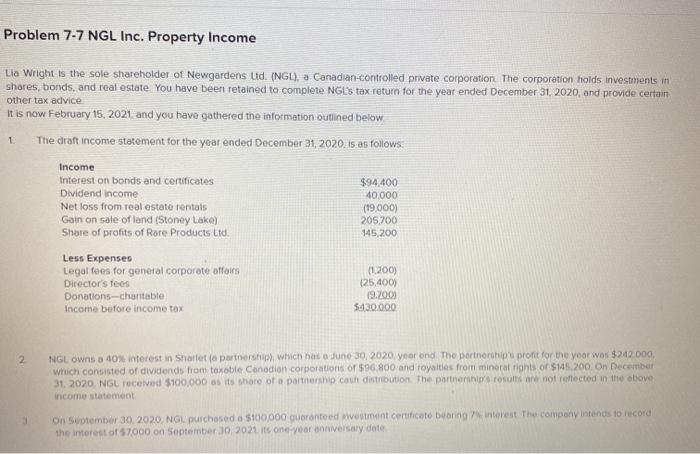

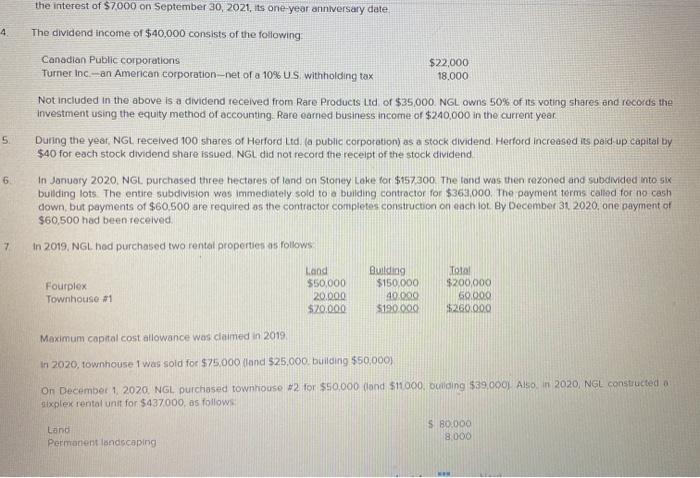

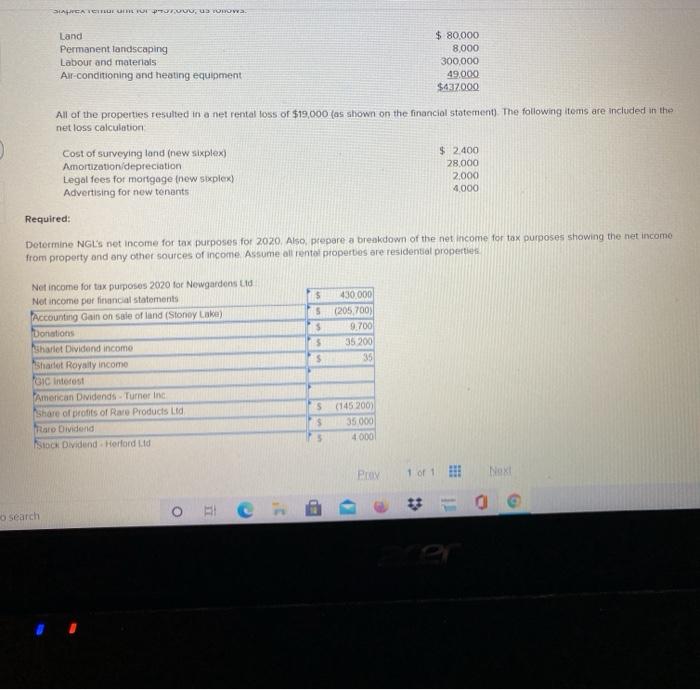

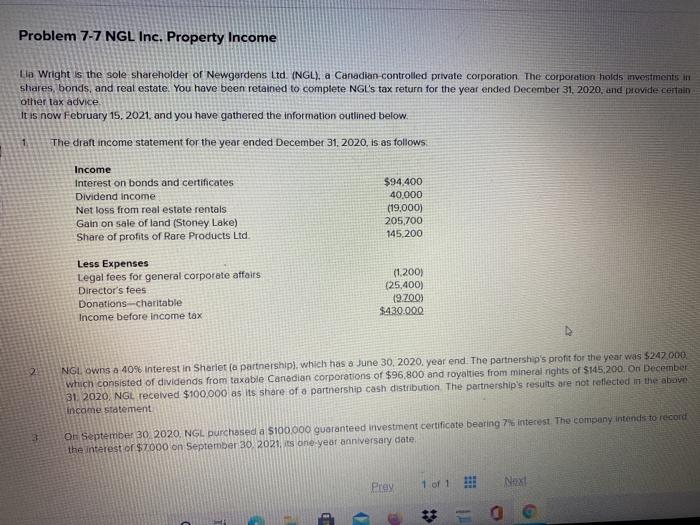

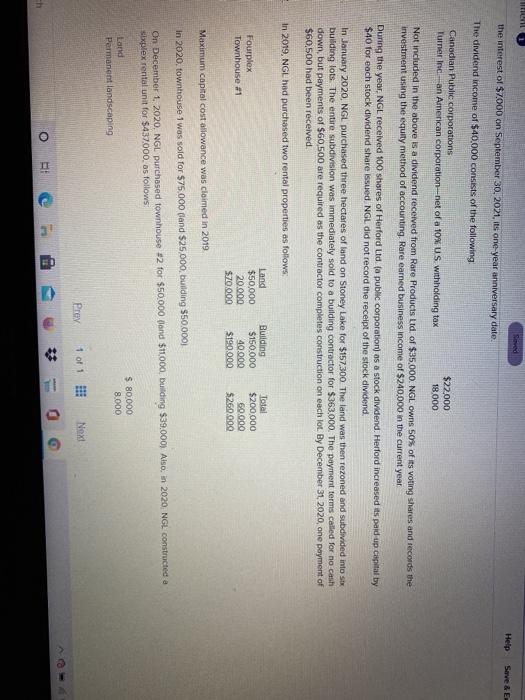

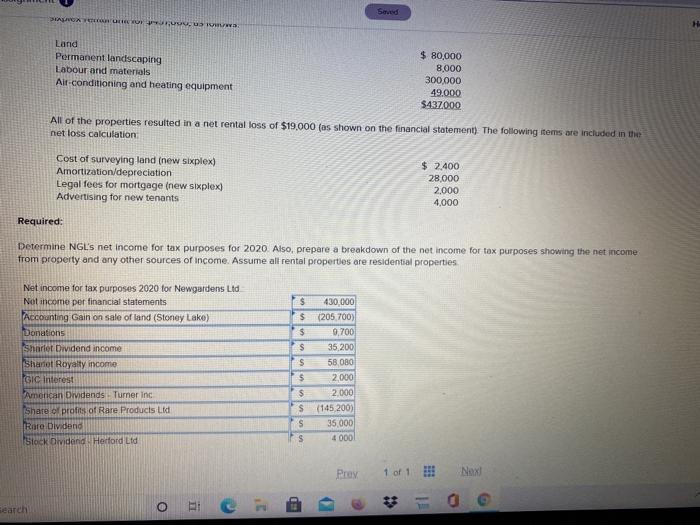

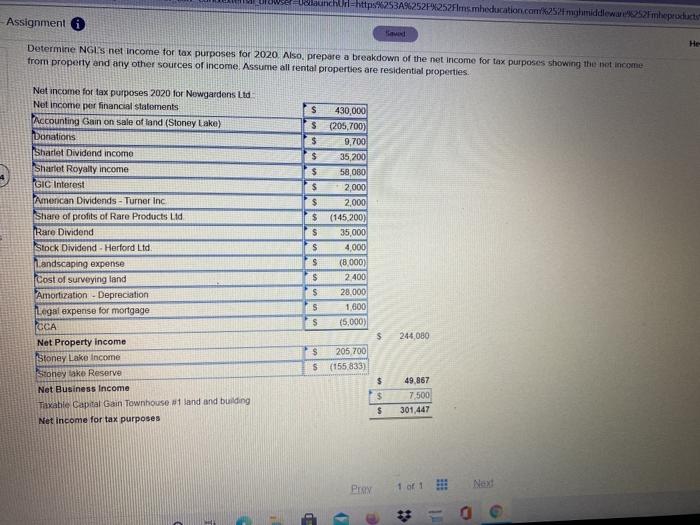

Problem 7-7 NGL Inc. Property Income Lia Wright is the sole shareholder of Newgardens Ltd. (NGL), a Canadian-controlled private corporation The corporation holds investments in shores, bonds, and real estate. You have been retained to complete NGOs tax return for the year ended December 31, 2020, and provide certain other tax advice It is now February 15, 2021 and you have gathered the information outlined below 1. The craft income statement for the year ended December 31, 2020. is as follows Income Interest on bonds and certificates $94.400 Dividend income 40.000 Net loss from real estate rentals (19.000) Gain on sale of land (Stoney Lake) 205700 Share of profits of Rare Products Ltd. 145,200 Less Expenses Legal fees for genetal corporate offores (1.200) Director's fees 125.400) Donations-chantable 19.2001 Income before income tax $430,000 2 NGL owns a 40% interest in Shartet (a partnership which has a June 30, 2020 year ond The partnership profit for the year was $242.000 which consisted of dividends from toxoble Canadian corporations of 596 800 and royalties from mineral rights of $145.200 On December 31, 2020, NSL roceived $100,000 as its share of a partnership con distribution. The partnerships rose not reflected in the above income statement On September 30, 2020 NGL purchased a $100,000 guaranteed westment certificate bearing interest. The company intends to record the interest of 57000 on September 10, 2021 is one year anniversary date the interest of $7000 on September 30, 2021, its one-year anniversary date 4 5 The dividend income of $40,000 consists of the following: Canadian Public corporations $22,000 Turner Inc. --an American corporation-net of a 10% US withholding tax 18.000 Not included in the above is a dividend received from Rare Products Lid of $35.000. NGL owns 50% of its voting shares and records the investment using the equity method of accounting. Rare earned business income of $240,000 in the current year. During the yeat, NGL received 100 shares of Herford Ltd (a public corporation) as a stock dividend Herford increased its poid-up capital by $40 for each stock dividend share issued NGL did not record the receipt of the stock dividend In January 2020. NGL purchased three hectares of land on Stoney Lake for $157300 The tand was then rezoned and subdivided into si building lots. The entire subdivision was immediately sold to a building contractor for $363.000. The payment forms called for no cash down, but payments of $60.500 are required as the contractor completes