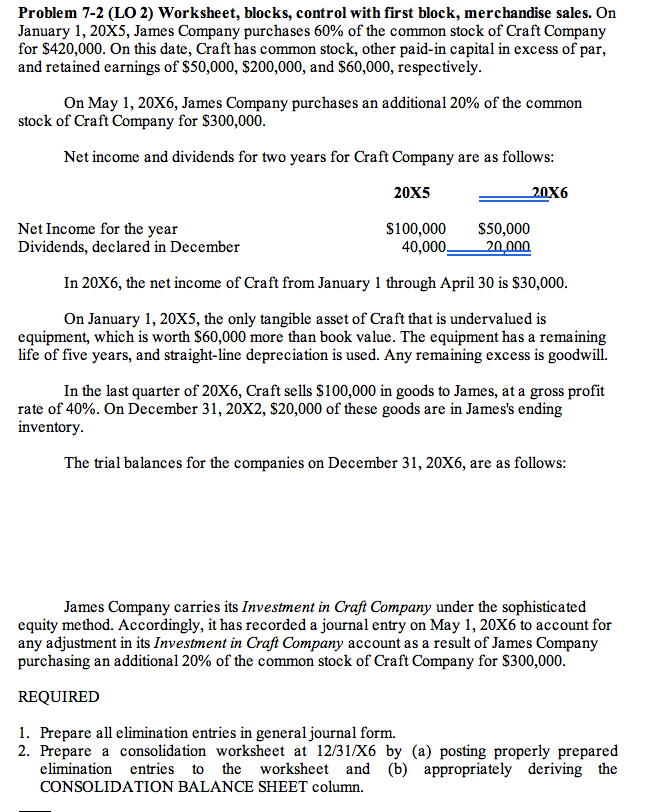

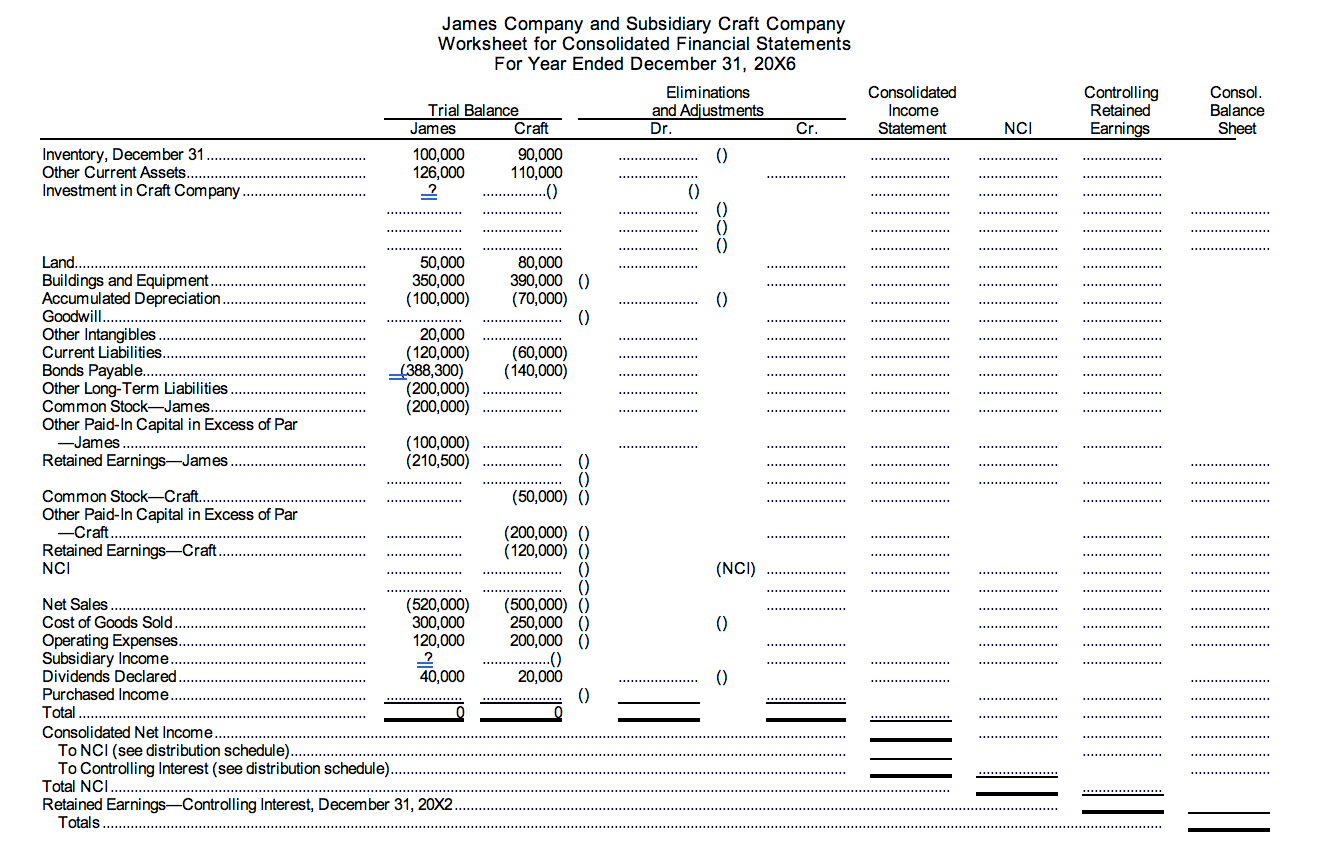

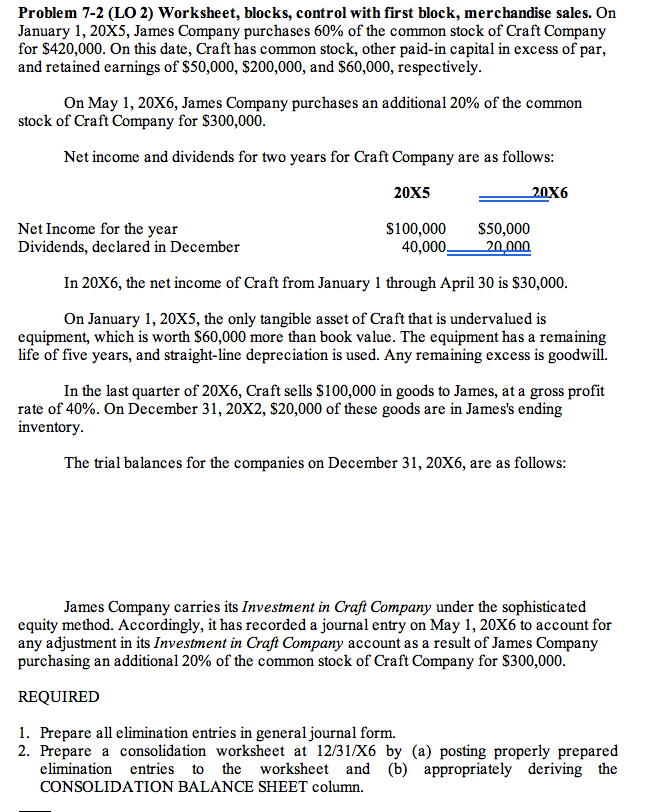

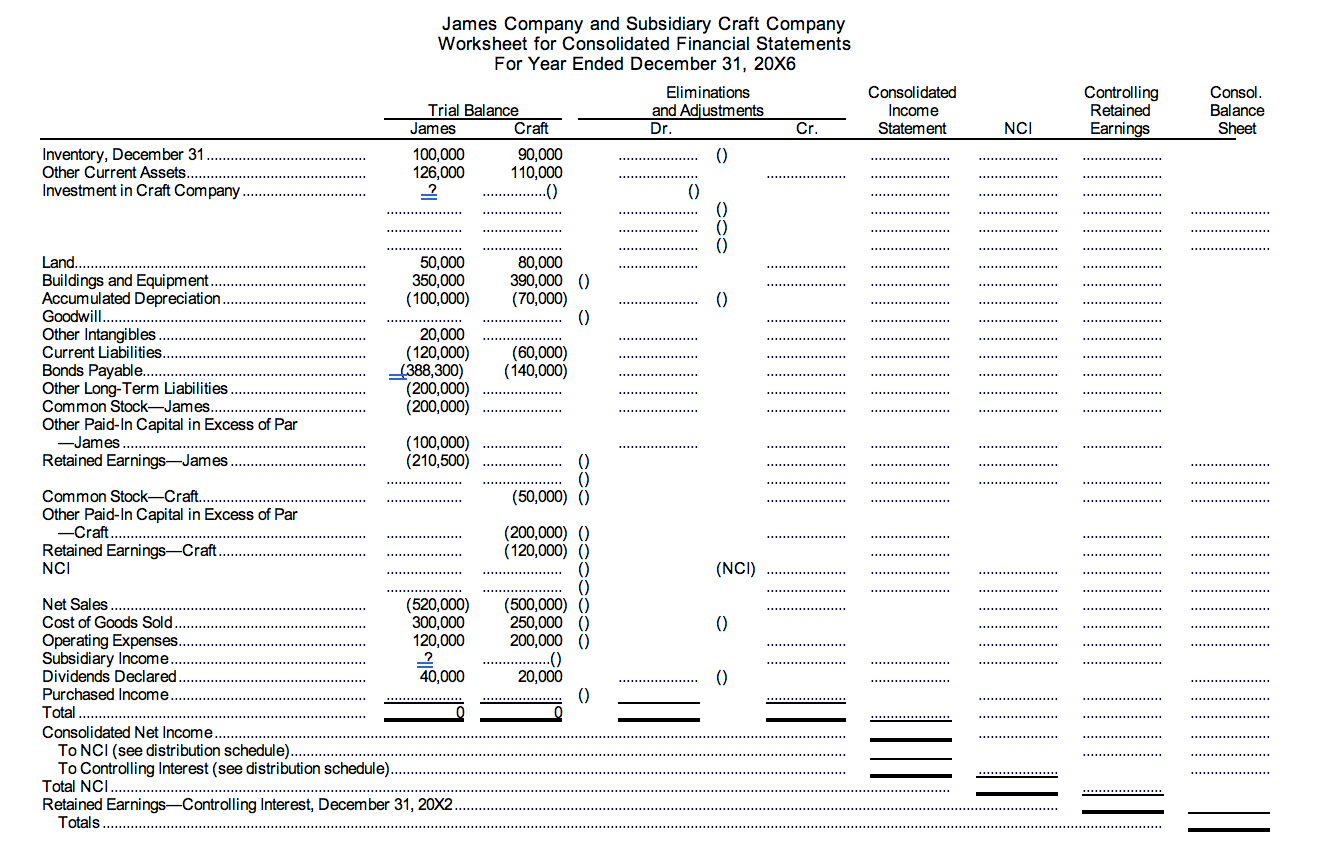

Problem 7-2 (LO 2) Worksheet, blocks, control with first block, merchandise sales. On January 1, 20X5, James Company purchases 60% of the common stock of Craft Company for $420,000. On this date, Craft has common stock, other paid-in capital in excess of par, and retained earnings of $50,000, $200,000, and $60,000, respectively. On May 1, 20X6, James Company purchases an additional 20% of the common stock of Craft Company for $300,000. Net income and dividends for two years for Craft Company are as follows: 20X5 20X6 Net Income for the year $100,000 $50,000 Dividends, declared in December 40,000 20.000 In 20X6, the net income of Craft from January 1 through April 30 is $30,000. On January 1, 20X5, the only tangible asset of Craft that is undervalued is equipment, which is worth $60,000 more than book value. The equipment has a remaining life of five years, and straight-line depreciation is used. Any remaining excess is goodwill. In the last quarter of 20X6, Craft sells $100,000 in goods to James, at a gross profit rate of 40%. On December 31, 20X2, $20,000 of these goods are in James's ending inventory. The trial balances for the companies on December 31, 20X6, are as follows: James Company carries its Investment in Craft Company under the sophisticated equity method. Accordingly, it has recorded a journal entry on May 1, 20X6 to account for any adjustment in its Investment in Craft Company account as