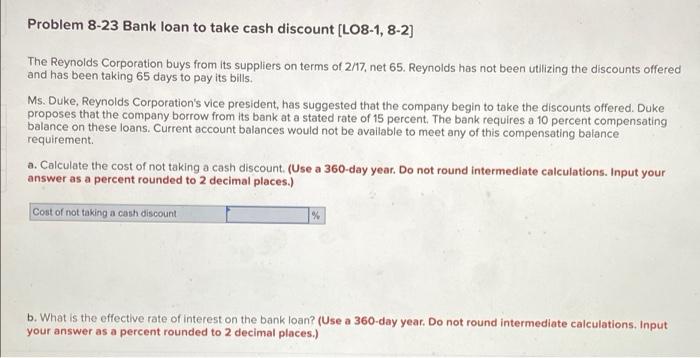

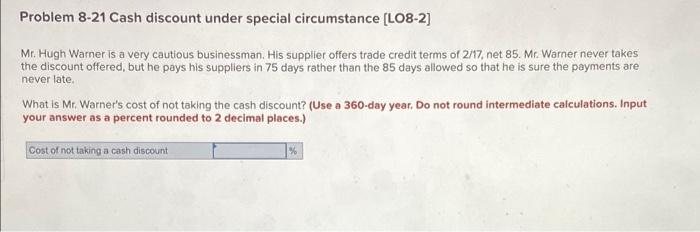

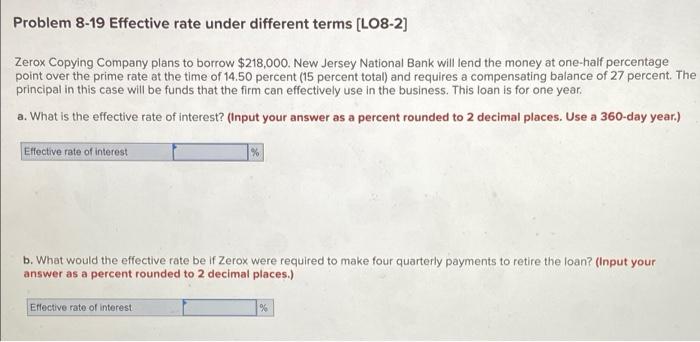

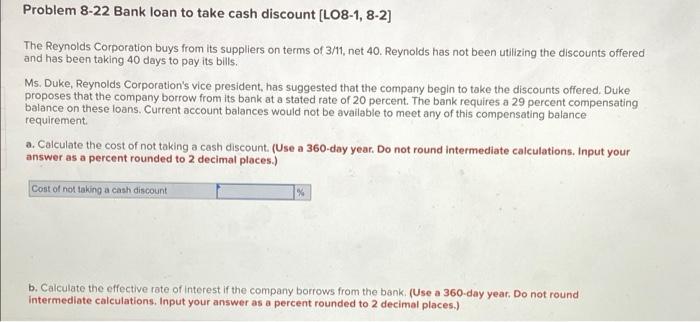

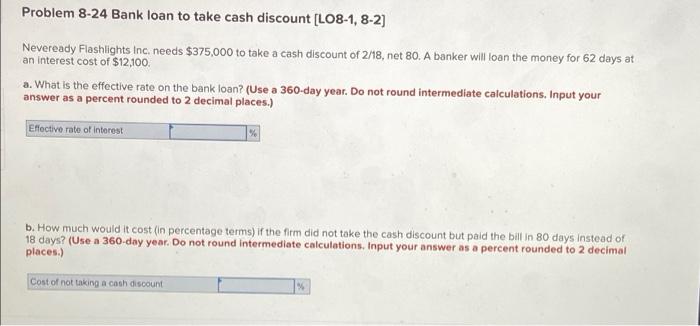

Problem 8-23 Bank loan to take cash discount [LO8-1, 8-2] The Reynolds Corporation buys from its suppliers on terms of 2/17, net 65. Reynolds has not been utilizing the discounts offered and has been taking 65 days to pay its bills. Ms. Duke, Reynolds Corporation's vice president, has suggested that the company begin to take the discounts offered. Duke proposes that the company borrow from its bank at a stated rate of 15 percent. The bank requires a 10 percent compensating balance on these loans. Current account balances would not be available to meet any of this compensating balance requirement. a. Calculate the cost of not taking a cash discount. (Use a 360-day year. Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Cost of not taking a cash discount % b. What is the effective rate of interest on the bank loan? (Use a 360-day year. Do not round intermediate calculations. Input. your answer as a percent rounded to 2 decimal places.) Problem 8-21 Cash discount under special circumstance [LO8-2] Mr. Hugh Warner is a very cautious businessman. His supplier offers trade credit terms of 2/17, net 85. Mr. Warner never takes the discount offered, but he pays his suppliers in 75 days rather than the 85 days allowed so that he is sure the payments are never late. What is Mr. Warner's cost of not taking the cash discount? (Use a 360-day year. Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Cost of not taking a cash discount % Problem 8-19 Effective rate under different terms [LO8-2] Zerox Copying Company plans to borrow $218,000. New Jersey National Bank will lend the money at one-half percentage point over the prime rate at the time of 14.50 percent (15 percent total) and requires a compensating balance of 27 percent. The principal in this case will be funds that the firm can effectively use in the business. This loan is for one year. a. What is the effective rate of interest? (Input your answer as a percent rounded to 2 decimal places. Use a 360-day year.) Effective rate of interest % b. What would the effective rate be if Zerox were required to make four quarterly payments to retire the loan? (Input your answer as a percent rounded to 2 decimal places.) Effective rate of interesti % Problem 8-22 Bank loan to take cash discount [LO8-1, 8-2] The Reynolds Corporation buys from its suppliers on terms of 3/11, net 40. Reynolds has not been utilizing the discounts offered and has been taking 40 days to pay its bills. Ms. Duke, Reynolds Corporation's vice president, has suggested that the company begin to take the discounts offered. Duke proposes that the company borrow from its bank at a stated rate of 20 percent. The bank requires a 29 percent compensating balance on these loans. Current account balances would not be available to meet any of this compensating balance requirement. a. Calculate the cost of not taking a cash discount. (Use a 360-day year. Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Cost of not taking a cash discount % b. Calculate the effective rate of interest if the company borrows from the bank. (Use a 360-day year. Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Problem 8-24 Bank loan to take cash discount [LO8-1, 8-2] Neveready Flashlights Inc. needs $375,000 to take a cash discount of 2/18, net 80. A banker will loan the money for 62 days at an interest cost of $12,100. a. What is the effective rate on the bank loan? (Use a 360-day year. Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Effective rate of interest b. How much would it cost (in percentage terms) if the firm did not take the cash discount but paid the bill in 80 days instead of 18 days? (Use a 360-day year. Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Cost of not taking a cash discount