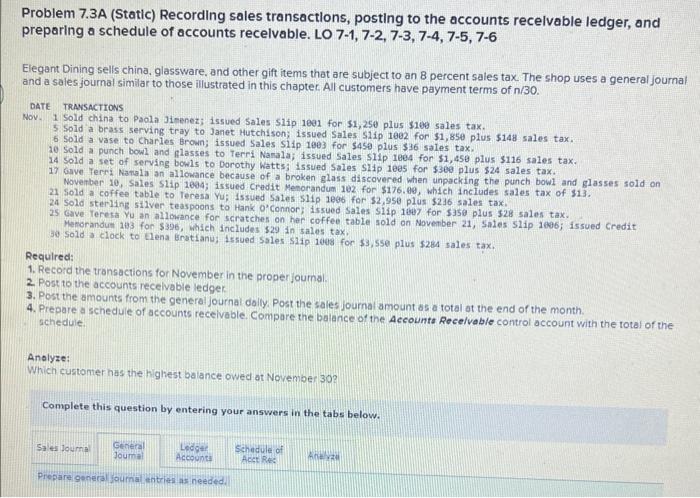

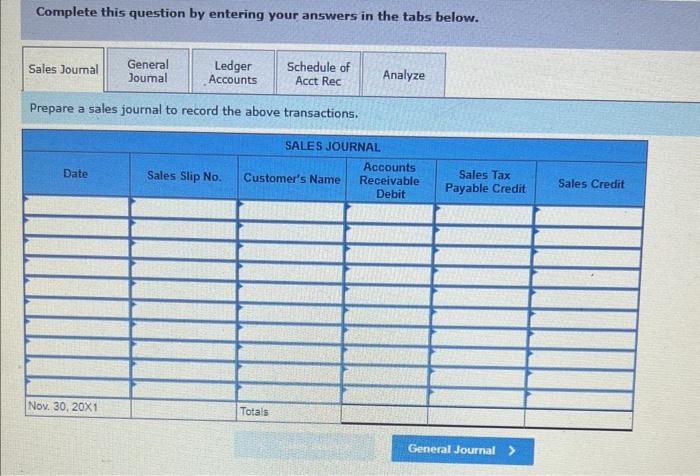

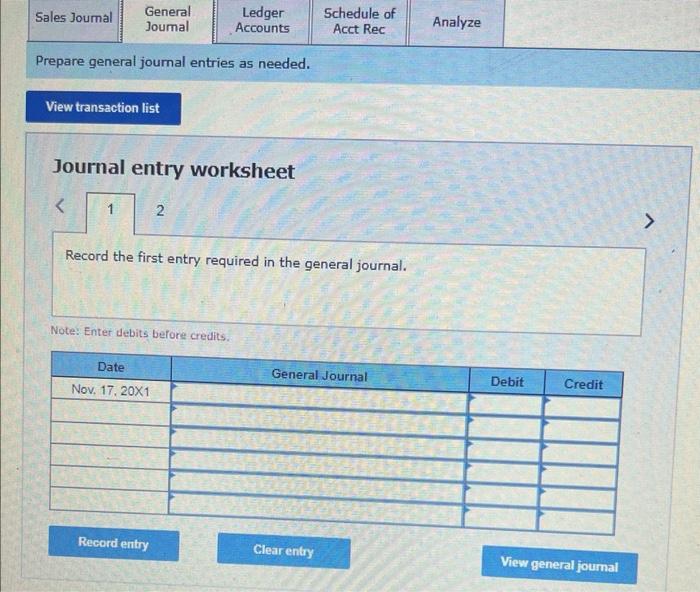

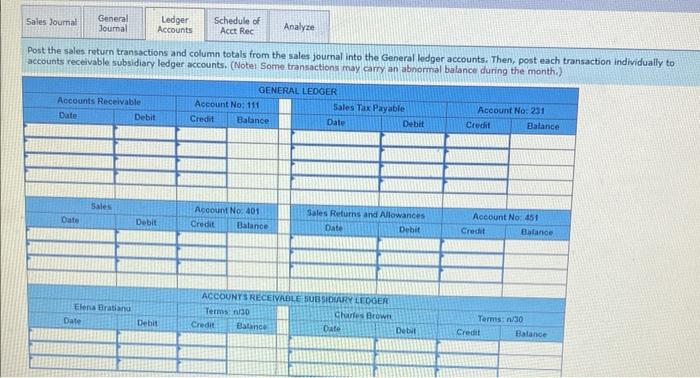

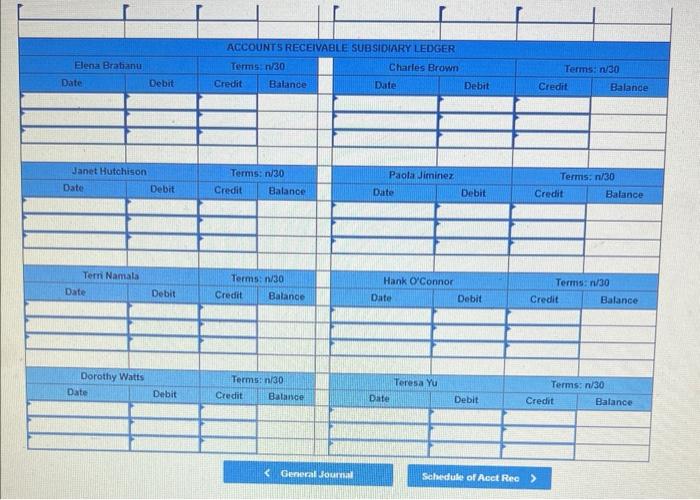

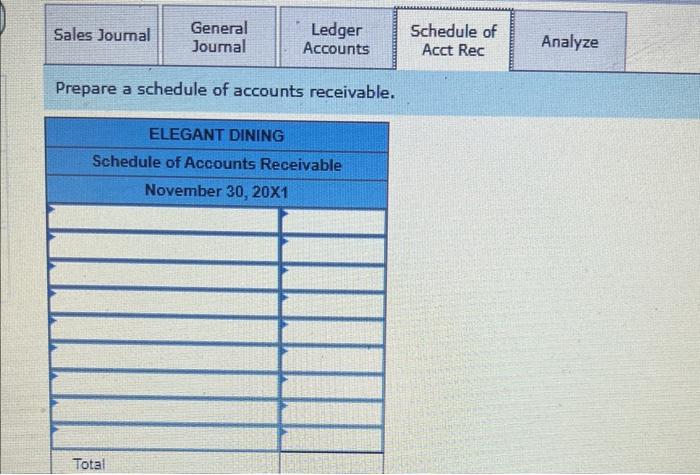

Problem 7.3A (Static) Recording sales transactlons, posting to the accounts recelvable ledger, and preparing a schedule of accounts recelvable. LO 7-1, 7-2, 7-3, 7-4, 7-5, 7-6 Elegant Dining sells china, glassware, and other gift items that are subject to an 8 percent sales tax. The shop uses a general journal and a sales journal similar to those illustrated in this chapter All customers have payment terms of n/30. date travisactions Nov. I Sold china to Paola Jimenez; issued Sales s1ip 1601 for $1,250 plus $100 sales tax. 5. Sold a beass serving tray to Janet Hutchison; issued Sales s1ip 1062 for $1,850 plus $148 sales tax. 6 sold a vase to Charles arown; issued Sales silp 1903 for 5450 plus $16 sales tax. 10 sold a punch bowl and glasses to Teri Narala; issued Sales s1ip 1ee4 for $1,450 plus $116 sales tax. 14 sold a set of serving bowls to Dorothy Wattsi issued sales slip lees for $360 plus $24 sales tax. 17 Gave Yernl Namala an allowance because of a broken glass discovered when unpacking the punch bowi and glasses sold on Novenber 10, sales S1ip 1004; issued credit Menorandum 102 for $176.60, which inc Iudes sales tax of 313. 21 Sold a coffee table to Teresa Yu; issued sales 511p1896 for 32,950 plus $216 sales tax. 24 Sold sterling silver teaspoons to Hank o' Connor; issued Sales s1ip le6 for s350 plus s28 sales tax. 25 cave terest Yu an allowance for scratches on her coffee table sold on November 21, Sales Slip 16o6; issued Credit 3e sold a clock to \$on \$396, which includes $29 in sales tax. Required: 1. Record the transactions for November in the properjoumal. 