a result of James Company purchasing an additional 20% of the common stock of Craft Company for $300,000. REQUIRED 1. Prepare all elimination entries in general journal form. 2. Prepare a consolidation worksheet at 12/31/X6 by (a) posting properly prepared elimination entries to the worksheet and (b) appropriately deriving the CONSOLIDATION BALANCE SHEET column. James Company and Subsidiary Craft Company Worksheet for Consolidated Financial Statements For Year Ended December 31, 20X6 Eliminations Trial Balance and Adjustments James Craft Dr. Cr. 100,000 90,000 0 126,000 110,000 2 0 Consolidated Income Statement Controlling Retained Earnings Consol. Balance Sheet NCI Inventory, December 31 Other Current Assets. Investment in Craft Company. CO. 50,000 350,000 (100,000) 80,000 390,000 () (70,000) 0 0 Land. Buildings and Equipment. Accumulated Depreciation Goodwill. Other Intangibles Current Liabilities. Bonds Payable......... Other Long-Term Liabilities Common Stock-James. Other Paid-In Capital in Excess of Par -James Retained EarningsJames 20,000 (120,000) _4388,300) (200,000) (200,000) (60,000) (140,000) (100,000) (210,500) SOO (50,000) () Common Stock-Craft... Other Paid-In Capital in Excess of Par -Craft. Retained EarningsCraft. NCI (200,000) () (120,000) () (NCI) 0 (500,000) () 250,000 (0) 200,000 () 0 20,000 0 0 Net Sales ....... (520,000) Cost of Goods Sold. 300,000 Operating Expenses. 120,000 Subsidiary Income Dividends Declared. 