Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 8 - 1 6 A ( Algo ) Direct Sale of Bonds to Parent ( Straight - Line Method ) LO 8 - 2

Problem A Algo Direct Sale of Bonds to Parent StraightLine Method LO

On January X Prize Corporation paid Morton Advertising $ to acquire percent of Statue Companys stock. Prize also paid $ to acquire $ par value percent, year bonds directly from Statue on that date. This purchase represented onehalf of the bonds that were originally issued. Interest payments are made on January and July The fair value of the noncontrolling interest at January X was $ and book value of Statues net assets was $ The book values and fair values of Statues assets and liabilities were equal except for buildings and equipment, which had a fair value $ greater than book value and a remaining economic life of years at January X

The trial balances for the two companies as of December X are as follows:

Item Prize Corporation Statue Company

Debit Credit Debit Credit

Cash and Current Receivables $ $

Inventory

Land, Buildings, and Equipment net

Investment in Statue Bonds

Investment in Statue Stock

Discount on Bonds Payable

Operating Expenses

Interest Expense

Dividends Declared

Current Liabilities $ $

Bonds Payable

Common Stock

Retained Earnings

Sales

Interest Income

Income from Statue Company

Total $ $ $ $

On July X Statue sold land that it had purchased for $ to Prize for $ Prize continues to hold the land at December X Assume Prize Corporation uses the fully adjusted equity method.

Required:

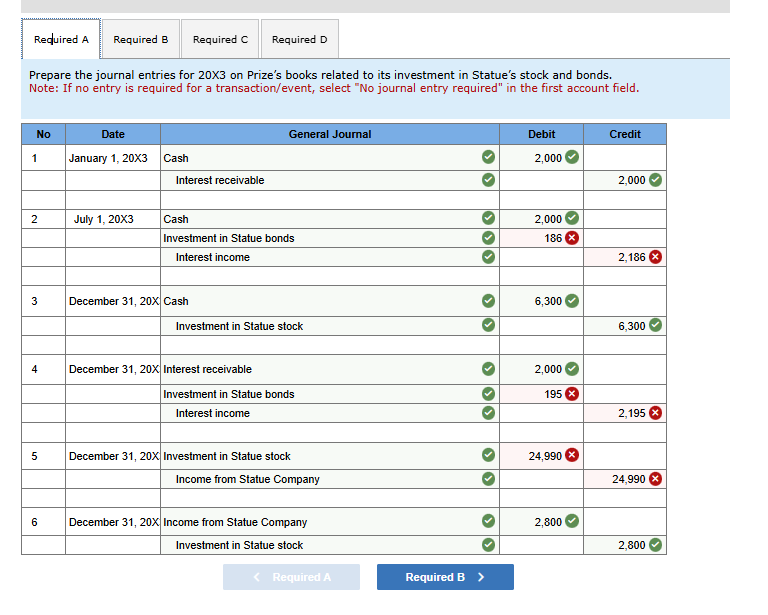

Prepare the journal entries for X on Prizes books related to its investment in Statues stock and bonds.

Prepare the entries for X on Statues books related to its bond issue.

Prepare consolidation entries needed to complete a worksheet for X

Prepare a threepart consolidation worksheet for X Required A

Prepare the journal entries for on Prize's books related to its investment in Statue's stock and bonds.

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

tableNoDate,General Journal,Debit,CreditJanuary times Cash,Interest receivable,OJuly times Cash,Investment in Statue bonds,Otimes Interest income,times December XCash,Investment in Statue stock,ODecember xInterest receivable,grad,Investment in Statue bonds,times Interest income,times December xInvestment in Statue stock,grad,times Income from Statue Company,Otimes December xIncome from Statue Company,Investment in Statue stock,theta Answer is not complete.

Complete this question by entering your answers in the tabs below.

Required &

Prepare the entries for on Statue's books related to its bond issue.

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

tableNoDate,General Journal,Debit,CreditJanuary times Interest payable,Cash,theta July times Interest expense,theta times Discount on bonds payable,times Cash,ODecember xInterest expense,times Discount on bonds payable,times Interest payable,tableNoEvent,Accounts,,Debit,CreditACommon stock,Retained earnings,Income from Statue Company,times NCl in Net Income of Statue Company,times Dividends declared,vvInvestment in Statue stock,times NCl in Net Assets of Statue Company stock,times BDepreciation expense,Income from Statue Company,NCl in Net Income of Statue Company,CBuildings and equipment,Accumulated depreciation,Investment in Statue bonds,times NCl in Net Assets of Statue Company stock,DInvestment in Statue stock,NCl in Net Assets of Statue Company stock,vvLand,EBonds payable,Interest income,times Investment in Statue bonds,Interest expense,times Discount on bonds payable,FInterest payable,vvInterest receivable,vv

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started