Answered step by step

Verified Expert Solution

Question

1 Approved Answer

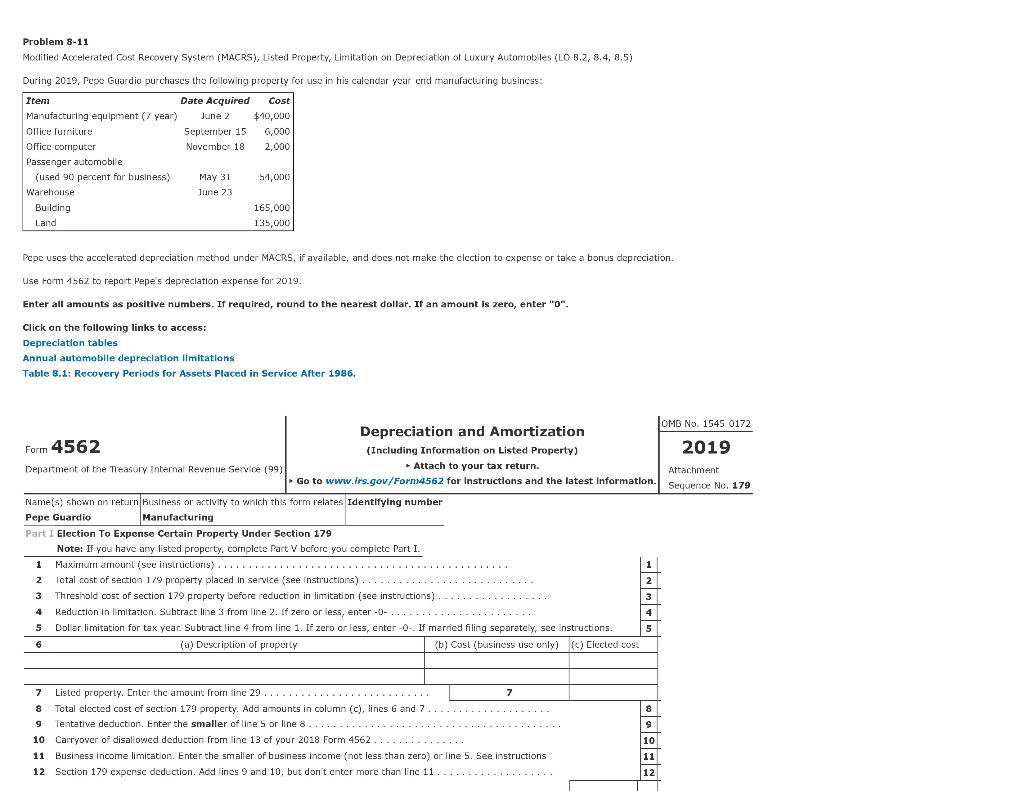

During 2019, Pepe Guardio purchases the following property for use in his calendar year-end manufacturing business: Item Date Acquired Cost Manufacturing equipment (7 year) June

During 2019, Pepe Guardio purchases the following property for use in his calendar year-end manufacturing business:

