Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 7-2 1. 2. 3. Free Cash Flow Time Value Factor 5% WACC Present Value (Rounded) FCF 2020 : $200 .95238 (n= 1) FCF 2021

Problem 7-2

1.

2.

3.

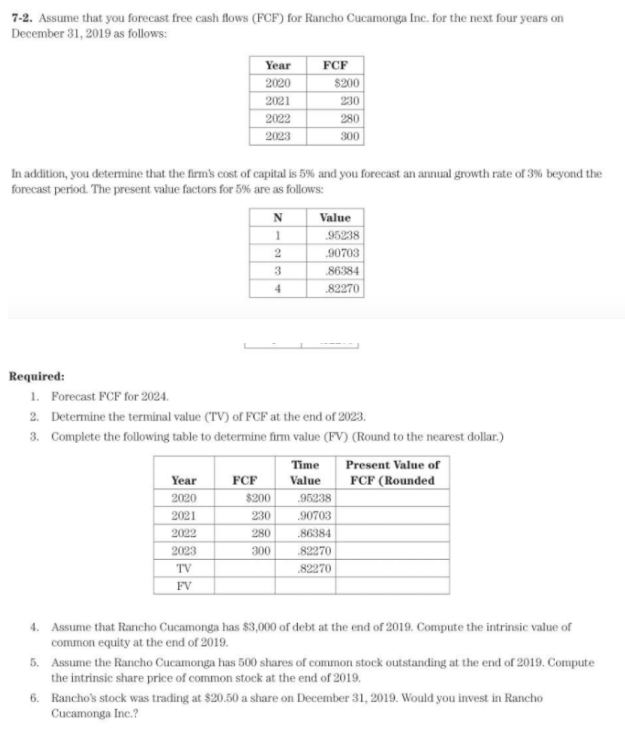

| Free Cash Flow | Time Value Factor 5% WACC | Present Value (Rounded) |

| FCF2020: $200 | .95238 (n= 1) |

|

| FCF2021: 230 | .90703 (n= 2) |

|

| FCF2022: 280 | .86384 (n= 3) |

|

| FCF2023: 300 | .82270 (n = 4) |

|

| FCFTV: | .82270 (n = 4) |

|

| Firm Value |

|

|

4.

5.

6.

Year 7-2. Assume that you forecast free cash flows (FCF) for Rancho Cucamonga Inc. for the next four years on December 31, 2019 as follows: FCF 2020 $200 2021 2022 2023 230 280 300 In addition, you determine that the firm's cost of capital is 5% and you forecast an annual growth rate of 3% beyond the forecast period. The present value factors for 5% are as follows: N Value 95238 .90703 .86384 .82270 1 2 3 4 Required: 1. Forecast FCF for 2024. 2. Determine the terminal value (TV) of FCF at the end of 2023. 3. Complete the following table to determine firm value (FV) (Round to the nearest dollar.) Time Present Value of Year FCF Value FCF (Rounded 2020 $200 95238 2021 .90703 2022 .86384 .82270 TV 82270 FV 230 280 300 2023 4. Assume that Rancho Cucamonga has $3,000 of debt at the end of 2019. Compute the intrinsic value of common equity at the end of 2019. 5. Assume the Rancho Cucamonga has 500 shares of common stock outstanding at the end of 2019. Compute the intrinsic share price of common stock at the end of 2019. 6. Rancho's stock was trading at $20.50 a share on December 31, 2019. Would you invest in Rancho Cucamonga Inc

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started