Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 7-3B Petty cash fund; reimbursement and analysis of errors LO4 The accounting system used by Dartmouth Sales and Service requires that all entries be

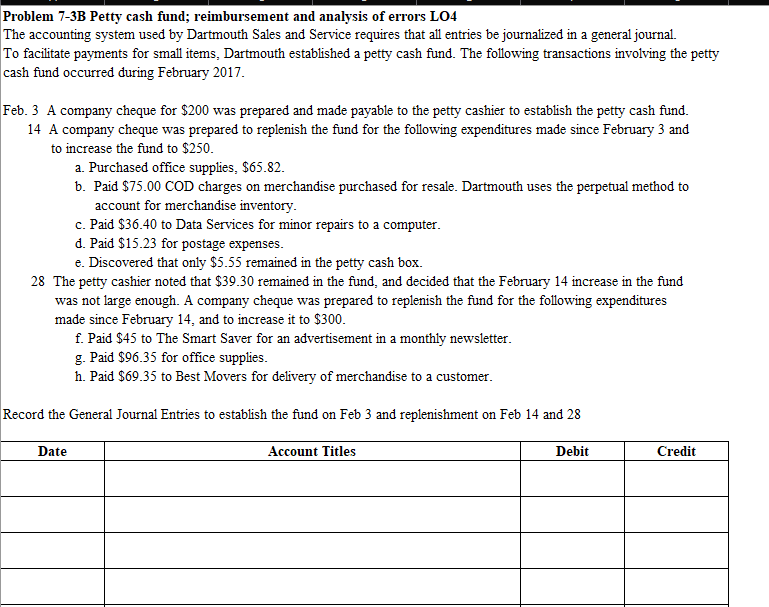

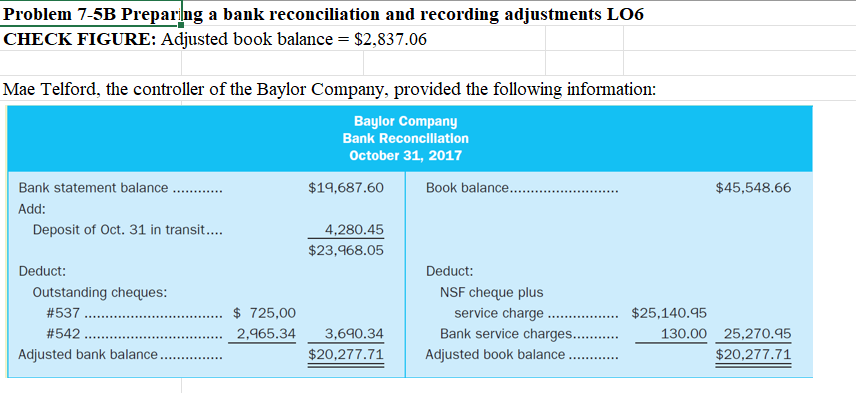

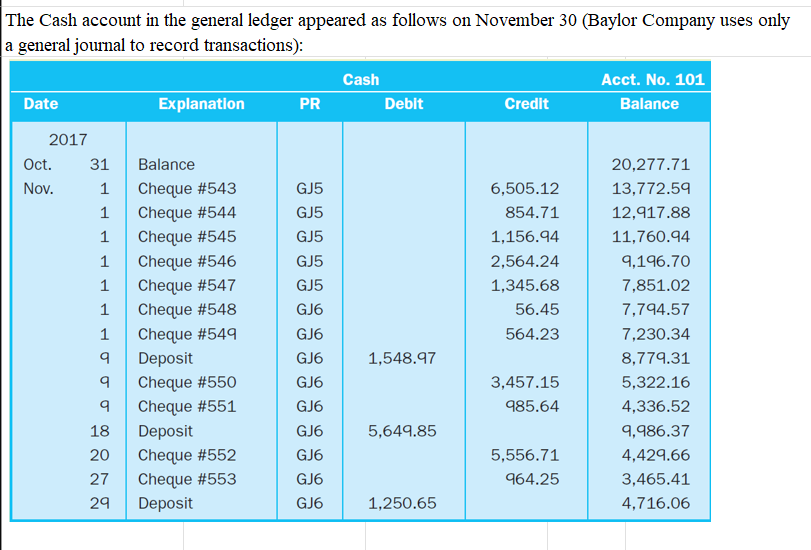

Problem 7-3B Petty cash fund; reimbursement and analysis of errors LO4 The accounting system used by Dartmouth Sales and Service requires that all entries be journalized in a general journal. To facilitate payments for small items, Dartmouth established a petty cash fund. The following transactions involving the petty cash fund occurred during February 2017. Feb. 3 A company cheque for $200 was prepared and made payable to the petty cashier to establish the petty cash fund. 14 A company cheque was prepared to replenish the fund for the following expenditures made since February 3 and to increase the fund to $250. a. Purchased office supplies, $65.82. b. Paid $75.00 COD charges on merchandise purchased for resale. Dartmouth uses the perpetual method to account for merchandise inventory. c. Paid $36.40 to Data Services for minor repairs to a computer. d. Paid $15.23 for postage expenses. e. Discovered that only $5.55 remained in the petty cash box. 28 The petty cashier noted that $39.30 remained in the fund, and decided that the February 14 increase in the fund was not large enough. A company cheque was prepared to replenish the fund for the following expenditures made since February 14 , and to increase it to $300. f. Paid $45 to The Smart Saver for an advertisement in a monthly newsletter. g. Paid $96.35 for office supplies. h. Paid $69.35 to Best Movers for delivery of merchandise to a customer. Record the General Journal Entries to establish the fund on Feb 3 and replenishment on Feb 14 and 28 Problem 7-5B Prepar|ng a bank reconciliation and recording adjustments LO6 CHECK FIGURE: Adjusted book balance =$2,837.06 Mae Telford, the controller of the Baylor Company, provided the following information: The Cash account in the general ledger appeared as follows on November 30 (Baylor Company uses only The following bank statement is available for November 2017 : Required a. Prepare a bank reconciliation for Baylor Company for the month of November 2017. Assume that any errors made were by the bookkeeper (cheque \#547 was for advertising expense; the deposit of November 9 was regarding a credit customer, Val Pacino). b. Prepare the necessary entries resulting from the bank reconciliation. Part a Part b Yardworx reconciled its book balance of Cash with its bank statement balance on April 30 and showed wo cheques outstanding at that time, \#1771 for $15,463.10 and \#1780 for $955.65. The following information is available for the May 31,2017 , reconciliation: From the May 31,2017 , bank statement: Analysis Component: You have been employed with Baylor Company since November 1, 2017, and part of your job is writing and recording cheques as well as preparing the bank reconciliation. In reviewing the cheques returned by the bank, you notice that the payee on cheque #543 is the employee you recently replaced. You investigate further and find that the journal entry recording cheque \#543 debited Office Supplies Expense. What should you do? Explain. - Cheque \#1788 was correctly written for $985.65 to pay for May utilities; however, the bookkeeper misread the amount and entered it in the accounting records with a debit to Utilities Expense and a credit to Cash as though it were for $895.65. The bank paid and deducted the correct amount. - The NSF cheque was originally received from a customer, Gertie Mayer, in payment of heraccount. Its return was unrecorded. - The credit memo resulted from a $5,300 electronic fund transfer for the collection of a customer payment. The bank had deducted a $100 bank service charge fee. The collection has not been recorded in the company's books. Required 1. Prepare a bank reconciliation for Yardworx. 2. Prepare the general journal entries needed to adjust the book balance of Cash to the reconciled returned with the bank statement are not numbered sequentially. In other words, some of the prenumbered cheques in the sequence are missing. Several possible situations would explain why the cancelled cheques returned with a bank statement might not be numbered sequentially. Describe three possible reasons that this might occur

