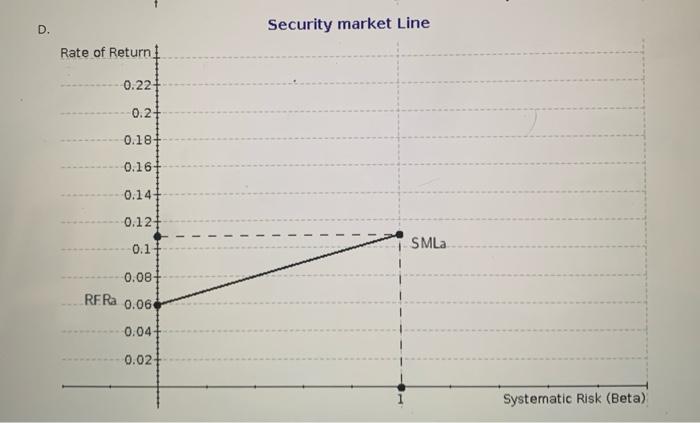

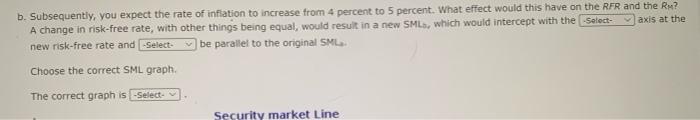

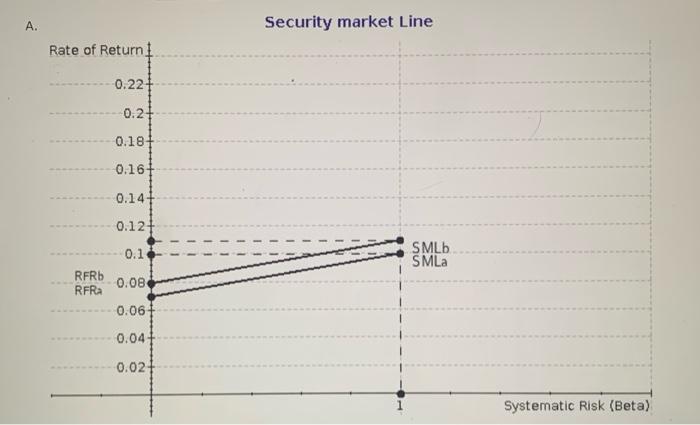

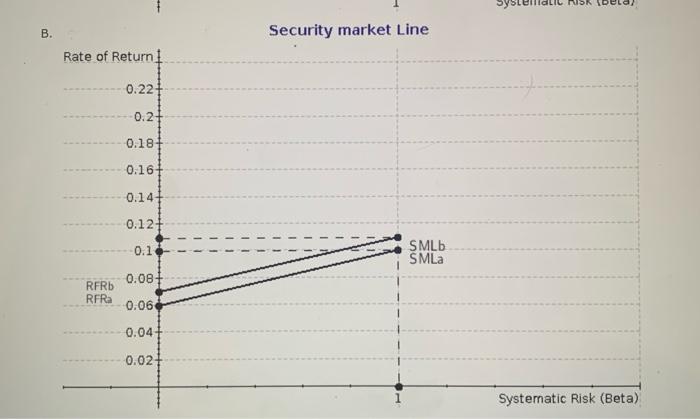

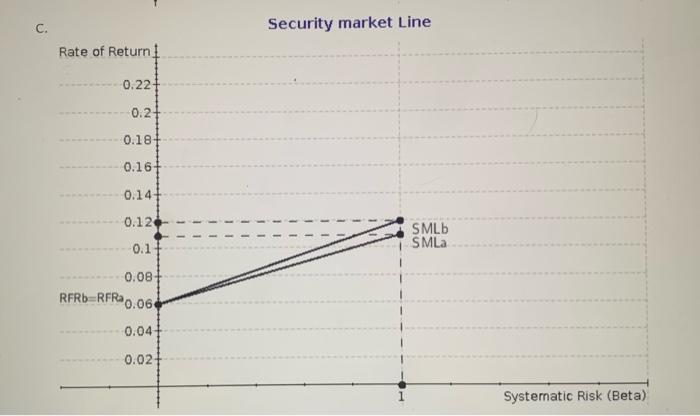

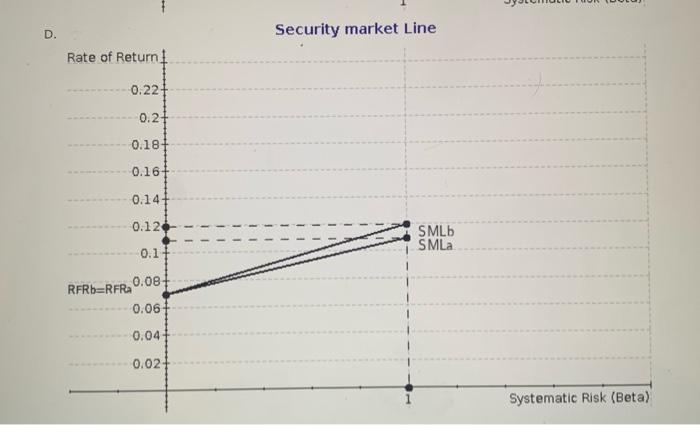

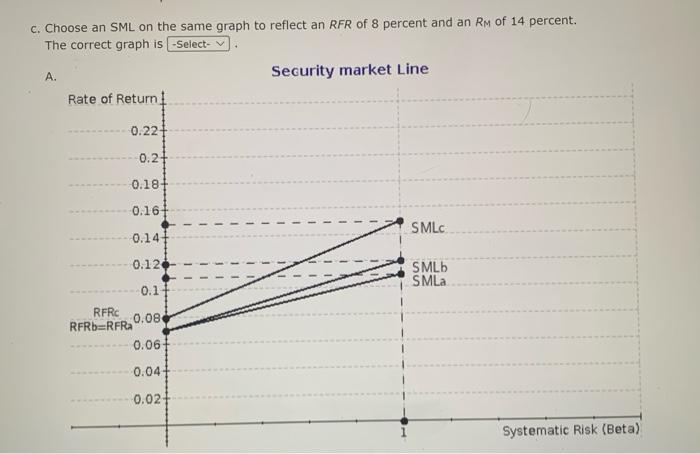

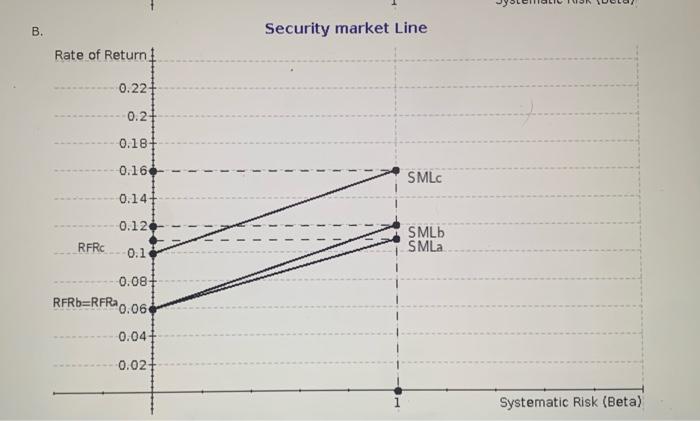

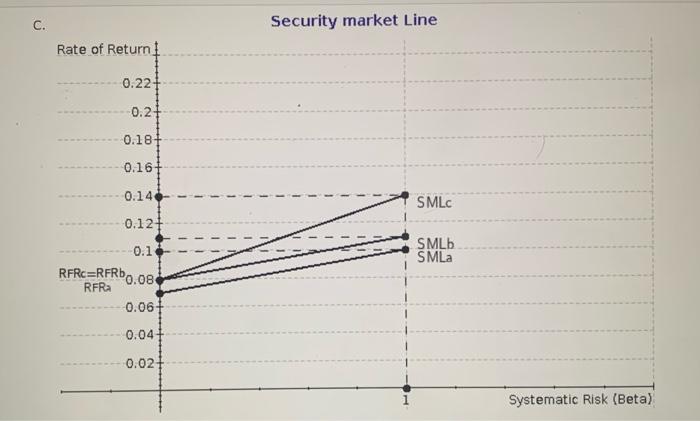

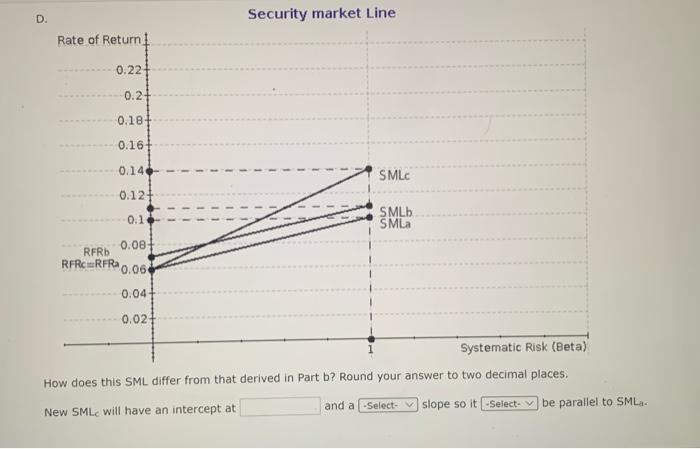

Problem 7-01 Assume that you expect the economy's rate of inflation to be 4 percent, giving an RFR of 7 percent and a market return (RM) of 10 percent. a. Choose the correct SML graph under these assumptions. The correct graph is - Select Security market Line Rate of Return A 0.22 0.2 0.181 0.16 0.14 0.12 0.1 - 1 -- SMLA 0.08 RFR 0.06 0.041 0.02 Systematic Risk (Beta) B. Security market Line Rate of Return 0.22 0.2+ 0.187 0.16 0.14 0.127 0.1 SMLa 0.08 RF Ra 0.06| 0.04 0.02 Systematic Risk (Beta) C. Security market Line Rate of Return 0.221 0.2 0.187 0.16+ 0.14 0.121 0.1 SMLa 0:08+ RF Ra 0.061 0.04 