Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 8-19A Analyzing not-for-profit entity variances The Redmond Management Association held its annual public relations luncheon in April Year 2. Based on the previous

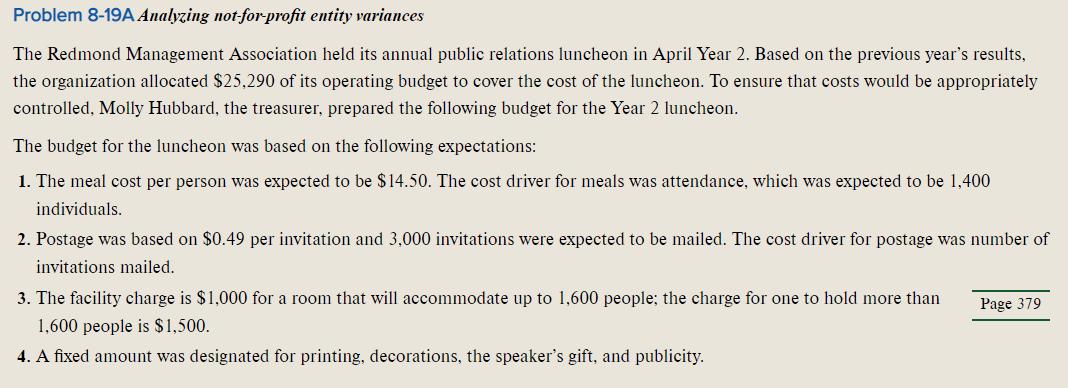

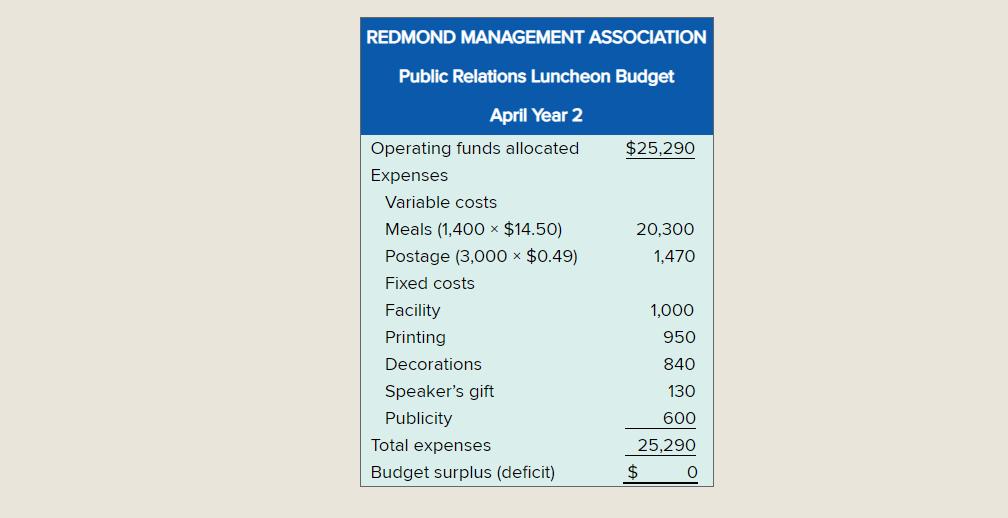

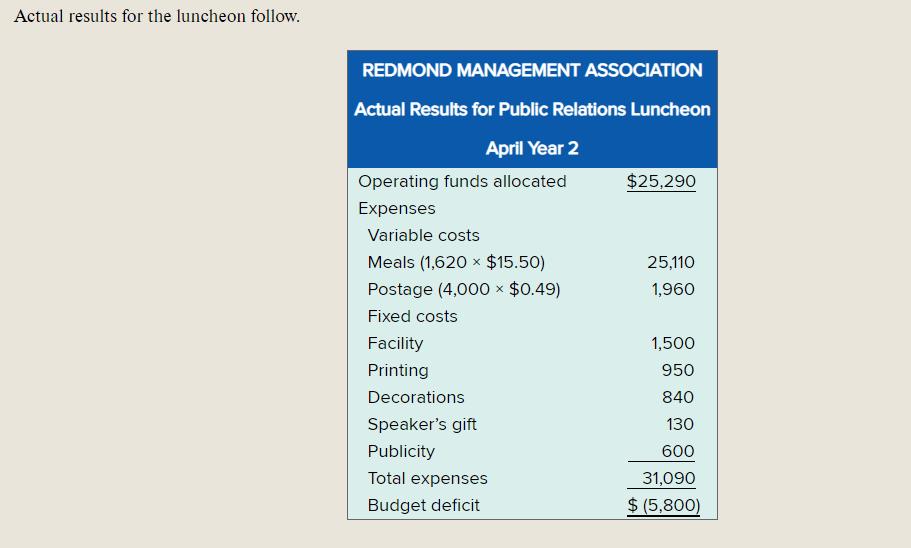

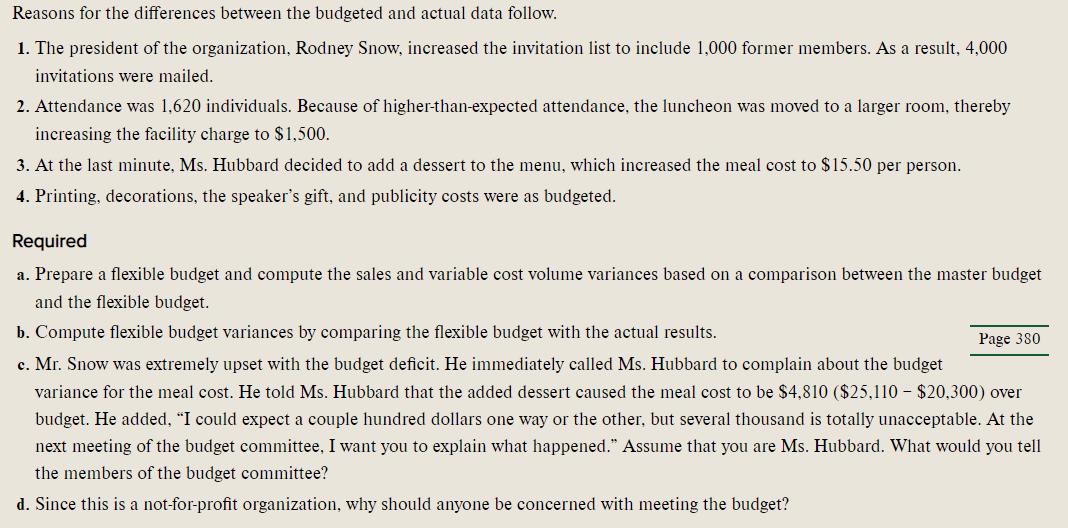

Problem 8-19A Analyzing not-for-profit entity variances The Redmond Management Association held its annual public relations luncheon in April Year 2. Based on the previous year's results, the organization allocated $25,290 of its operating budget to cover the cost of the luncheon. To ensure that costs would be appropriately controlled, Molly Hubbard, the treasurer, prepared the following budget for the Year 2 luncheon. The budget for the luncheon was based on the following expectations: 1. The meal cost per person was expected to be $14.50. The cost driver for meals was attendance, which was expected to be 1,400 individuals. 2. Postage was based on $0.49 per invitation and 3,000 invitations were expected to be mailed. The cost driver for postage was number of invitations mailed. 3. The facility charge is $1,000 for a room that will accommodate up to 1,600 people; the charge for one to hold more than 1,600 people is $1,500. 4. A fixed amount was designated for printing, decorations, the speaker's gift, and publicity. Page 379 REDMOND MANAGEMENT ASSOCIATION Public Relations Luncheon Budget April Year 2 Operating funds allocated $25,290 Expenses Variable costs Meals (1,400 x $14.50) 20,300 Postage (3,000 $0.49) 1,470 Fixed costs Facility 1,000 Printing 950 Decorations 840 Speaker's gift 130 Publicity 600 Total expenses 25,290 Budget surplus (deficit) $ Actual results for the luncheon follow. REDMOND MANAGEMENT ASSOCIATION Actual Results for Public Relations