Answered step by step

Verified Expert Solution

Question

1 Approved Answer

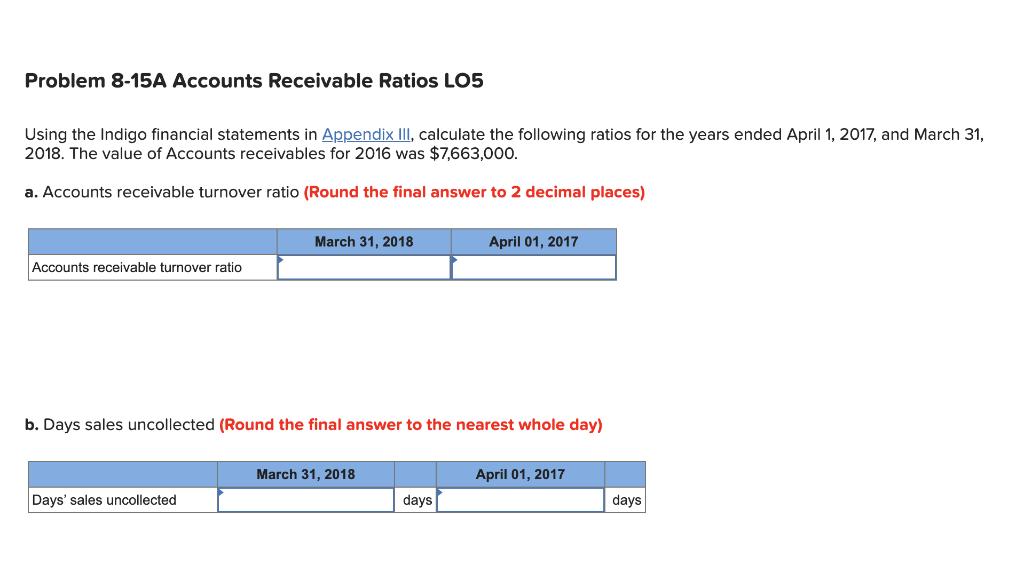

Problem 8-15A Accounts Receivable Ratios LO5 Using the Indigo financial statements in Appendix III, calculate the following ratios for the years ended April 1,