construction on each lot By December 31 2020, one payment of $60,500 had been received In 2019, NGL had purchased two rental properties as follows Land Building Total Fourplex $150,000 $200,000 Townhouse #1 20.000 60.000 $20.000 $190.000 $260.000 6 7 $50,000 40.000 Maximum capital cost allowance was claimed in 2019 in 2020, townhouse I was sold for $75,000 and $25,000, building $50,000) On December 1, 2020, NGL purchased townhouse #2 for $50.000 (ond $11000 guilding $39.000). Also in 2020, NGL constructed sixplex rental unit for $437000, as follows Land Permanent landscaping 5 80.000 8.000 SHAREA COUTO, UTOROV Land Permanent landscaping Labour and materials Air-conditioning and heating equipment $ 80.000 8,000 300,000 49.000 $427000 All of the properties resulted in a net rental loss of $19.000 (as shown on the financial statement). The following items are included in the net loss calculation Cost of surveying tond (new sixplex) $ 2.400 Amortization/depreciation 28.000 Legal fees for mortgage new sixplex) 2.000 Advertising for new tenants 4.000 Required: Determine NGLS net income for tax purposes for 2020. Also, prepare a breakdown of the net income for tax purposes showing the net incomo from property and any other sources of income Assume all rental properties are residential properties $ 430,000 5 (205,700) $ 9.700 5 35 200 $ 35 Net income for tax purposes 2020 for Newgardens Lid Not income per financial statements Accounting Gain on sale of land (Stoney Lake) Donations Shariot Dividend incomo Shalet Royally income TGIC interest American Dividends-Turner Inc Share of profits of Rare Products Lid aro Dividend Sock Dividend Herford Lid 5 5 5 (145 2001 35 000 4000 Prey 1 of 1 !!! Nax OP - Search Problem 7-7 NGL Inc. Property Income Ela Wright is the sole shareholder of Newgardens Ltd. (NGL), a Canadian controlled private corporation. The corporation holds investments in shares, bonds, and real estate. You have been retained to complete NGL's tax return for the year ended December 31, 2020, and provide certain other tax advice It is now February 15, 2021, and you have gathered the information outlined below. 1 The draft income statement for the year ended December 31, 2020, is as follows Income Interest on bonds and certificates Dividend income Net loss from real estate rentals Gain on sale of land (Stoney Lake) Share of profits of Rare Products Ltd. $94.400 40.000 (19,000) 205,700 145.200 Less Expenses Legal fees for general corporate affairs Director's fees Donations charitable Income before income tax (1.200) (25,400) 19.700) $430.000 NGI owns a 40% Interest in Shariet (a partnership), which has a June 30, 2020. year end. The partnership's profit for the year was $242.000 which consisted of dividends from taxable Canadian corporations of $96,800 and royalties from mineral rights of $145.200 On December 31 2020, NGL received $100.000 as its share of a partnership cash distribution. The partnership's results are not reflected in the above income statement 3 On September 30 2020. NGL purchased a $100.000 guaranteed investment certificate bearing interest. The company intends to record the Interest of $7000 on September 30, 2021 is one year anniversary date Pray 1 of 1 !!! Next D * Sved Help Serve & E the interest of $7.000 on September 30, 2021, its one year anniversary date. The dividend income of $40,000 consists of the following: Canadian Public corporations Tumar incan American corporation-net of a 10% US withholding tax $22,000 18.000 Not included in the above is a dividend received from Rare Products Lid. of $35,000 NGL owns 50% of its voting shares and records the investment using the equity method of accounting. Rare earned business income of $240,000 in the current year During the year, NGL received 100 shares of Herford Lid to public corporation) as a stock dividend. Herford increased its paid up capital by $40 for each stock dividend share issued NGL did not record the receipt of the stock dividend. In January 2020, NGL purchased three hectares of land on Stoney Lake for $157,300 The land was then rezoned and subdivided into six building lots. The entire subdivision was immediately sold to a building contractor for $363.000. The payment terms called for no cash down but payments of $60.500 are required as the contractor completes construction on each lot. By December 31, 2020, one payment of $60,500 had been received. In 2019, NGL had purchased two rental properties as follows: Fourplex Townhouse #1 Land $50,000 20.000 $70.000 Building $150.000 40.000 $190.000 Total $200,000 60.000 $260.000 Maximum capital cost allowance was claimed in 2019 In 2020, townhouse I was sold for $75,000 and $25000, building $50,000 On December 1, 2020. NGL purchased townhouse 12 for $50.000 and $11000, building $39.000). Also, in 2020, NGL constructed a sixplex rental unit for $437.000, as follows: Lard Permanent landscaping S 80 000 8.000 Prey 1 of 1 : Next O RE ED G 3 Swed BOX UKUROWS H Land Permanent landscaping Labour and materials Air conditioning and heating equipment $ 80,000 8,000 300.000 49.000 $437000 All of the properties resulted in a net rental loss of $19.000 (as shown on the financial statement). The following items are included in the net loss calculation Cost of surveying land (new sixplex) Amortization/depreciation Legol fees for mortgage (new sixplex) Advertising for new tenants $ 2.400 28.000 2.000 4,000 Required: Determine NGL's net income for tax purposes for 2020. Also, prepare a breakdown of the net income for tax purposes showing the net income from property and any other sources of income. Assume all rental properties are residential properties $ $ $ $ Net income for tax purposes 2020 for Newgardens Ltd Not income per financial statements Accounting Gain on sale of land (Stoney Lake) Donations Snarlet Dividend income Shariot Royalty income GIC Interest Amencan Dividends - Turnering Share o profits of Rare Products Ltd Rare Dividend Stock Dividend Herford Ltd $ $ 430 000 (205 700) 9.700 35,200 58 080 2.000 2.000 (145 200) 35 000 4 000 $ S S S Pray 1 of 1 !!! Nox search O TI ED launchurl=http%253A%252F%252Fmsmheducation.com/62521 glumiddlewar252Fmeproducto Assignment werd He Determine NGIS net income for tax purposes for 2020. Also, prepare a breakdown of the net income for tax purposes showing the net income from property and any other sources of income. Assume all rental properties are residential properties $ $ $ $ $ S $ $ Net income for tax purposes 2020 for Newgardens Ltd Net income per financial statements Accounting Gain on sale of land (Stoney Lake) Donations Sharlet Dividend income Sharlet Royally income GIC Interest Amencan Dividends - Turner Inc Share of profits of Rare Products Lid Rare Dividend Stock Dividend - Herford Ltd Landscaping expense Cost of surveying land Amortization - Depreciation Legal expense for mortgage ICCA Net Property Income Stoney Lake Income Stoney take Reserve Net Business Income Taxable Capital Gain Townhouse #1 land and building Net income for tax purposes 430,000 (205,700) 9,700 35,200 58,080 2,000 2.000 (145.200) 35,000 4,000 (8 000) 2.400 28.000 1.800 (5,000) $ $ $ $ $ S $ $ 244 080 $ $ 205 700 (155,833) $ $ S 49.867 7500 301,447 Pray Next D - ** Problem 7-7 NGL Inc. Property Income Lia Wright is the sole shareholder of Newgardens Ltd. (NGL), a Canadian-controlled private corporation The corporation holds investments in shores, bonds, and real estate. You have been retained to complete NGOs tax return for the year ended December 31, 2020, and provide certain other tax advice It is now February 15, 2021 and you have gathered the information outlined below 1. The craft income statement for the year ended December 31, 2020. is as follows Income Interest on bonds and certificates $94.400 Dividend income 40.000 Net loss from real estate rentals (19.000) Gain on sale of land (Stoney Lake) 205700 Share of profits of Rare Products Ltd. 145,200 Less Expenses Legal fees for genetal corporate offores (1.200) Director's fees 125.400) Donations-chantable 19.2001 Income before income tax $430,000 2 NGL owns a 40% interest in Shartet (a partnership which has a June 30, 2020 year ond The partnership profit for the year was $242.000 which consisted of dividends from toxoble Canadian corporations of 596 800 and royalties from mineral rights of $145.200 On December 31, 2020, NSL roceived $100,000 as its share of a partnership con distribution. The partnerships rose not reflected in the above income statement