2. Post to the accounts recelvabie ledger 3. Post the amounts from the general journal dolly. Post the sales journal amount as a total at the end of the month. 4. Prepare a schedule of accounts recelvable. Compare the balance of the Accounta Recelvable control account with the total of the schedule. Anelyze: Which customer has the highest balance owed ot November 30 ? Complete this question by entering your answers in the tabs below. Prepare general joumal entriei as needed. Complete this question by entering your answers in the tabs below. Prepare a sales journal to record the above transactions. Prepare general joumal entries as needed. Journal entry worksheet Record the first entry required in the general journal. Note: Enter debits before credits. Post the sales return transactions and column totals from the sales journal into the General ledper accounts. Then. post each transaction individually to accounts receivable subsidiary ledger accounts. (Noter Some transactions may carry an abnormal balance during the month.) Prepare a schedule of accounts receivable. Which customer has the highest balance owed at November 30 ? Problem 7.3A (Static) Recording sales transactlons, posting to the accounts recelvable ledger, and preparing a schedule of accounts recelvable. LO 7-1, 7-2, 7-3, 7-4, 7-5, 7-6 Elegant Dining sells china, glassware, and other gift items that are subject to an 8 percent sales tax. The shop uses a general journal and a sales journal similar to those illustrated in this chapter All customers have payment terms of n/30. date travisactions Nov. I Sold china to Paola Jimenez; issued Sales s1ip 1601 for $1,250 plus $100 sales tax. 5. Sold a beass serving tray to Janet Hutchison; issued Sales s1ip 1062 for $1,850 plus $148 sales tax. 6 sold a vase to Charles arown; issued Sales silp 1903 for 5450 plus $16 sales tax. 10 sold a punch bowl and glasses to Teri Narala; issued Sales s1ip 1ee4 for $1,450 plus $116 sales tax. 14 sold