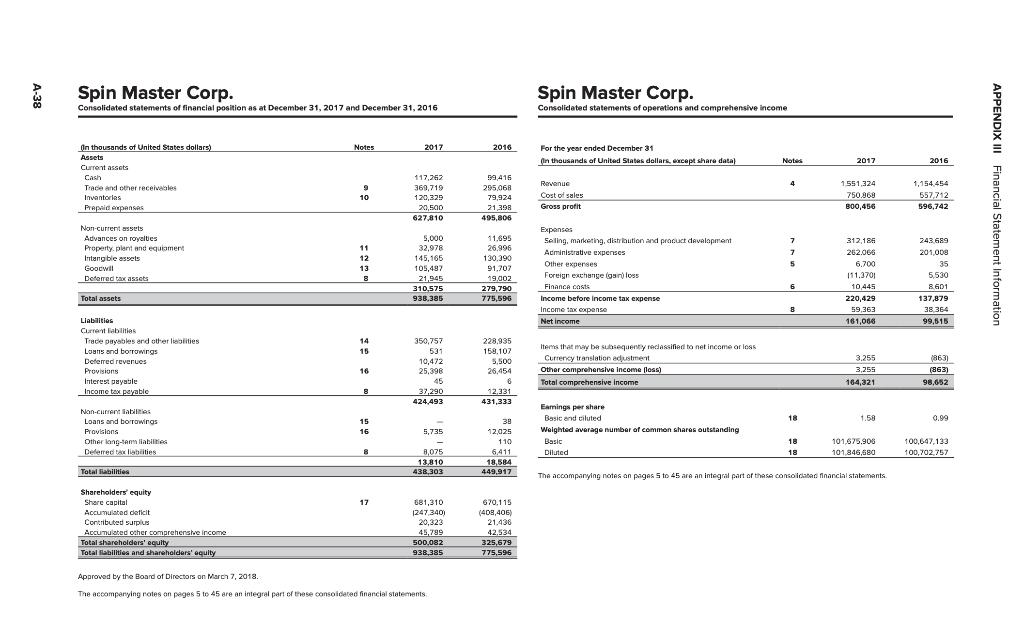

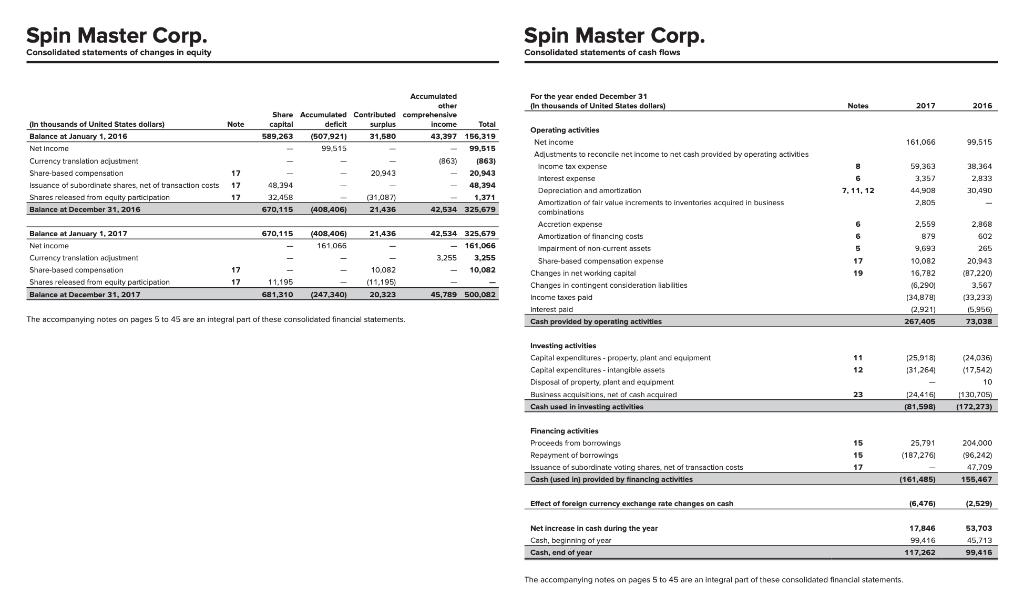

Problem 8-15A Accounts Receivable Ratios LO5 Using the Indigo financial statements in Appendix III, calculate the following ratios for the years ended April 1, 2017, and March 31, 2018. The value of Accounts receivables for 2016 was $7,663,000. a. Accounts receivable turnover ratio (Round the final answer to 2 decimal places) Accounts receivable turnover ratio March 31, 2018 Days' sales uncollected b. Days sales uncollected (Round the final answer to the nearest whole day) March 31, 2018 April 01, 2017 days April 01, 2017 days A-38 Spin Master Corp. Consolidated statements of financial position as at December 31, 2017 and December 31, 2016 On thousands of United States dollars) Assets Current assets Cash Trace and other receivables Inventorias Prepaid expenses Non-current assets Advances on royalties Property, plant and equipment Intangible assets Goodwill Deferred tax assets Total assets Liabilities Current abilities Trace payables and other lieblities Loans and borrowings Deferred reverues Provisions Interest payable Income tax payable Non-current abilities Loans and borrowings Provisions Other long-term liabilities Deferred tax liabilities. Total liabilities Shareholders' equity Share capital Accumulated deficit Contributed surplus Accumulated other comprehensive income Total shareholders' equity Total abilities and shareholders' equity Notes 9 10 11 12 13 8 14 15 16 8 15 16 - 8 17 2017 117,262 369,719 120,329 20,500 627,810 5,000 32,978 145,165 105,487 21,945 310,575 938.385 350,757 531 10,472 25,398 45 37,290 424 492 424,493 -- 5,735 10- 8,075 13,810 438,303 681,310 (247,340) 20,323 45,799 500,082 938,385 Approved by the Board of Directors on March 7, 2018. The accompanying notes on pages 5 to 45 are an integral part of these consolidated financial statements 2016 59,416 295,068 79,924 21,398 495,806 11.695 26,996 130.390 91,707 19,002 279,790 775,596 228,935 158.107 5,500 26,454 6 12,331 431 2 38 12,025 110 6,411 18,584 449,917 670,115 (408,406) 21,436 42.534 325,679 775,596 Spin Master Corp. Consolidated statements of operations and comprehensive income For the year ended December 31 (In thousands of United States dollars, except share data) Revenue Cost of sales Gross profit Expenses Selling, marketing, distribution and product development Administrative expenses Other expenses Foreign exchange (gar) loss Finance costs Income before income tax expense Income tax expense Net income Items that may be subsequently reclassified to net income or loss Currency translation adjustment Other comprehensive Income (loss) Total comprehensive income Earings per share Basic and ciluted Weighted average number of common shares outstanding Basic Diluted Notes 4 7 7 5 6 8 18 18 18 2017 1551,324 750.968 800,456 312,186 262.066 6,700 111.3701 10,445 220,429 59,363 161,066 3,255 3,255 164,321 1.58 101,675,906 101.846,680 The accompanying notes on pages 5 to 45 are an integral part of these consolidated financial statements. 