Answered step by step

Verified Expert Solution

Question

1 Approved Answer

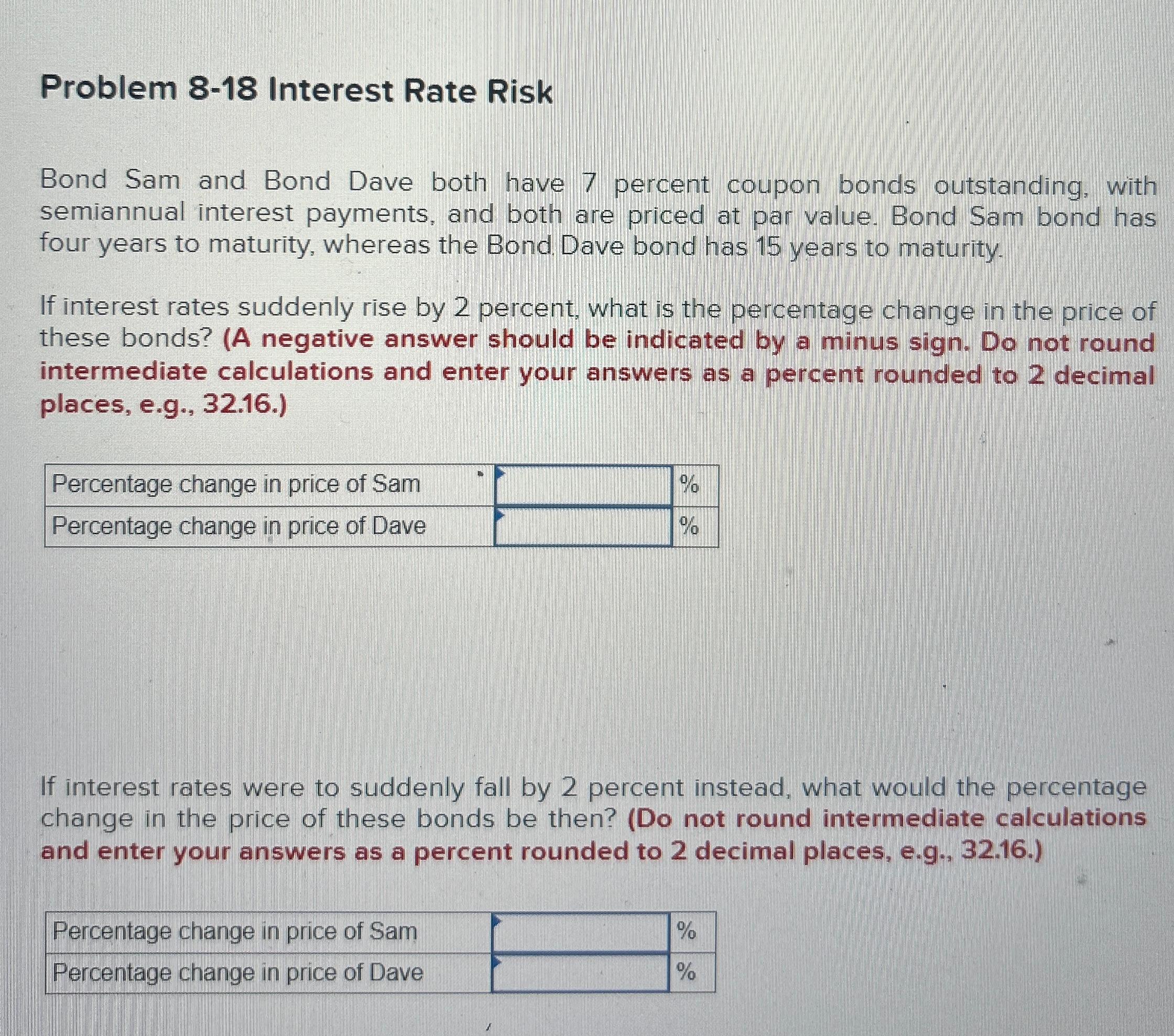

Problem 8 - 1 8 Interest Rate Risk Bond Sam and Bond Dave both have 7 percent coupon bonds outstanding, with semiannual interest payments, and

Problem Interest Rate Risk

Bond Sam and Bond Dave both have percent coupon bonds outstanding, with semiannual interest payments, and both are priced at par value. Bond Sam bond has four years to maturity, whereas the Bond Dave bond has years to maturity.

If interest rates suddenly rise by percent, what is the percentage change in the price of these bonds? A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to decimal places, eg

tablePercentage change in price of Sam,,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started