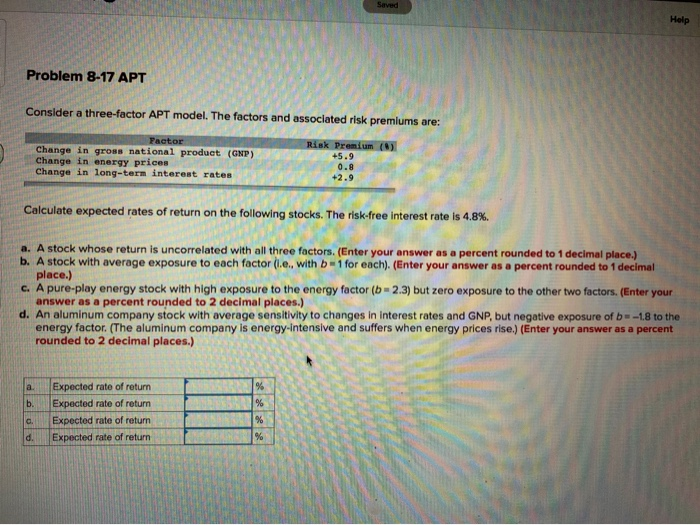

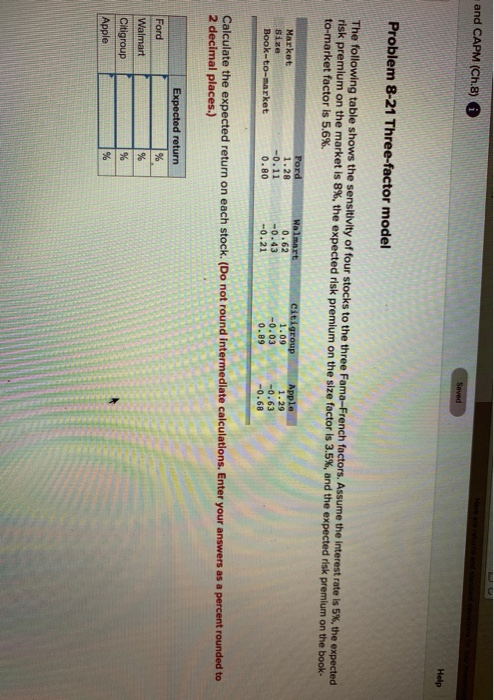

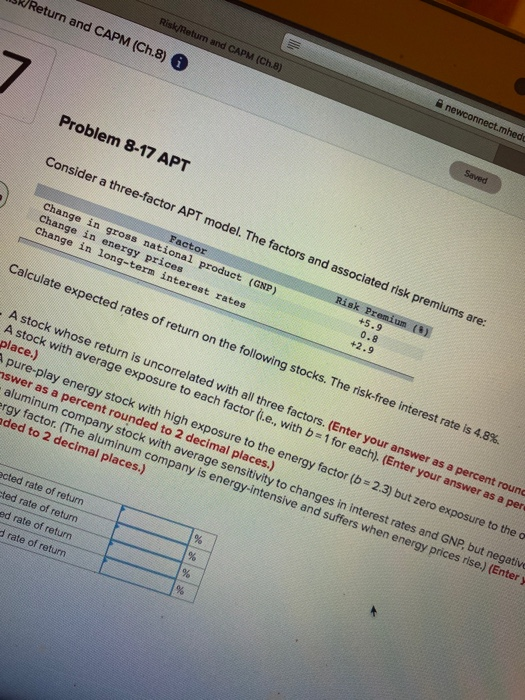

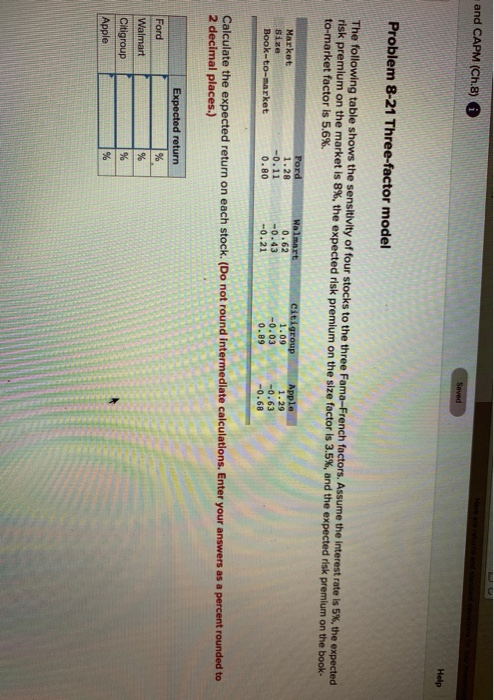

Problem 8-17 APT Consider a three-factor APT model. The factors and associated risk premiums are: Tactor Change in gross national product (GNP) Change in energy prices Change in long-term interest rates Risk Premium -5.9 0.8 +2.9 Calculate expected rates of return on the following stocks. The risk-free interest rate is 4.8% a. A stock whose return is uncorrelated with all three factors. (Enter your answer as a percent rounded to 1 decimal place.) b. A stock with average exposure to each factor (le, with b-1 for each). (Enter your answer as a percent rounded to 1 decimal place.) C. A pure-play energy stock with high exposure to the energy factor ( 2.3) but zero exposure to the other two factors. (Enter your answer as a percent rounded to 2 decimal places.) d. An aluminum company stock with average sensitivity to changes in interest rates and GNP, but negative exposure of b -1.8 to the energy factor. (The aluminum company is energy-intensive and suffers when energy prices rise.) (Enter your answer as a percent rounded to 2 decimal places.) mal places.). changes in interestr energy prices rise a. b. C. d. Expected rate of return Expected rate of return Expected rate of return Expected rate of return 1 and CAPM (Ch.8) Saved Help Problem 8-21 Three-factor model The following table shows the sensitivity of four stocks to the three Fama-French factors. Assume the interest rate is 5%, the expected risk premium on the market is 8%, the expected risk premium on the size factor is 3.5%, and the expected risk premium on the book. to-market factor is 5.6%. Market Size Book-to-market Ford 1.28 -0.11 0.80 Walmart 0.62 -0.43 -0.21 Citigroup 1.09 -0.03 0.89 Apple 1.29 -0.63 -0.68 Calculate the expected return on each stock. (Do not round Intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Expected return Ford Walmart Citigroup Apple Return and CAPM (Ch.8) 6 Risk/Return and CAPM (Ch.B) newconnect.mhed Problem 8-17 APT Consider a three-factor APT model. The factors and associated risk premiums are: Saved Factor Change in gross national product (GNP) Change in energy prices Change in long-term interest rates Calculate expected rates of return on the following stocks. The risk-free interest rate is 4.8% Risk Premium (8) +5.9 0.8 +2.9 A stock whose return is uncorrelated with all three factors. (Enter your answer as a percent roung A stock with average exposure to each factor (.e., with b 1 for each). (Enter your answer as a pery place.) pure-play energy stock with high exposure to the energy factor (b.2.3) but zero exposure to the nswer as a percent rounded to 2 decimal places.) aluminum company stock with average sensitivity to changes in interest rates and GNP, but negative ergy factor. (The aluminum company is energy-intensive and suffers when energy prices rise.) (Enter aded to 2 decimal places.) ected rate of return eted rate of return ed rate of return rate of return