On September 30, 2020 NGL purchased a $100,000 guaranteed westment certificate bearing interest. The company intends to record the interest of 57000 on September 10, 2021 is one year anniversary date the interest of $7000 on September 30, 2021, its one-year anniversary date 4 5 The dividend income of $40,000 consists of the following: Canadian Public corporations $22,000 Turner Inc. --an American corporation-net of a 10% US withholding tax 18.000 Not included in the above is a dividend received from Rare Products Lid of $35.000. NGL owns 50% of its voting shares and records the investment using the equity method of accounting. Rare earned business income of $240,000 in the current year. During the yeat, NGL received 100 shares of Herford Ltd (a public corporation) as a stock dividend Herford increased its poid-up capital by $40 for each stock dividend share issued NGL did not record the receipt of the stock dividend In January 2020. NGL purchased three hectares of land on Stoney Lake for $157300 The tand was then rezoned and subdivided into si building lots. The entire subdivision was immediately sold to a building contractor for $363.000. The payment forms called for no cash down, but payments of $60.500 are required as the contractor completes construction on each lot By December 31 2020, one payment of $60,500 had been received In 2019, NGL had purchased two rental properties as follows Land Building Total Fourplex $150,000 $200,000 Townhouse #1 20.000 60.000 $20.000 $190.000 $260.000 6 7 $50,000 40.000 Maximum capital cost allowance was claimed in 2019 in 2020, townhouse I was sold for $75,000 and $25,000, building $50,000) On December 1, 2020, NGL purchased townhouse #2 for $50.000 (ond $11000 guilding $39.000). Also in 2020, NGL constructed sixplex rental unit for $437000, as follows Land Permanent landscaping 5 80.000 8.000 SHAREA COUTO, UTOROV Land Permanent landscaping Labour and materials Air-conditioning and heating equipment $ 80.000 8,000 300,000 49.000 $427000 All of the properties resulted in a net rental loss of $19.000 (as shown on the financial statement). The following items are included in the net loss calculation Cost of surveying tond (new sixplex) $ 2.400 Amortization/depreciation 28.000 Legal fees for mortgage new sixplex) 2.000 Advertising for new tenants 4.000 Required: Determine NGLS net income for tax purposes for 2020. Also, prepare a breakdown of the net income for tax purposes showing the net incomo from property and any other sources of income Assume all rental properties are residential properties $ 430,000 5 (205,700) $ 9.700 5 35 200 $ 35 Net income for tax purposes 2020 for Newgardens Lid Not income per financial statements Accounting Gain on sale of land (Stoney Lake) Donations Shariot Dividend incomo Shalet Royally income TGIC interest American