| Item | Date Acquired | Cost | ||

| Manufacturing equipment (7 year) | June 2 | $40,000 | ||

| Office furniture | September 15 | $6,000 | ||

| Office computer | November 18 | $2,000 | ||

| Passenger automobile | ||||

| (used 90 percent for business) | May 31 | $54,000 | ||

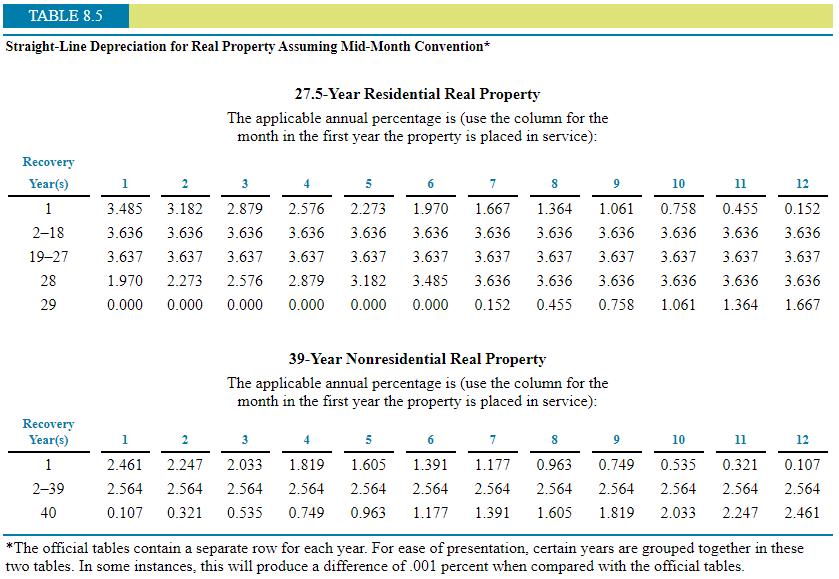

| Warehouse | June 23 | |||

| Building | $165,000 | |||

| Land | $135,000 | |||

