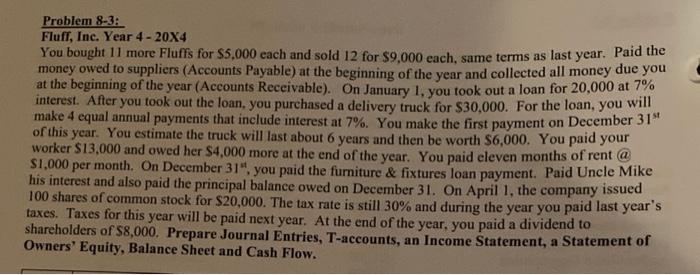

Problem 8-3: Fluff, Inc. Year 4 - 20X4 You bought 11 more Fluffs for $5.000 each and sold 12 for $9,000 each, same terms as last year. Paid the money owed to suppliers (Accounts Payable) at the beginning of the year and collected all money due you at the beginning of the year (Accounts Receivable). On January 1, you took out a loan for 20,000 at 7% interest. After you took out the loan, you purchased a delivery truck for $30,000. For the loan, you will make 4 equal annual payments that include interest at 7%. You make the first payment on December 31 of this year. You estimate the truck will last about 6 years and then be worth $6,000. You paid your worker S13,000 and owed her $4,000 more at the end of the year. You paid eleven months of rent @ $1.000 per month. On December 31", you paid the furniture & fixtures loan payment. Paid Uncle Mike his interest and also paid the principal balance owed on December 31. On April 1, the company issued 100 shares of common stock for $20,000. The tax rate is still 30% and during the year you paid last year's taxes. Taxes for this year will be paid next year. At the end of the year, you paid a dividend to shareholders of $8,000. Prepare Journal Entries, T-accounts, an Income Statement, a Statement of Owners' Equity, Balance Sheet and Cash Flow. Problem 8-3: Fluff, Inc. Year 4 - 20X4 You bought 11 more Fluffs for $5.000 each and sold 12 for $9,000 each, same terms as last year. Paid the money owed to suppliers (Accounts Payable) at the beginning of the year and collected all money due you at the beginning of the year (Accounts Receivable). On January 1, you took out a loan for 20,000 at 7% interest. After you took out the loan, you purchased a delivery truck for $30,000. For the loan, you will make 4 equal annual payments that include interest at 7%. You make the first payment on December 31 of this year. You estimate the truck will last about 6 years and then be worth $6,000. You paid your worker S13,000 and owed her $4,000 more at the end of the year. You paid eleven months of rent @ $1.000 per month. On December 31", you paid the furniture & fixtures loan payment. Paid Uncle Mike his interest and also paid the principal balance owed on December 31. On April 1, the company issued 100 shares of common stock for $20,000. The tax rate is still 30% and during the year you paid last year's taxes. Taxes for this year will be paid next year. At the end of the year, you paid a dividend to shareholders of $8,000. Prepare Journal Entries, T-accounts, an Income Statement, a Statement of Owners' Equity, Balance Sheet and Cash Flow