Question

Problem 8-4 Modified Accelerated Cost Recovery System (MACRS) (LO 8.2) On June 8, 2021, Holly purchased a residential apartment building. The cost basis assigned

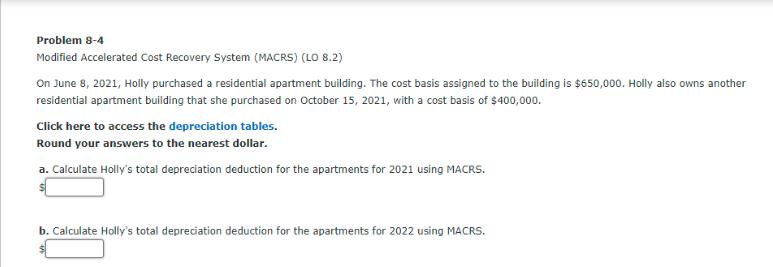

Problem 8-4 Modified Accelerated Cost Recovery System (MACRS) (LO 8.2) On June 8, 2021, Holly purchased a residential apartment building. The cost basis assigned to the building is $650,000. Holly also owns another residential apartment building that she purchased on October 15, 2021, with a cost basis of $400,000. Click here to access the depreciation tables. Round your answers to the nearest dollar. a. Calculate Holly's total depreciation deduction for the apartments for 2021 using MACRS. b. Calculate Holly's total depreciation deduction for the apartments for 2022 using MACRS.

Step by Step Solution

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Answer a 15837 b 38178 Calculation As per depreciation table For residential b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2015

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven Gill

33rd Edition

9781305177772, 128543952X, 1305177770, 978-1285439525

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App