Dividends-Turner Inc Share of profits of Rare Products Lid aro Dividend Sock Dividend Herford Lid 5 5 5 (145 2001 35 000 4000 Prey 1 of 1 !!! Nax OP - Search Problem 7-7 NGL Inc. Property Income Ela Wright is the sole shareholder of Newgardens Ltd. (NGL), a Canadian controlled private corporation. The corporation holds investments in shares, bonds, and real estate. You have been retained to complete NGL's tax return for the year ended December 31, 2020, and provide certain other tax advice It is now February 15, 2021, and you have gathered the information outlined below. 1 The draft income statement for the year ended December 31, 2020, is as follows Income Interest on bonds and certificates Dividend income Net loss from real estate rentals Gain on sale of land (Stoney Lake) Share of profits of Rare Products Ltd. $94.400 40.000 (19,000) 205,700 145.200 Less Expenses Legal fees for general corporate affairs Director's fees Donations charitable Income before income tax (1.200) (25,400) 19.700) $430.000 NGI owns a 40% Interest in Shariet (a partnership), which has a June 30, 2020. year end. The partnership's profit for the year was $242.000 which consisted of dividends from taxable Canadian corporations of $96,800 and royalties from mineral rights of $145.200 On December 31 2020, NGL received $100.000 as its share of a partnership cash distribution. The partnership's results are not reflected in the above income statement 3 On September 30 2020. NGL purchased a $100.000 guaranteed investment certificate bearing interest. The company intends to record the Interest of $7000 on September 30, 2021 is one year anniversary date Pray 1 of 1 !!! Next D * Sved Help Serve & E the interest of $7.000 on September 30, 2021, its one year anniversary date. The dividend income of $40,000 consists of the following: Canadian Public corporations Tumar incan American corporation-net of a 10% US withholding tax $22,000 18.000 Not included in the above is a dividend received from Rare Products Lid. of $35,000 NGL owns 50% of its voting shares and records the investment using the equity method of accounting. Rare earned business income of $240,000 in the current year During the year, NGL received 100 shares of Herford Lid to public corporation) as a stock dividend. Herford increased its paid up capital by $40 for each stock dividend share issued NGL did not record the receipt of the stock dividend. In January 2020, NGL purchased three hectares of land on Stoney Lake for $157,300 The land was then rezoned and subdivided into six building lots. The entire subdivision was immediately sold to a building contractor for $363.000. The payment terms called for no cash down but payments of $60.500 are required as the contractor completes construction on each lot. By December 31, 2020, one payment of $60,500 had been