2016 1,154,454 557,712 596,742 243,689 201,008 35 5,530 8601 137,879 38,364 99,515 (863) (863) 98,652 0.99 100,647,133 100,702,757 APPENDIX III Financial Statement Information Spin Master Corp. Consolidated statements of changes in equity In thousands of United States dollars) Balance at January 1, 2016 Net Income Note Currency translation acjustment Share-based compensation 17 Issuance of subordinate shares, net of transaction costs 17 Shares released from equity participation 17 Balance at December 31, 2016 Balance at January 1, 2017 Net income Currency translation adjustment Share-based compensation. Shares released from equity participation Balance at December 31, 2017 17 17 Share Accumulated Contributed capital deficit surplus 589,263 (507,921) 31,580 99,515 48.394 32.458 670,115 (408,406) 670,115 (408,406) 161.065 11.195 681,310 (247,340) 20,943 (31,087) 21,436 21,436 10,082 (11,195) 20,323 Accumulated comprehensive Income The accompanying notes on pages 5 to 45 are an integral part of these consolidated financial statements. other Total 43,397 156,319 99,515 (863) 20,943 48,394 1,371 42,534 325,679 (863) 42,534 325,679 161,066 3,255 10,082 3,255 45,789 500,082 Spin Master Corp. Consolidated statements of cash flows For the year ended December 31 (In thousands of United States dollars) Operating activities Net income Adjustments to reconcile net income to net cash provided by operating activities income tax expense Interest expense Depreciation and amortization Amortization of fair value increments to inventaries acquired in business combinations Accretion expense Amortization of financing costs Impairment of non current assets Share-based compensation expense Changes in net working capital Changes in contingent consideration abilities Income taxes paid Interest paid Cash provided by operating activities Investing activities Capital expenditures-property, plant and equipment Capital expenditures-intangible assets Disposal of property, plant and equipment Business acquisitions, net of cash acquired Cash used in investing activities Financing activities Proceeds from borrowings. Repeyment of borrowings Issuance of subordinate voting shares, net of transaction costs Cash (used in) provided by financing activities Effect of foreign currency exchange rate changes on cash Net increase in cash during the year Cash, beginning of year Cash, end of year Notes 6 7, 11, 12 6 6 5 17 11 12 23 15 15 17 2017 161,066 59,363 3,357 44,908 2,805 2,559 879 9,693 10,082 16,782 (6,290) 134,878) (2,921) 267,405 125,918) 131,2641 [24,416) (81,598) The accompanying notes on pages 5 to 45 are an integral part of these consolidated financial statements. 25,791 (187,276) (161,485) (6,476) 17,846 99,416 117,262 2016 99.515 38,364 2,833 30,490 2,968 602 265 20,943 (87.220) 3.567 (33,233) (5,956) 73,038 (24,036) (17,542) 10 (130,705) (172,273) 204,000 (96,242) 47,709 155,467 (2,529) 53,703 45,713 99.416

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Year Accounts receivable turnover ratio average of accou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started