40,000 Purchased Income Total Consolidated Net Income To NCI (see distribution schedule). To Controlling Interest (see distribution schedule). Total NCI. Retained EarningsControlling Interest, December 31, 20x2. Totals Problem 7-2 (LO 2) Worksheet, blocks, control with first block, merchandise sales. On January 1, 20X5, James Company purchases 60% of the common stock of Craft Company for $420,000. On this date, Craft has common stock, other paid-in capital in excess of par, and retained earnings of $50,000, $200,000, and $60,000, respectively. On May 1, 20X6, James Company purchases an additional 20% of the common stock of Craft Company for $300,000. Net income and dividends for two years for Craft Company are as follows: 20X5 20X6 Net Income for the year $100,000 $50,000 Dividends, declared in December 40,000 20.000 In 20X6, the net income of Craft from January 1 through April 30 is $30,000. On January 1, 20X5, the only tangible asset of Craft that is undervalued is equipment, which is worth $60,000 more than book value. The equipment has a remaining life of five years, and straight-line depreciation is used. Any remaining excess is goodwill. In the last quarter of 20X6, Craft sells $100,000 in goods to James, at a gross profit rate of 40%. On December 31, 20X2, $20,000 of these goods are in James's ending inventory. The trial balances for the companies on December 31, 20X6, are as follows: James Company carries its Investment in Craft Company under the sophisticated equity method. Accordingly, it has recorded a journal entry on May 1, 20X6 to account for any adjustment in its Investment in Craft Company account as a result of James Company purchasing an additional 20% of the common stock of Craft