Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 8 - 2 The Cascot Firm has the following transactions: Jan. 1 0 Sold merchandise to Lovely Firm in the amount of $ 7

Problem

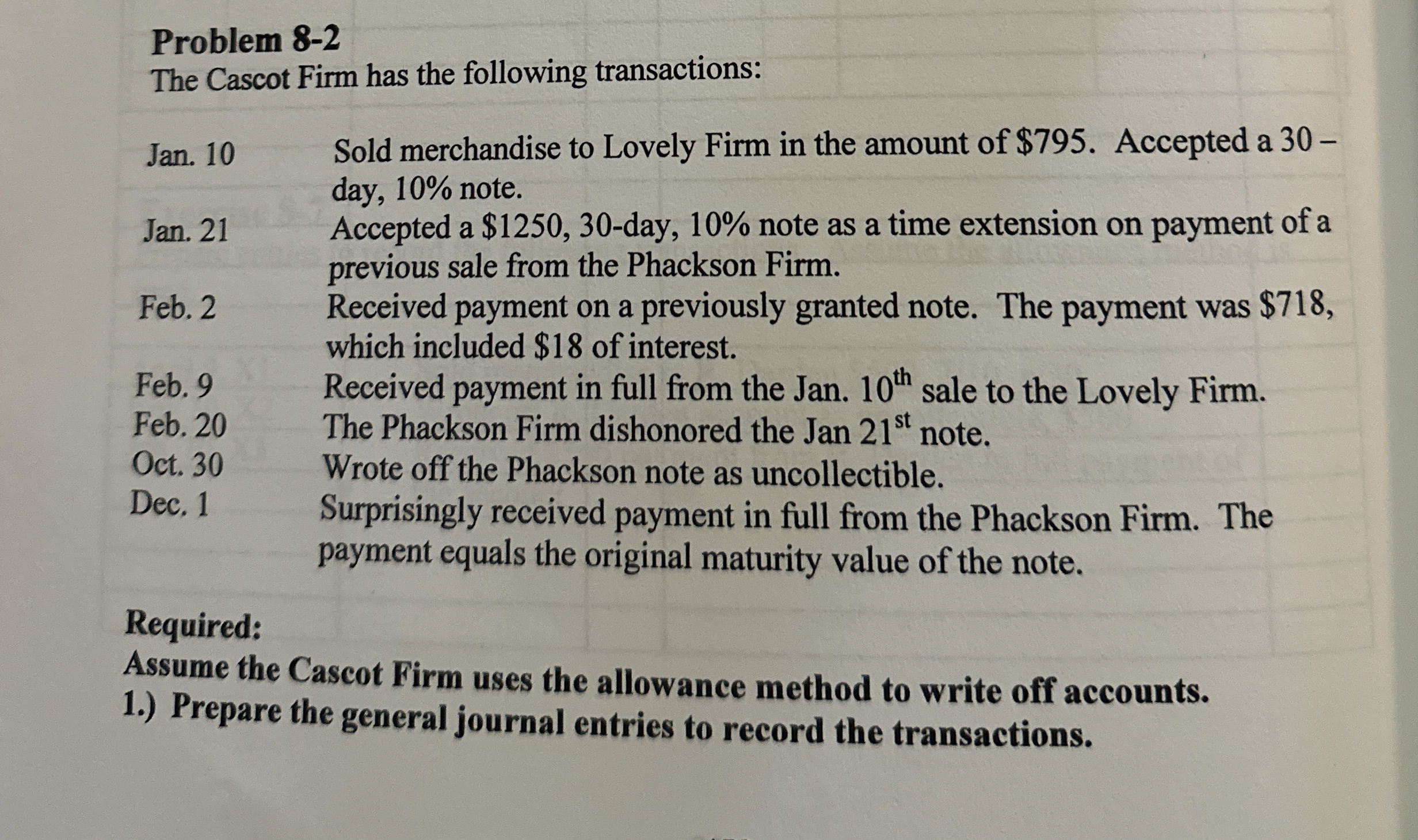

The Cascot Firm has the following transactions:

Jan. Sold merchandise to Lovely Firm in the amount of $ Accepted a day, note.

Jan. Accepted a $day, note as a time extension on payment of a previous sale from the Phackson Firm.

Feb. Received payment on a previously granted note. The payment was $ which included $ of interest.

Feb. Received payment in full from the Jan. sale to the Lovely Firm.

Feb. The Phackson Firm dishonored the Jan note.

Oct. Wrote off the Phackson note as uncollectible.

Dec. Surprisingly received payment in full from the Phackson Firm. The payment equals the original maturity value of the note.

Required:

Assume the Cascot Firm uses the allowance method to write off accounts.

Prepare the general journal entries to record the transactions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started