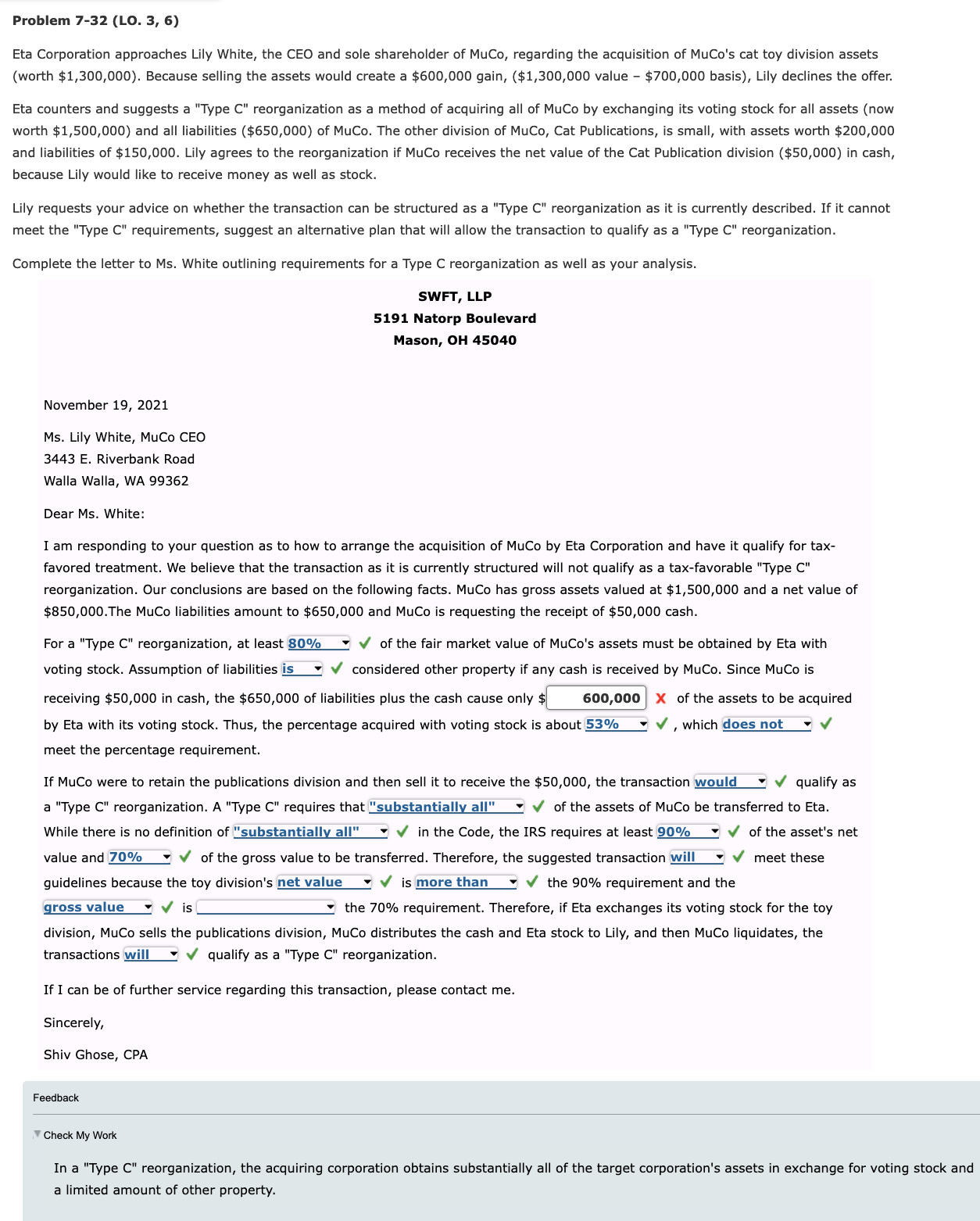

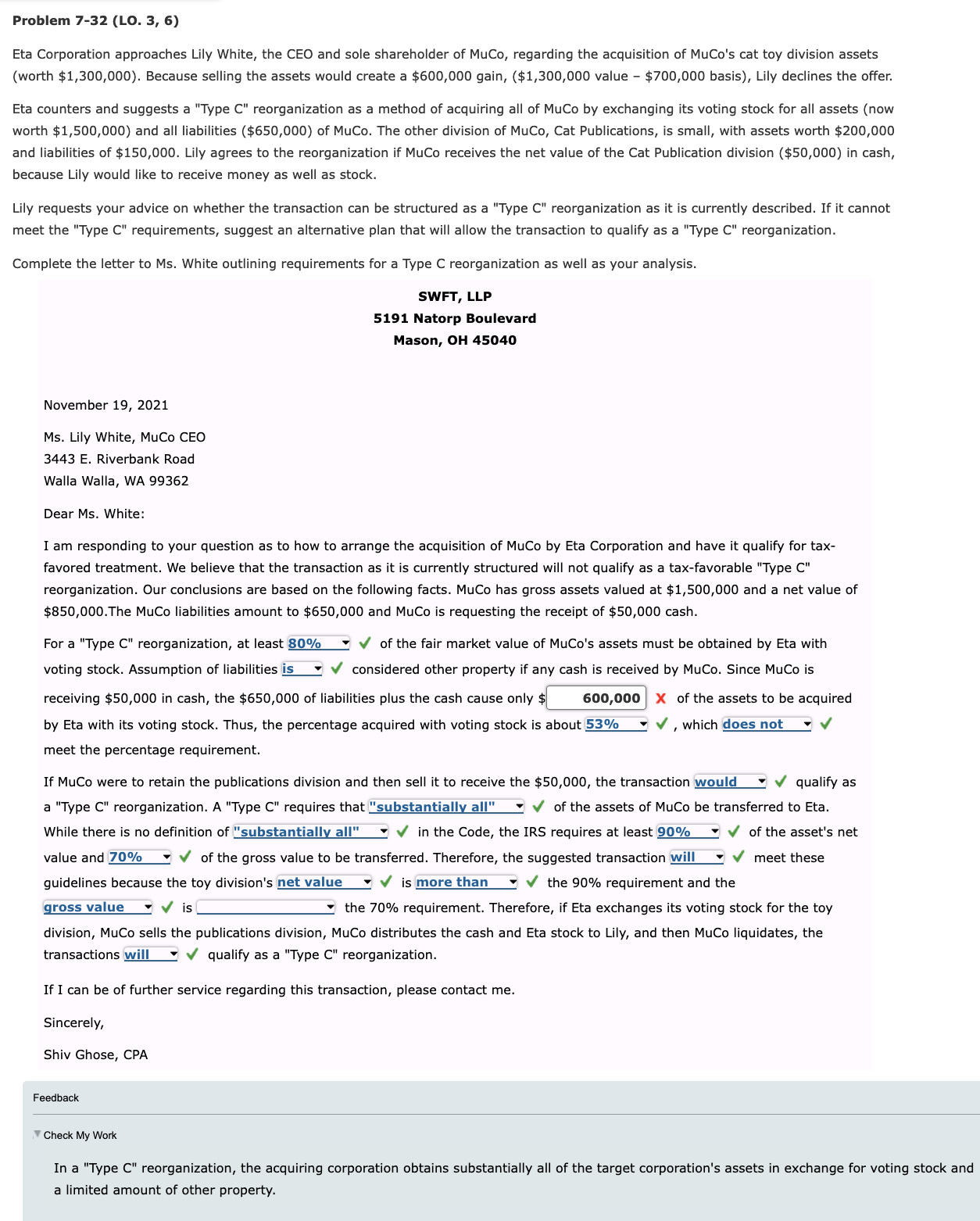

Problem 7-32 (LO. 3, 6) Eta Corporation approaches Lily White, the CEO and sole shareholder of MuCo, regarding the acquisition of MuCo's cat toy division assets (worth $1,300,000 ). Because selling the assets would create a $600,000 gain, $1,300,000 value - $700,000 basis), Lily declines the offer. Eta counters and suggests a "Type C " reorganization as a method of acquiring all of MuCo by exchanging its voting stock for all assets (now worth $1,500,000 ) and all liabilities ( $650,000) of MuCo. The other division of MuCo, Cat Publications, is small, with assets worth $200,000 and liabilities of $150,000. Lily agrees to the reorganization if MuCo receives the net value of the Cat Publication divion ( $50,000 ) in cash, because Lily would like to receive money as well as stock. Lily requests your advice on whether the transaction can be structured as a "Type C" reorganization as it is currently described. If it cannot meet the "Type C" requirements, suggest an alternative plan that will allow the transaction to qualify as a "Type C" reorganization. Complete the letter to Ms. White outlining requirements for a Type C reorganization as well as your analysis. November 19, 2021 Ms. Lily White, MuCo CEO 3443 E. Riverbank Road Walla Walla, WA 99362 Dear Ms. White: I am responding to your question as to how to arrange the acquisition of MuCo by Eta Corporation and have it qualify for taxfavored treatment. We believe that the transaction as it is currently structured will not qualify as a tax-favorable "Type C" reorganization. Our conclusions are based on the following