Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 8-28A Problem 8-29A Required balance depreciation the choice of one depreciation method over another produce a different amount of cash Base Would 6 Calculate

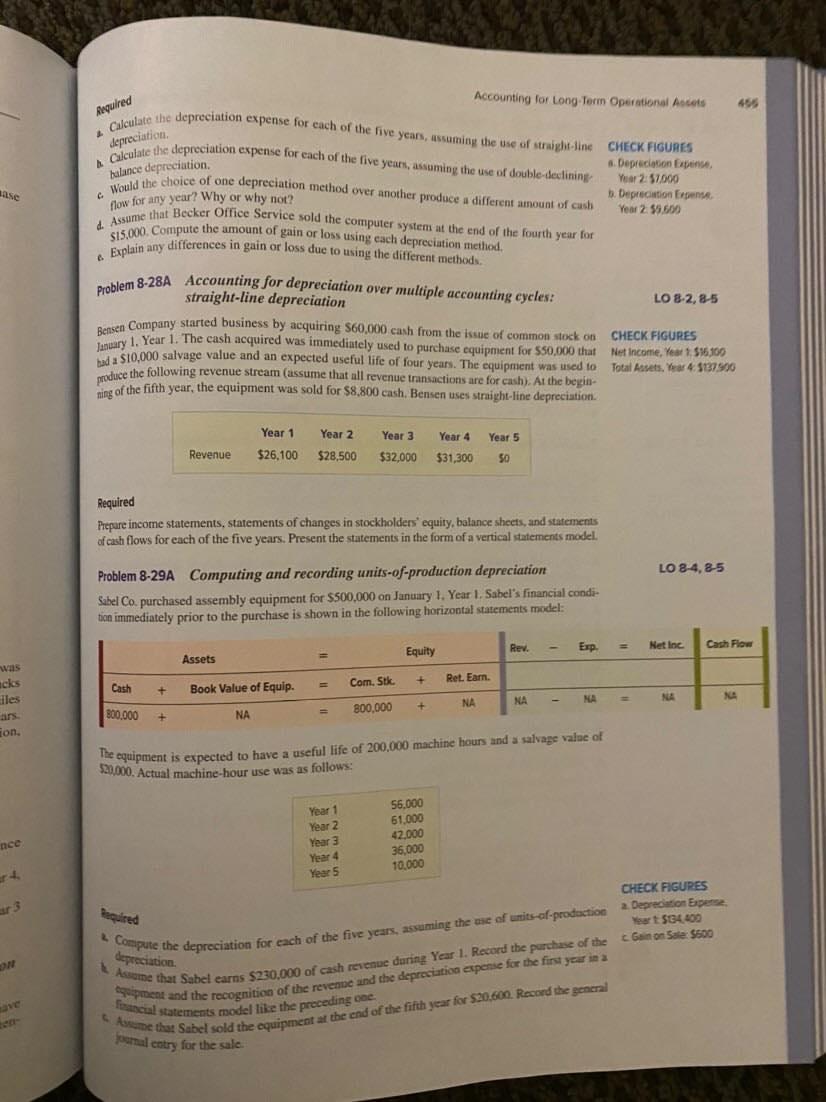

Problem 8-28A

Problem 8-29A

Required balance depreciation the choice of one depreciation method over another produce a different amount of cash Base Would 6 Calculate the depreciation expense for each of the five years, assuming the use of straight-line Calculate the depreciation expense for each of the five years, assuming the use of double-declining d. Assume that Becker Office Service sold the computer system at the end of the fourth year for $15,000. Compute the amount of gain or loss using cach depreciation method. 6 Explain any differences in gain or loss due to using the different methods Problem 8-28A Accounting for depreciation over multiple accounting cycles: produce the following revenue stream (assume that all revenue transactions are for cash). At the begin Compute the depreciation for each of the five years, assuming Assume that Sabel earns $230,000 of cash revenue during Year 1. Record the purchase of the Squipment and the recognition of the revenue and the depreciation expense for the first year in a Francual statements model like the preceding one. me that Sabel sold the equipment at the end of the fifth year for $20.600. Record the general Accounting for Long-Term Operational Assets CHECK FIGURES Depreciation Expense Year 2:57.000 flow for any year? Why or why not? b. Depreciation En Year 2 35.600 straight-line depreciation LO 8-2,8-5 Bensen Company started business by acquiring 560.000 cash from the issue of common stock on CHECK FIGURES, anuary 1Year 1. The cash acquired was immediately used to purchase equipment for $50,000 that Net Income, Yew 1.516.30 had a $10,000 salvage value and an expected useful life of four years. The equipment was used to Total Assets. Y 4296 ning of the fifth year, the equipment was sold for $8,800 cash. Bensen uses straight-line depreciation. Year 1 Year 2 Year 3 Year 4 Year 5 Revenue $26.100 $28,500 $32,000 $31,300 50 Required Prepare income statements, statements of changes in stockholders' equity, balance sheets, and statements of cash flows for each of the five years. Present the statements in the form of a vertical statements model. Problem 8-29A Computing and recording units-of-production depreciation LO 8-4,85 Sabel Co. purchased assembly equipment for $500,000 on January 1. Year 1. Sabel's financial condi- tion immediately prior to the purchase is shown in the following horizontal statements model: Equity Rev. Exp Net Inc. Cash Flow Assets acks Cash Book Value of Equip. Com. Stk. les NE NA NA NA 800.000 NA Fon. The equipment is expected to have a useful life of 200.000 machine hours and a salvage value of $20,000. Actual machine-hour use was as follows: CHECK FIGURES 2 Depreciation Espen Yeart $34.400 Ganon Sale $500 smal entry for the sale + Ret. Earn + + 800,000 56,000 61.000 42,000 36,000 10.000 Year 1 Year 2 Year 3 Year 4 Year 5 nce ar 3 Required we of units-of-production ONStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started