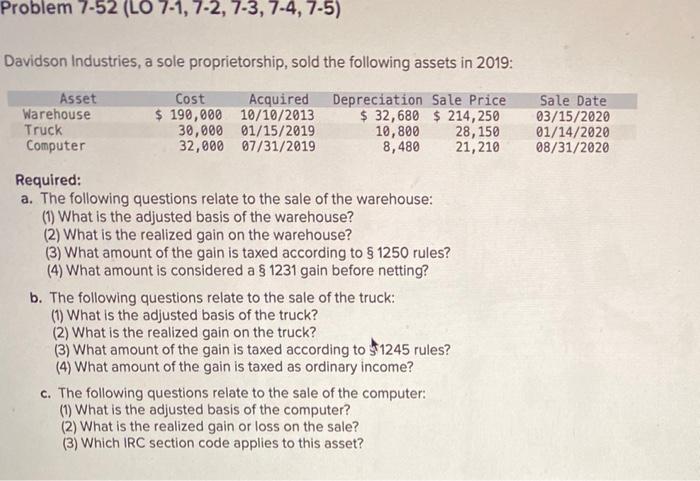

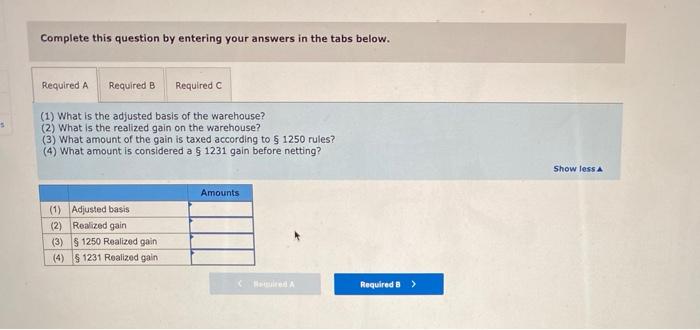

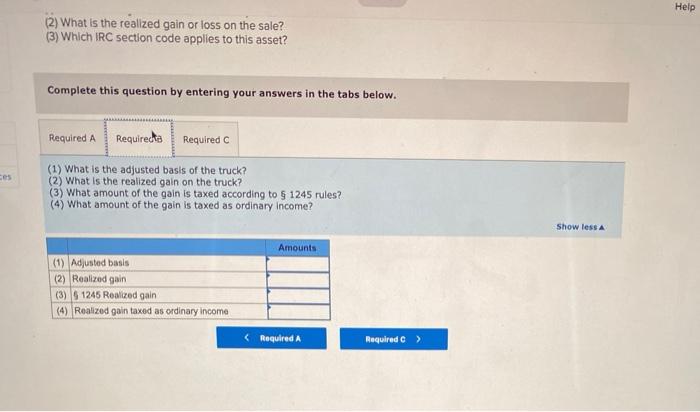

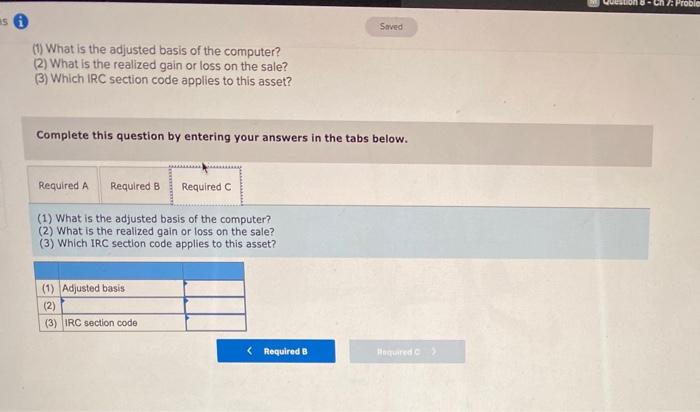

Problem 7-52 (LO 7-1,7-2,7-3, 7-4, 7-5) Davidson Industries, a sole proprietorship, sold the following assets in 2019: Asset Warehouse Truck Computer Cost Acquired Depreciation Sale Price $ 190,000 10/10/2013 $ 32,680 $ 214,250 30,000 01/15/2019 10,800 28,150 32,000 07/31/2019 8,480 21,210 Sale Date 03/15/2020 01/14/2020 08/31/2020 Required: a. The following questions relate to the sale of the warehouse: (1) What is the adjusted basis of the warehouse? (2) What is the realized gain on the warehouse? (3) What amount of the gain is taxed according to $ 1250 rules? (4) What amount is considered a $ 1231 gain before netting? b. The following questions relate to the sale of the truck: (1) What is the adjusted basis of the truck? (2) What is the realized gain on the truck? (3) What amount of the gain is taxed according to 1245 rules? (4) What amount of the gain is taxed as ordinary income? C. The following questions relate to the sale of the computer: (1) What is the adjusted basis of the computer? (2) What is the realized gain or loss on the sale? (3) Which IRC section code applies to this asset? Complete this question by entering your answers in the tabs below. Required A Required B Required (1) What is the adjusted basis of the warehouse? (2) What is the realized gain on the warehouse? (3) What amount of the gain is taxed according to $ 1250 rules? (4) What amount is considered a 1231 gain before netting? Show less Amounts (1) Adjusted basis (2) Realized gain (3) S 1250 Realized gain (4) $ 1231 Realized gain Required 8 > Help (2) What is the realized gain or loss on the sale? (3) Which IRC section code applies to this asset? Complete this question by entering your answers in the tabs below. Required A Requiredte Required (1) What is the adjusted basis of the truck? (2) What is the realized gain on the truck? (3) What amount of the gain is taxed according to 5 1245 rules? (4) What amount of the gain is taxed as ordinary income? Show less Amounts (1) Adjusted basis (2) Realized gain (3) S 1245 Realized gain (4) Realized gain taxed as ordinary income CA A Proble as Saved What is the adjusted basis of the computer? (2) What is the realized gain or loss on the sale? (3) Which IRC section code applies to this asset? Complete this question by entering your answers in the tabs below. Required A Required B Required (1) What is the adjusted basis of the computer? (2) What is the realized gain or loss on the sale? (3) Which IRC section code applies to this asset? (1) Adjusted basis (2) (3) IRC section code Help (2) What is the realized gain or loss on the sale? (3) Which IRC section code applies to this asset? Complete this question by entering your answers in the tabs below. Required A Requiredte Required (1) What is the adjusted basis of the truck? (2) What is the realized gain on the truck? (3) What amount of the gain is taxed according to 5 1245 rules? (4) What amount of the gain is taxed as ordinary income? Show less Amounts (1) Adjusted basis (2) Realized gain (3) S 1245 Realized gain (4) Realized gain taxed as ordinary income CA A Proble as Saved What is the adjusted basis of the computer? (2) What is the realized gain or loss on the sale? (3) Which IRC section code applies to this asset? Complete this question by entering your answers in the tabs below. Required A Required B Required (1) What is the adjusted basis of the computer? (2) What is the realized gain or loss on the sale? (3) Which IRC section code applies to this asset? (1) Adjusted basis (2) (3) IRC section code