Question

Problem 8. A firm's capital structure consists of 5000 shares of stock trading at $2 per share and risk-free bonds worth $5000 at 2%

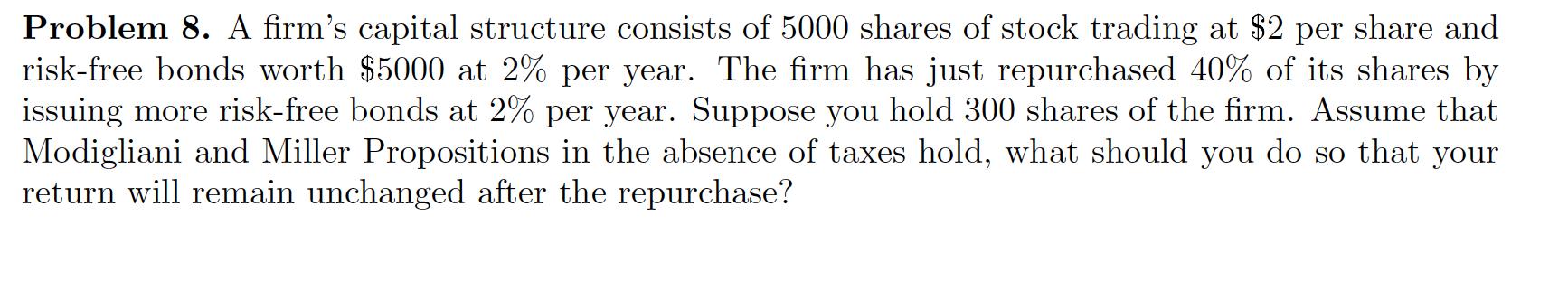

Problem 8. A firm's capital structure consists of 5000 shares of stock trading at $2 per share and risk-free bonds worth $5000 at 2% per year. The firm has just repurchased 40% of its shares by issuing more risk-free bonds at 2% per year. Suppose you hold 300 shares of the firm. Assume that Modigliani and Miller Propositions in the absence of taxes hold, what should you do so that your return will remain unchanged after the repurchase?

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

In the absence of taxes and assuming Modigliani and Miller Propositions hold the capital structure o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald E. Kieso, Jerry J. Weygandt, and Terry D. Warfield

15th edition

978-1118159644, 9781118562185, 1118159640, 1118147294, 978-1118147290

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App