Company for $300,000. REQUIRED 1. Prepare all elimination entries in general journal form. 2. Prepare a consolidation worksheet at 12/31/X6 by (a) posting properly prepared elimination entries to the worksheet and (b) appropriately deriving the CONSOLIDATION BALANCE SHEET column. James Company and Subsidiary Craft Company Worksheet for Consolidated Financial Statements For Year Ended December 31, 20X6 Eliminations Trial Balance and Adjustments James Craft Dr. Cr. 100,000 90,000 0 126,000 110,000 2 0 Consolidated Income Statement Controlling Retained Earnings Consol. Balance Sheet NCI Inventory, December 31 Other Current Assets. Investment in Craft Company. CO. 50,000 350,000 (100,000) 80,000 390,000 () (70,000) 0 0 Land. Buildings and Equipment. Accumulated Depreciation Goodwill. Other Intangibles Current Liabilities. Bonds Payable......... Other Long-Term Liabilities Common Stock-James. Other Paid-In Capital in Excess of Par -James Retained EarningsJames 20,000 (120,000) _4388,300) (200,000) (200,000) (60,000) (140,000) (100,000) (210,500) SOO (50,000) () Common Stock-Craft... Other Paid-In Capital in Excess of Par -Craft. Retained EarningsCraft. NCI (200,000) () (120,000) () (NCI) 0 (500,000) () 250,000 (0) 200,000 () 0 20,000 0 0 Net Sales ....... (520,000) Cost of Goods Sold. 300,000 Operating Expenses. 120,000 Subsidiary Income Dividends Declared. 40,000 Purchased Income Total Consolidated Net Income To NCI (see distribution schedule). To Controlling Interest (see distribution schedule). Total NCI. Retained EarningsControlling Interest, December 31, 20x2. Totals