facts. MuCo has gross assets valued at $1,500,000 and a net value of $850,000. The MuCo liabilities amount to $650,000 and MuCo is requesting the receipt of $50,000 cash. For a "Type C" reorganization, at least of the fair market value of MuCo's assets must be obtained by Eta with voting stock. Assumption of liabilities considered other property if any cash is received by MuCo. Since MuCo is receiving $50,000 in cash, the $650,000 of liabilities plus the cash cause only $X of the assets to be acquired by Eta with its voting stock. Thus, the percentage acquired with voting stock is about , which meet the percentage requirement. If MuCo were to retain the publications division and then sell it to receive the $50,000, the transaction qualify as a "Type C" reorganization. A "Type C " requires that of the assets of MuCo be transferred to Eta. While there is no definition of in the Code, the IRS requires at least of the asset's net value and of the gross value to be transferred. Therefore, the suggested transaction guidelines because the toy division's is the 90% requirement and the is the 70% requirement. Therefore, if Eta exchanges its voting stock for the toy division, MuCo sells the publications division, MuCo distributes the cash and Eta stock to Lily, and then MuCo liquidates, the transactions qualify as a "Type C reorganization. If I can be of further service regarding this transaction, please contact me. Sincerely, Shiv Ghose, CPA Feedback Check My Work In a "Type C " reorganization, the acquiring corporation obtains substantially all of the target corporation's assets in exchange for voting stock and a limited amount of other property