received. In 2019, NGL had purchased two rental properties as follows: Fourplex Townhouse #1 Land $50,000 20.000 $70.000 Building $150.000 40.000 $190.000 Total $200,000 60.000 $260.000 Maximum capital cost allowance was claimed in 2019 In 2020, townhouse I was sold for $75,000 and $25000, building $50,000 On December 1, 2020. NGL purchased townhouse 12 for $50.000 and $11000, building $39.000). Also, in 2020, NGL constructed a sixplex rental unit for $437.000, as follows: Lard Permanent landscaping S 80 000 8.000 Prey 1 of 1 : Next O RE ED G 3 Swed BOX UKUROWS H Land Permanent landscaping Labour and materials Air conditioning and heating equipment $ 80,000 8,000 300.000 49.000 $437000 All of the properties resulted in a net rental loss of $19.000 (as shown on the financial statement). The following items are included in the net loss calculation Cost of surveying land (new sixplex) Amortization/depreciation Legol fees for mortgage (new sixplex) Advertising for new tenants $ 2.400 28.000 2.000 4,000 Required: Determine NGL's net income for tax purposes for 2020. Also, prepare a breakdown of the net income for tax purposes showing the net income from property and any other sources of income. Assume all rental properties are residential properties $ $ $ $ Net income for tax purposes 2020 for Newgardens Ltd Not income per financial statements Accounting Gain on sale of land (Stoney Lake) Donations Snarlet Dividend income Shariot Royalty income GIC Interest Amencan Dividends - Turnering Share o profits of Rare Products Ltd Rare Dividend Stock Dividend Herford Ltd $ $ 430 000 (205 700) 9.700 35,200 58 080 2.000 2.000 (145 200) 35 000 4 000 $ S S S Pray 1 of 1 !!! Nox search O TI ED launchurl=http%253A%252F%252Fmsmheducation.com/62521 glumiddlewar252Fmeproducto Assignment werd He Determine NGIS net income for tax purposes for 2020. Also, prepare a breakdown of the net income for tax purposes showing the net income from property and any other sources of income. Assume all rental properties are residential properties $ $ $ $ $ S $ $ Net income for tax purposes 2020 for Newgardens Ltd Net income per financial statements Accounting Gain on sale of land (Stoney Lake) Donations Sharlet Dividend income Sharlet Royally income GIC Interest Amencan Dividends - Turner Inc Share of profits of Rare Products Lid Rare Dividend Stock Dividend - Herford Ltd Landscaping expense Cost of surveying land Amortization - Depreciation Legal expense for mortgage ICCA Net Property Income Stoney Lake Income Stoney take Reserve Net Business Income Taxable Capital Gain Townhouse #1 land and building Net income for tax purposes 430,000 (205,700) 9,700 35,200 58,080 2,000 2.000 (145.200) 35,000 4,000 (8 000) 2.400 28.000 1.800 (5,000) $ $ $ $ $ S $ $ 244 080 $ $ 205 700 (155,833) $ $ S 49.867 7500 301,447 Pray Next D - **