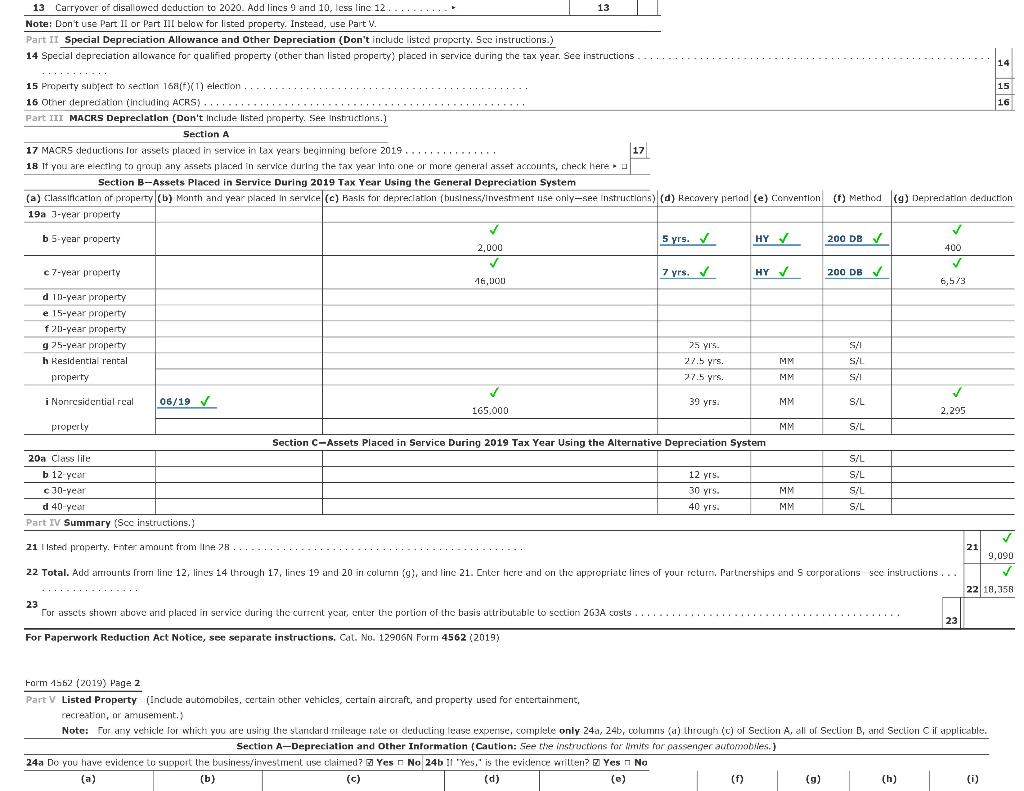

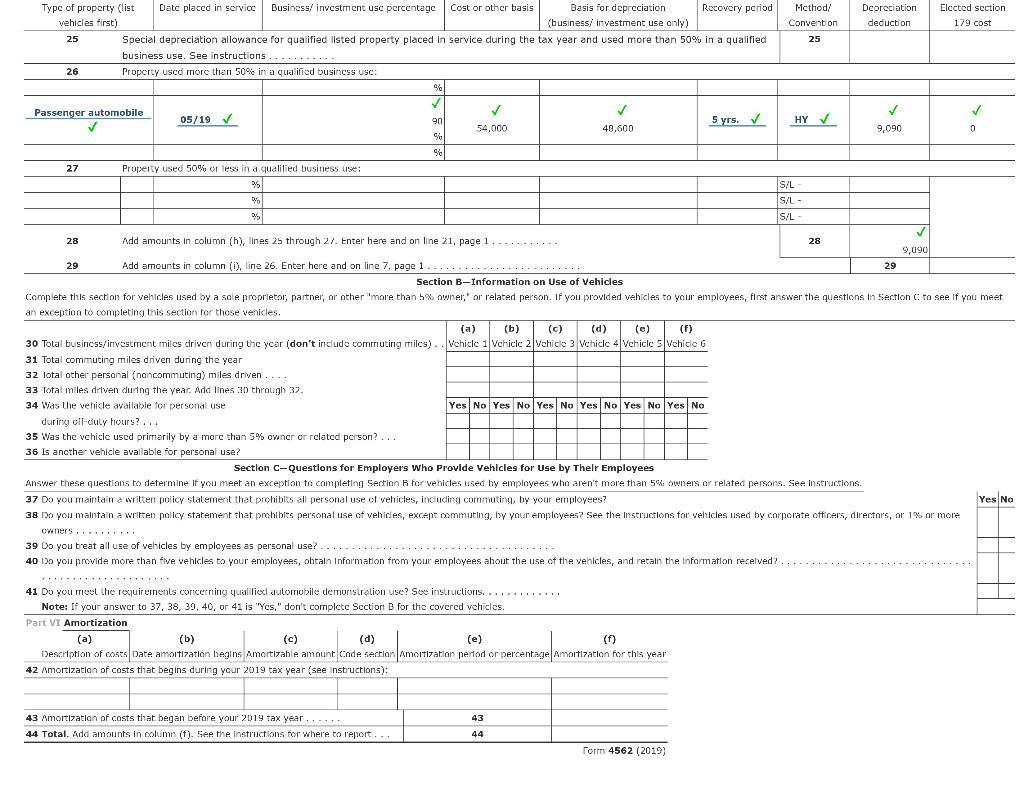

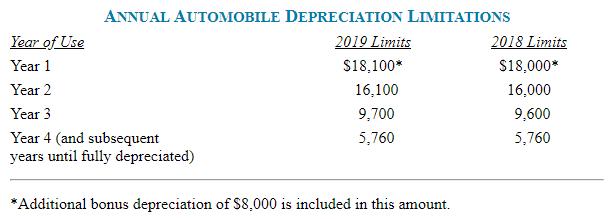

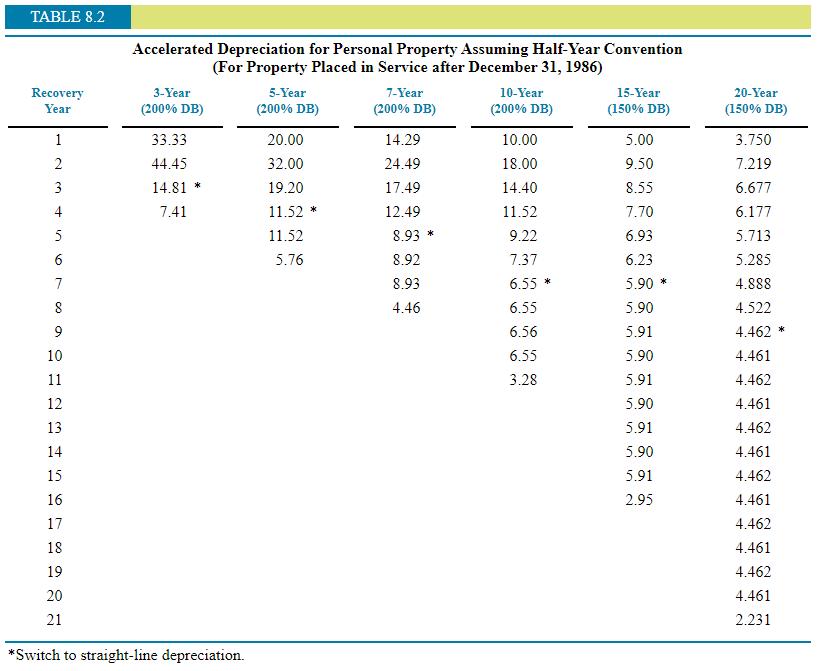

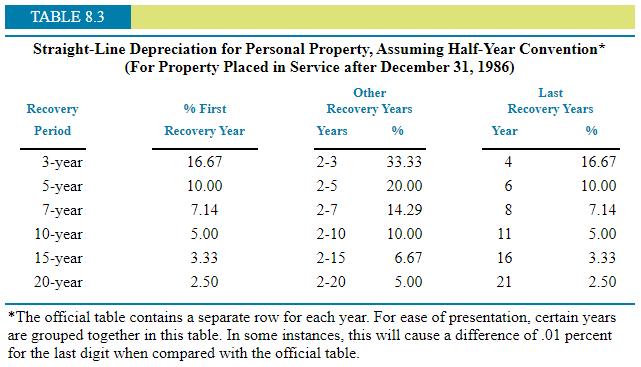

Pepe uses the accelerated depreciation method under MACRS, if available, and does not make the election to expense or take a bonus depreciation. Use Form 4562 to report Pepe's depreciation expense for 2019.

