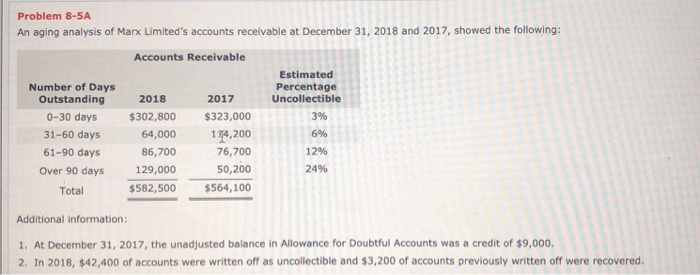

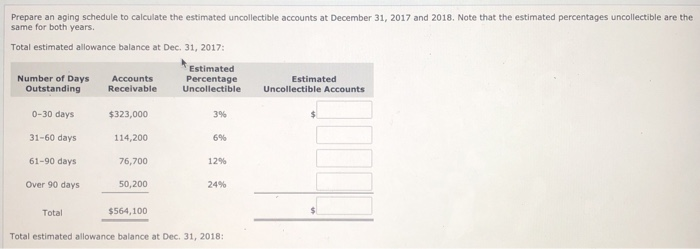

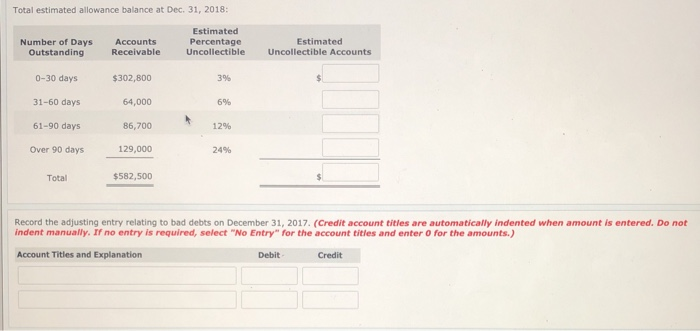

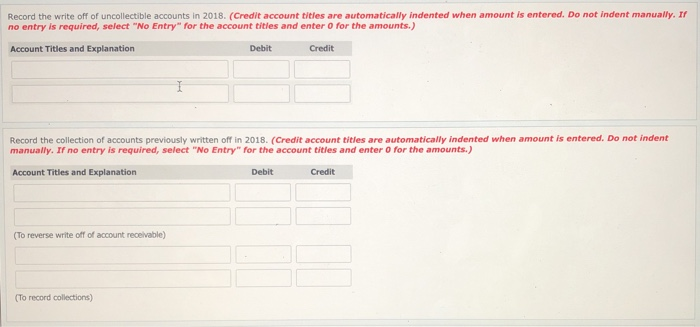

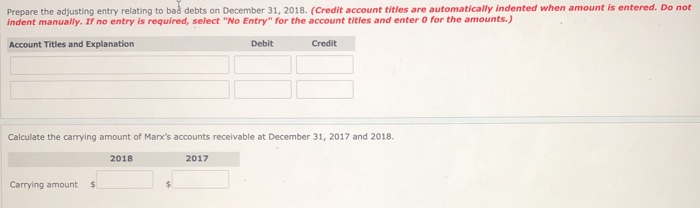

Problem 8-5A An aging analysis of Marx Limited's accounts receivable at December 31, 2018 and 2017, showed the following: Accounts Receivable Estimated Number of Days Percentage Outstanding 2018 2017 Uncollectible 0-30 days $302,800 $323,000 3% 31-60 days 64,000 1914,200 6% 61-90 days 86,700 76,700 12% Over 90 days 129,000 50,200 Total $582,500 $564,100 24% Additional information: 1. At December 31, 2017, the unadjusted balance in Allowance for Doubtful Accounts was a credit of $9,000, 2. In 2018, $42,400 of accounts were written off as uncollectible and $3,200 of accounts previously written off were recovered. Prepare an aging schedule to calculate the estimated uncollectible accounts at December 31, 2017 and 2018. Note that the estimated percentages uncollectible are the same for both years. Total estimated allowance balance at Dec 31, 2017: Estimated Number of Days Accounts Percentage Estimated Outstanding Receivable Uncollectible Uncollectible Accounts 0-30 days $323,000 3% 31-60 days 114,200 6% 61-90 days 76,700 12% Over 90 days 50,200 24% Total $564,100 Total estimated allowance balance at Dec 31, 2018: Total estimated allowance balance at Dec 31, 2018: Number of Days Outstanding Accounts Receivable Estimated Percentage Uncollectible Estimated Uncollectible Accounts 0-30 days $302,800 39 31-60 days 64,000 6% 61-90 days 86,700 12% Over 90 days 129,000 24% Total $582,500 Record the adjusting entry relating to bad debts on December 31, 2017. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit Record the write off of uncollectible accounts in 2018. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit I Record the collection of accounts previously written off in 2018. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit (To reverse write off of account receivable) (To record collections) Prepare the adjusting entry relating to bad debts on December 31, 2018. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit Calculate the carrying amount of Marx's accounts receivable at December 31, 2017 and 2018. 2018 2017 Carrying amount