0.02 Systematic Risk (Beta) D. Security market Line Rate of Return 0.221 0.27 0.18 0.16 0.14 0.12 SMLa 0.1 0.08 RF Ra 0.06 0.04 0.02 Systematic Risk (Beta) b. Subsequently, you expect the rate of inflation to increase from 4 percent to 5 percent. What effect would this have on the RFR and the R? A change in risk-free rate, with other things being equal, would result in a new SML, which would intercept with the Select- axis at the new risk-free rate and select- be parallel to the original SML: Choose the correct SML graph. The correct graph is Select Security market Line A. Security market Line Rate of Return 0.22 0.2+ 0.181 0.16 0.14 0.12 0.1 SMLD SMLa RFRb RFR 0.08 0.06 0.04 0.02 1 Systematic Risk (Beta) sy B. Security market Line Rate of Return 0.221 0.2+ 0.18 0.167 0.14 0.121 0.1 SML SMLa 0.08 RFRb RFR 0.06 0.04 0.02 HO Systematic Risk (Beta) C. Security market Line Rate of Return 0.22 0.24 0.18 0.16 0.14 1 1 0.12 11 SMLb SMLa 0.1 0.08 RFRb RFR 0.06 0.04 0.02 Systematic Risk (Beta) D. Security market Line Rate of Return 0.22 0.2+ 0.187 0.161 0.14 0.126 SMLb SMLa 0.17 0.08 RFRE=RFRA 0.06 0.04 0.02 Systematic Risk (Beta) c. Choose an SML on the same graph to reflect an RFR of 8 percent and an RM of 14 percent. The correct graph is -Select- A. Security market Line Rate of Return 0.22 0.2 0.18 0.16 SMLC 0.14 0.12 SMLD SMLa 0.1 RFRC 0.08 RFRbaRFR 0.06 0.04 0.021 Systematic Risk (Beta) B. Security market Line Rate of Return 1 0.22 0.2 0.18 0.16 - 1 - 1 SMLC 0.14- ! 0.12 - 1 - SMLb SMLa RFRC 0.1 0.081 RFRE=RFRA *0.06 0.04 0.02 1 Systematic Risk (Beta) C. Security market Line Rate of Return 0.227 0.2 0.18 0.16 0.14 SMLC 0.12 0.1 SML SMLa RFRCERFRB0.08 RFRA 0.06 0.04 0.02 1 Systematic Risk (Beta) D. Security market Line Rate of Return 0.22 0.2- 0.18 0.16 0.14 SMLC 0.12 0.1 SMLb SMLa 0.00 RFRb RFR ERFRA 0.06 0.04 0.02 Systematic Risk (Beta) How does this SML differ from that derived in Part b? Round your answer to two decimal places. New SMLC will have an intercept at and a Select slope so it -Select- be parallel to SML