Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 8-42 (Algorithmic) (LO. 4) On June 1, 2022, Leo purchased and placed in service a new car that cost $61,600. The business use percentage

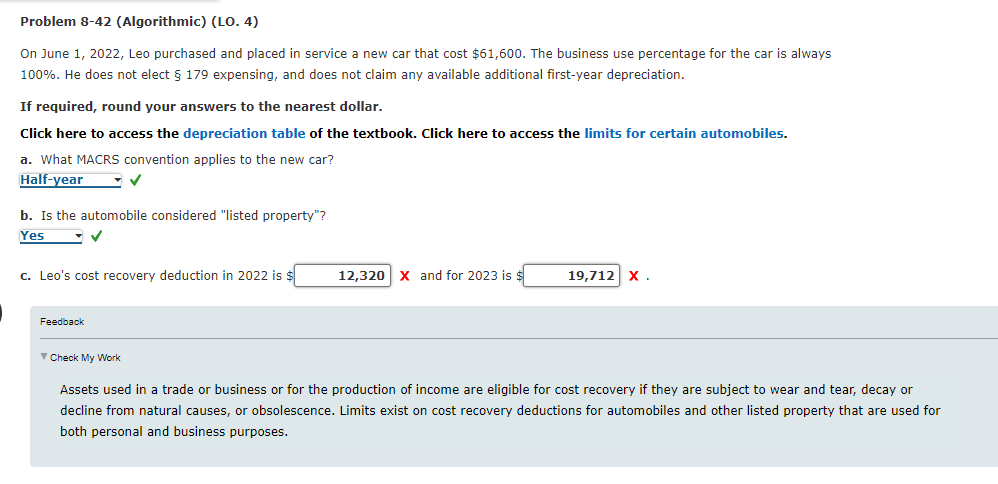

Problem 8-42 (Algorithmic) (LO. 4) On June 1, 2022, Leo purchased and placed in service a new car that cost $61,600. The business use percentage for the car is always 100%. He does not elect 179 expensing, and does not claim any available additional first-year depreciation. If required, round your answers to the nearest dollar. Click here to access the depreciation table of the textbook. Click here to access the limits for certain automobiles. a. What MACRS convention applies to the new car? b. Is the automobile considered "listed property"? c. Leo's cost recovery deduction in 2022 is $ X and for 2023 is $ X. Feedback Check My Work Assets used in a trade or business or for the production of income are eligible for cost recovery if they are subject to wear and tear, decay or decline from natural causes, or obsolescence. Limits exist on cost recovery deductions for automobiles and other listed property that are used for both personal and business purposes

Problem 8-42 (Algorithmic) (LO. 4) On June 1, 2022, Leo purchased and placed in service a new car that cost $61,600. The business use percentage for the car is always 100%. He does not elect 179 expensing, and does not claim any available additional first-year depreciation. If required, round your answers to the nearest dollar. Click here to access the depreciation table of the textbook. Click here to access the limits for certain automobiles. a. What MACRS convention applies to the new car? b. Is the automobile considered "listed property"? c. Leo's cost recovery deduction in 2022 is $ X and for 2023 is $ X. Feedback Check My Work Assets used in a trade or business or for the production of income are eligible for cost recovery if they are subject to wear and tear, decay or decline from natural causes, or obsolescence. Limits exist on cost recovery deductions for automobiles and other listed property that are used for both personal and business purposes Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started