Answered step by step

Verified Expert Solution

Question

1 Approved Answer

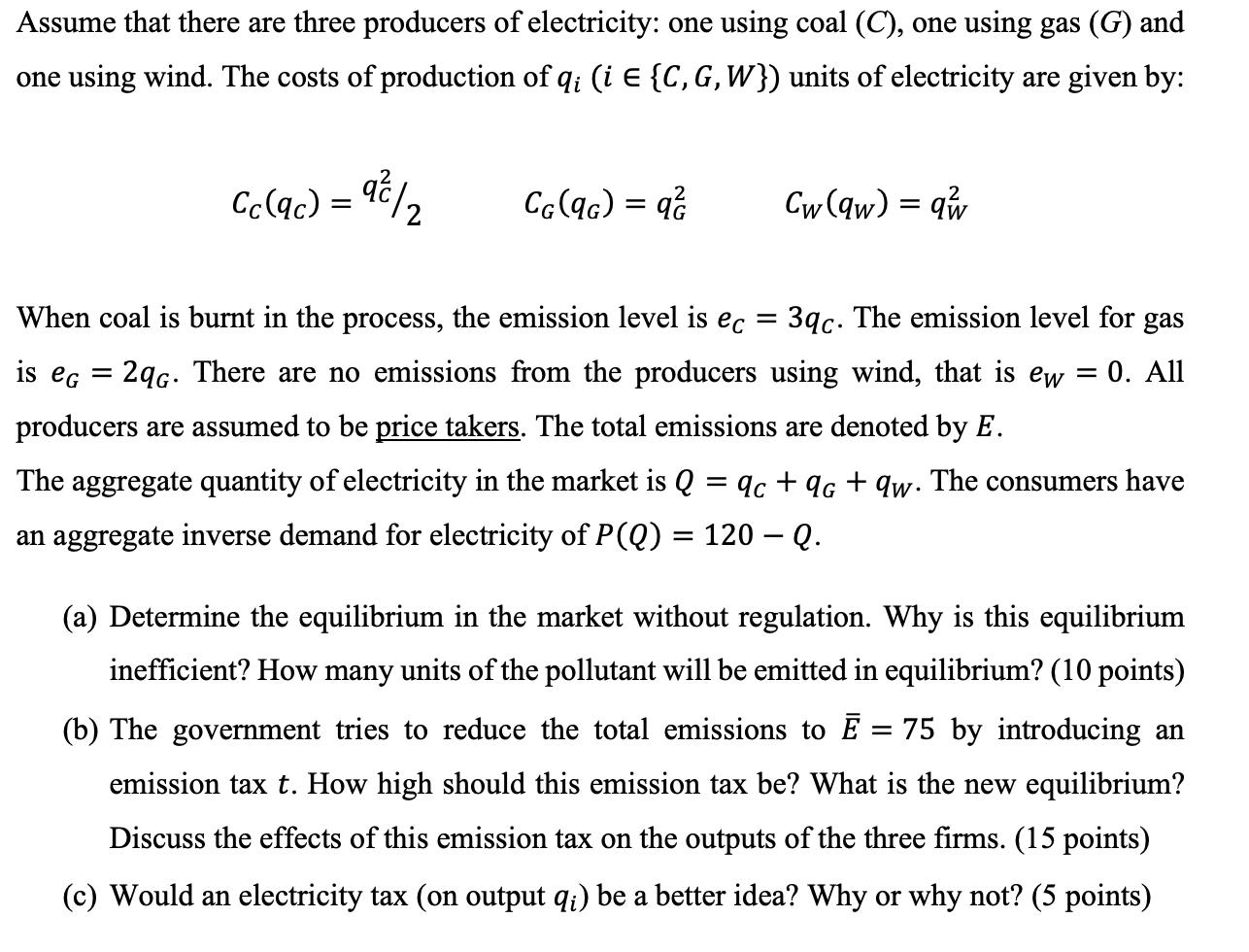

Assume that there are three producers of electricity: one using coal (C), one using gas (G) and one using wind. The costs of production

Assume that there are three producers of electricity: one using coal (C), one using gas (G) and one using wind. The costs of production of qi (i E {C, G, W}) units of electricity are given by: Cc (9c) = 9/2 CG (9G) =q is eg Cw (qw) = qw When coal is burnt in the process, the emission level is ec = 3qc. The emission level for gas = 0. All = = 2qG. There are no emissions from the producers using wind, that is ew producers are assumed to be price takers. The total emissions are denoted by E. The aggregate quantity of electricity in the market is Q = qc + qG+qw. The consumers have an aggregate inverse demand for electricity of P(Q) = 120 - Q. (a) Determine the equilibrium in the market without regulation. Why is this equilibrium inefficient? How many units of the pollutant will be emitted in equilibrium? (10 points) (b) The government tries to reduce the total emissions to E = 75 by introducing an emission tax t. How high should this emission tax be? What is the new equilibrium? Discuss the effects of this emission tax on the outputs of the three firms. (15 points) (c) Would an electricity tax (on output qi) be a better idea? Why or why not? (5 points)

Step by Step Solution

★★★★★

3.41 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

aAt the equilibrium P MC so we have 120 Q 902 Q 30 Therefore in equilibrium qc 10 qg 10 and qw 10 The total emissions in equilibrium are E 30 This equ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started