Enter all amounts as positive numbers. If required, round to the nearest dollar. If an amount is zero, enter "0."

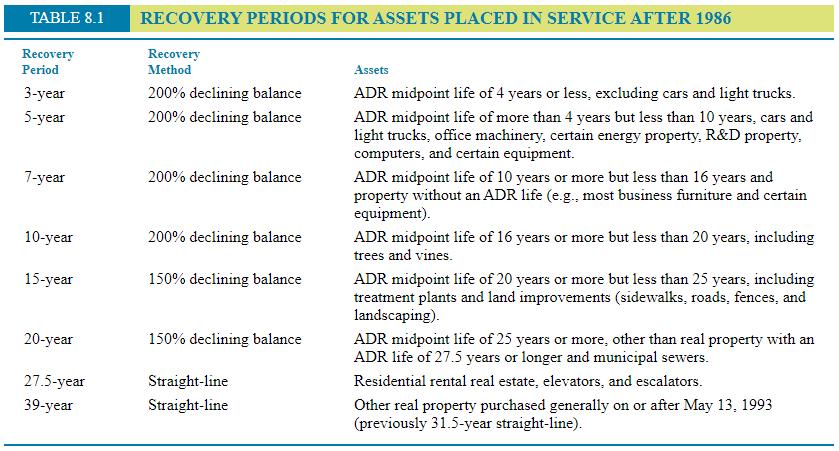

Problem 8-11 Moditied Accelerated Cost Recovery System (MACRS), Listed Property, Limitation on Depreciation of Luxury Automobiles (LO B.2, 8.4, 8,5) During 2019, Ppe Guardio purchases the followirng property for use in his calendar ycar cnd marnufacturing busincss: Item Date Acquired Cost Manufacturing equipment (/ year) Ollice lurnikur e June 2 $10,000 Seplember 15 6,000 Office cormputer Novembor 18 2,000 Passenger automobile (used 90 percent for business) May 31 51,000 Warehouse June 23 Building 165,000 Land 135,000 Pepe uses the accelerated depreciation method under MACRS, if available, and docs not make the clection to cxpense or take a bonus depreciation. Use Farm 1562 to report Pepe's depreciation expense for 2019. Enter all amounts as positive numbers. If required, round to the nearest dollar. If an amount is zero, enter "0". Click on the following links to access: Depreclation tables Annual automoble depreclation limitations Table 8.1: Recovery Periods for Assets Placed in Service After 1986, OMB No. 1545 0172 Depreciation and Amortization Form 4562 2019 (Including Information on Listed Property) Attach to your tax return. Go to www.Irs.gov/Form4562 for Instructions and the latest Informatlon. Department of the Treasury Internal Revenue Service (99) Attachment Sequence No. 179 Name(s) shown an return Business or activity to which this form relates Identifylng number Pepe Guardio Manufacturing Part I Election To Expense Certain Property Under Section 179 Note: If you have any listed property, cormplete Part V bcforc you complete Part I. 1 Maxirriurm amour:l (see instructions)....... 1 2 Iatal cost of sectilon 1/9 property placed in service (see Instructions) 3 Threshold cost of section 179 property before reduction in limitation (see instructions) 3 Reduction in limitation. Subtract line 3 from Ine 2. If zero or less, enter -0-...... Dollar limitation for tax year. Subtract line 4 from line 1. If zero or less, enter -0-. If married filing separately, see instructions. 4 4 5 5 (a) Descriplion of properly (b) Cosl (busincss use only) (c) Clected cost 7 Listed property. Cnter the amount frorm line 29 7 Total elected cost of section 179 property. Add amounts in column (c), lines 6 and 7 Tentative deduction. Enter the smaller of line 5 or line 8............ 10 Carryover of disalowed deduction from line 13 of your 2018 Form 4562.. 10 11 Business income limitation. Enter the smaller of business income (not less than zero) or line 5. See instructions 11 12 Sction 179 cxpense deduction. Add lines 9 and 10, but don't enter more than linc 11 12 .-............

Step by Step Solution

★★★★★

3.61 Rating (183 Votes )

There are 3 Steps involved in it

Step: 1

Depreciation expenses for 2019 using form 4562 Basis for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started