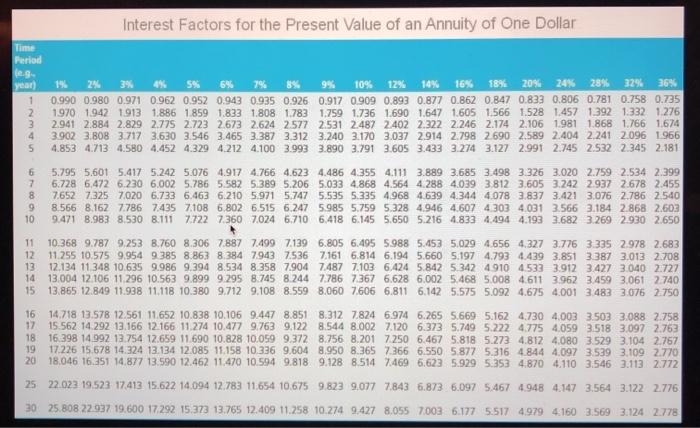

Problem 7-06 A widow currently has a $91,000 investment that yields 6 percent annually. Can she withdraw $13,000 for the next ten years? Use Appendix D to answer the question. Round your answer to the nearest dollar. The maximum amount that can be withdrawn Is $ so she -Select- v withdraw $13,000 for the next ten years. Would your answer be different if the yield were 9 percent? Use Appendix D to answer the question. Round your answer to the nearest dollar. If the yield is 9 percent the maximum amount that can be withdrawn is $ so she -Select- withdraw $13,000 for the next ten years. Interest Factors for the Present Value of an Annuity of One Dollar Period 19 year) 1 WN- 2% 3% 5% 6% 7% 9% 10% 12% 10% 16% 18% 20% 24 28% 32% 36% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0909 0.893 0.877 0.862 0.847 0.833 0.806 0.781 0.758 0.735 1970 1942 1913 1.886 1859 1.833 1.808 1.783 1.759 1.736 1.690 1.647 1.605 1.566 1.528 1.457 1392 1.332 1.276 2.9412.884 2.829 2.775 2.723 2.673 2.624 2.577 2531 2.487 2402 2.322 2.246 2.174 2.106 1981 1.868 1.766 1674 3902 3.808 3.717 3.630 3.546 3.465 3.387 3,312 3.240 3.170 3,037 2.914 2.798 2690 2.589 2.404 2.241 2.096 1966 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.274 3.127 2.991 2.745 2.532 2.345 2.181 4 5 6 7 8 9 10 5.795 5.601 5.417 5.242 5.076 4.917 4.766 4.623 4.486 4355 4.111 3.889 3.685 3.498 3.326 3.020 2.759 2.534 2.399 6.728 6,472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.039 3.812 3.605 3.242 2.937 2.678 2.455 7.652 7325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.344 4.078 3.837 3.421 3.076 2.786 2.540 8.566 8.162 7.786 7435 7108 6.802 6.515 6.247 5.985 5.759 5328 4.946 4.607 4303 4.031 3.566 3.184 2.868 2.603 9.471 8.983 8.530 8.111 7722 7360 7.024 6.710 6.418 6.145 5.650 5.216 4.833 4.494 4.193 3.682 3.269 2.930 2.650 11 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 5.988 5.453 5.029 4656 4.327 3.776 3.335 2.978 2.683 12 11.255 10.575 9.954 9385 8.863 8.384 7943 7.536 7.161 6.814 6.194 5.660 5.197 4.793 4.439 3.851 3387 3.013 2.708 13 12.134 11 348 10.635 9.986 9.394 8.534 8.358 7.904 7487 7.103 6.424 5.842 5.342 4910 4.533 3.912 3.427 3.040 2.727 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.468 5,008 4.611 3962 3.459 3.061 2740 15 13.865 12.849 11.938 11,118 10:380 9712 9.108 8.559 8.060 7.606 6.811 6.142 5.575 5.092 4.675 4.001 3.483 3.076 2.750 16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.312 7.824 6.974 6.265 5.669 5.162 4.730 4.003 3.503 3.088 2.758 17 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.002 7.120 6.373 5.749 5.222 4.775 4,059 3.518 3.097 2.763 18 16.398 14.992 12.754 12.659 11.690 10.828 10.059 9.372 8.756 8.2017.250 6.467 5.818 5.2734.812 4.080 3.529 3.104 2.757 19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.550 5.877 5.316 4.844 4.0973.539 3.109 2.770 20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.128 8.514 7.469 6.623 5.929 5.353 4.870 4.110 3.546 3.113 2772 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.8239.077 7.843 6.8736.097 5.467 4.948 4.147 3.564 3.122 2.776 30 25.808 22.937 19.600 17.292 15.373 13.765 12.409 11.258 10.274 9.427 8.055 7003 6.177 5.517 4.9794.160 3.569 3.124 2.778 ent annually. Can she withdraw $13,000 for the next ten years? Use mearest dollar. so she -Select- v withdraw $13,000 for the next ten years. Appendix D to answer the question. Round your answer to the ndrawn is $ withdraw $13,000 for so sh -Select- can cannot