Problem 7-3B Petty cash fund; reimbursement and analysis of errors LO4 The accounting system used by Dartmouth Sales and Service requires that all entries be journalized in a general journal. To facilitate payments for small items, Dartmouth established a petty cash fund. The following transactions involving the petty cash fund occurred during February 2017. Feb. 3 A company cheque for $200 was prepared and made payable to the petty cashier to establish the petty cash fund. 14 A company cheque was prepared to replenish the fund for the following expenditures made since February 3 and to increase the fund to $250. a. Purchased office supplies, $65.82. b. Paid $75.00 COD charges on merchandise purchased for resale. Dartmouth uses the perpetual method to account for merchandise inventory. c. Paid $36.40 to Data Services for minor repairs to a computer. d. Paid $15.23 for postage expenses. e. Discovered that only $5.55 remained in the petty cash box. 28 The petty cashier noted that $39.30 remained in the fund, and decided that the February 14 increase in the fund was not large enough. A company cheque was prepared to replenish the fund for the following expenditures made since February 14 , and to increase it to $300. f. Paid $45 to The Smart Saver for an advertisement in a monthly newsletter. g. Paid $96.35 for office supplies. h. Paid $69.35 to Best Movers for delivery of merchandise to a customer. Record the General Journal Entries to establish the fund on Feb 3 and replenishment on Feb 14 and 28 Problem 7-5B Prepar|ng a bank reconciliation and recording adjustments LO6 CHECK FIGURE: Adjusted book balance =$2,837.06 Mae Telford, the controller of the Baylor Company, provided the following information: The Cash account in the general ledger appeared as follows on November 30 (Baylor Company uses only The following bank statement is available for November 2017 : Required a. Prepare a bank reconciliation for Baylor Company for the month of November 2017. Assume that any errors made were by the bookkeeper (cheque \#547 was for advertising expense; the deposit of November 9 was regarding a credit customer, Val Pacino). b. Prepare the necessary entries resulting from the bank reconciliation. Part a Part b Yardworx reconciled its book balance of Cash with its bank statement balance on April 30 and showed wo cheques outstanding at that time, \#1771 for $15,463.10 and \#1780 for $955.65. The following information is available for the May 31,2017 , reconciliation: From the May 31,2017 , bank statement: Analysis Component: You have been employed with Baylor Company since November 1, 2017, and part of your job is writing and recording cheques as well as preparing the bank reconciliation. In reviewing the cheques returned by the bank, you notice that the payee on cheque #543 is the employee you recently replaced. You investigate further and find that the journal entry recording cheque \#543 debited Office Supplies Expense. What should you do? Explain. - Cheque \#1788 was correctly written for $985.65 to pay for May utilities; however, the bookkeeper misread the amount and entered it in the accounting records with a debit to Utilities Expense and a credit to Cash as though it were for $895.65. The bank paid and deducted the correct amount. - The NSF cheque was originally received from a customer, Gertie Mayer, in payment of heraccount. Its return was unrecorded. - The credit memo resulted from a $5,300 electronic fund transfer for the collection of a customer payment. The bank had deducted a $100 bank service charge fee. The collection has not been recorded in the company's books. Required 1. Prepare a bank reconciliation for Yardworx. 2. Prepare the general journal entries needed to adjust the book balance of Cash to the reconciled returned with the bank statement are not numbered sequentially. In other words, some of the prenumbered cheques in the sequence are missing. Several possible situations would explain why the cancelled cheques returned with a bank statement might not be numbered sequentially. Describe three possible reasons that this might occur Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started