a set of serving bowls to Dorothy Wattsi issued sales slip lees for $360 plus $24 sales tax. 17 Gave Yernl Namala an allowance because of a broken glass discovered when unpacking the punch bowi and glasses sold on Novenber 10, sales S1ip 1004; issued credit Menorandum 102 for $176.60, which inc Iudes sales tax of 313. 21 Sold a coffee table to Teresa Yu; issued sales 511p1896 for 32,950 plus $216 sales tax. 24 Sold sterling silver teaspoons to Hank o' Connor; issued Sales s1ip le6 for s350 plus s28 sales tax. 25 cave terest Yu an allowance for scratches on her coffee table sold on November 21, Sales Slip 16o6; issued Credit 3e sold a clock to \$on \$396, which includes $29 in sales tax. Required: 1. Record the transactions for November in the properjoumal. 2. Post to the accounts recelvabie ledger 3. Post the amounts from the general journal dolly. Post the sales journal amount as a total at the end of the month. 4. Prepare a schedule of accounts recelvable. Compare the balance of the Accounta Recelvable control account with the total of the schedule. Anelyze: Which customer has the highest balance owed ot November 30 ? Complete this question by entering your answers in the tabs below. Prepare general joumal entriei as needed. Complete this question by entering your answers in the tabs below. Prepare a sales journal to record the above transactions. Prepare general joumal entries as needed. Journal entry worksheet Record the first entry required in the general journal. Note: Enter debits before credits. Post the sales return transactions and column totals from the sales journal into the General ledper accounts. Then. post each transaction individually to accounts receivable subsidiary ledger accounts. (Noter Some transactions may carry an abnormal balance during the month.) Prepare a schedule of accounts receivable. Which customer has the highest balance owed at November 30