Answered step by step

Verified Expert Solution

Question

1 Approved Answer

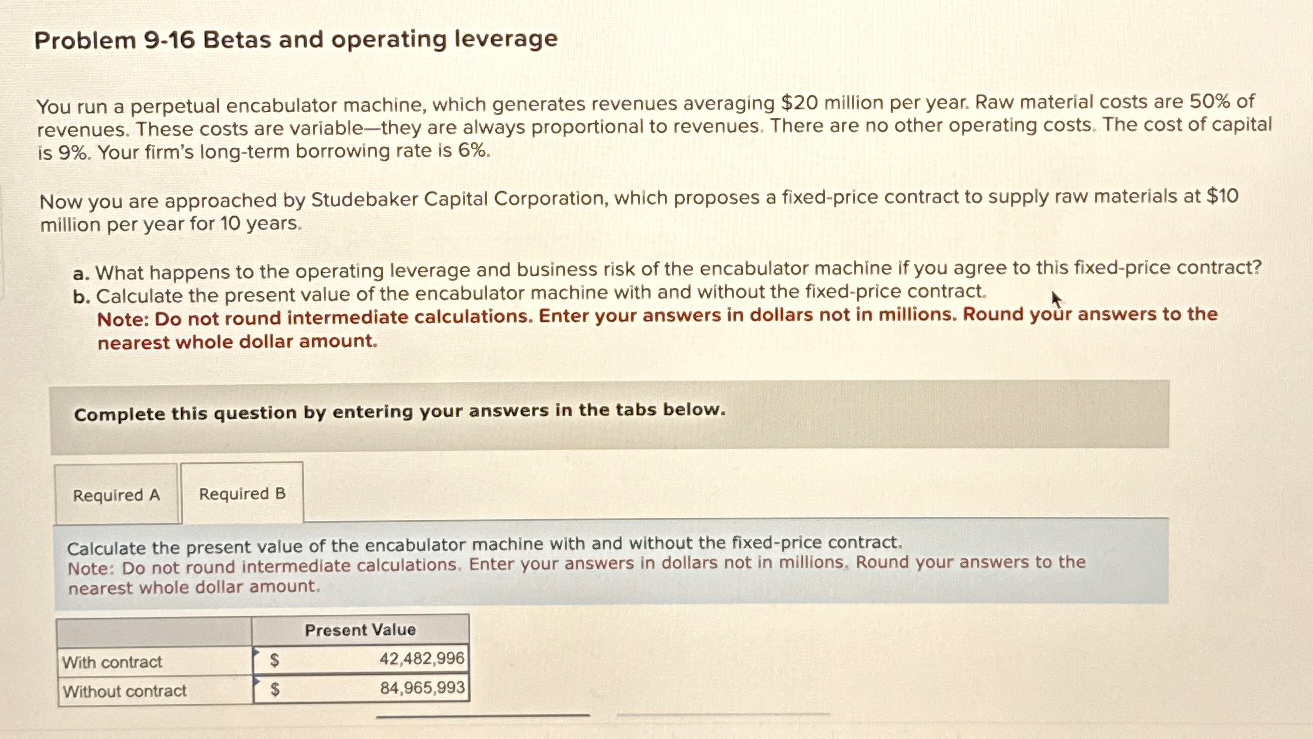

Problem 9 - 1 6 Betas and operating leverage You run a perpetual encabulator machine, which generates revenues averaging $ 2 0 million per year.

Problem Betas and operating leverage

You run a perpetual encabulator machine, which generates revenues averaging $ million per year. Raw material costs are of revenues. These costs are variablethey are always proportional to revenues. There are no other operating costs. The cost of capital is Your firm's longterm borrowing rate is

Now you are approached by Studebaker Capital Corporation, which proposes a fixedprice contract to supply raw materials at $ million per year for years.

a What happens to the operating leverage and business risk of the encabulator machine if you agree to this fixedprice contract?

b Calculate the present value of the encabulator machine with and without the fixedprice contract. Note: Do not round intermediate calculations. Enter your answers in dollars not in millions. Round your answers to the nearest whole dollar amount.

Complete this question by entering your answers in the tabs below.

Calculate the present value of the encabulator machine with and without the fixedprice contract.

Note: Do not round intermediate calculations. Enter your answers in dollars not in millions, Round your answers to the nearest whole dollar amount.

tablePresent ValueWith contract,$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started