Luncheon April Year 2 Operating funds allocated $25,290 Expenses Variable costs Meals (1,620 x $15.50) 25,110 Postage (4,000 $0.49) 1,960 Fixed costs Facility 1,500 Printing 950 Decorations 840 Speaker's gift Publicity Total expenses Budget deficit 130 600 31,090 $ (5,800) Reasons for the differences between the budgeted and actual data follow. 1. The president of the organization, Rodney Snow, increased the invitation list to include 1,000 former members. As a result, 4,000 invitations were mailed. 2. Attendance was 1,620 individuals. Because of higher-than-expected attendance, the luncheon was moved to a larger room, thereby increasing the facility charge to $1,500. 3. At the last minute, Ms. Hubbard decided to add a dessert to the menu, which increased the meal cost to $15.50 per person. 4. Printing, decorations, the speaker's gift, and publicity costs were as budgeted. Required a. Prepare a flexible budget and compute the sales and variable cost volume variances based on a comparison between the master budget and the flexible budget. b. Compute flexible budget variances by comparing the flexible budget with the actual results. Page 380 c. Mr. Snow was extremely upset with the budget deficit. He immediately called Ms. Hubbard to complain about the budget variance for the meal cost. He told Ms. Hubbard that the added dessert caused the meal cost to be $4,810 ($25,110 - $20,300) over budget. He added, "I could expect a couple hundred dollars one way or the other, but several thousand is totally unacceptable. At the next meeting of the budget committee, I want you to explain what happened." Assume that you are Ms. Hubbard. What would you tell the members of the budget committee? d. Since this is a not-for-profit organization, why should anyone be concerned with meeting the budget?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started