Question

Problem 9: Betty and Bob buy a 20-year bond with a coupon rate of 7% per annum payable semiannually and a face and redemption

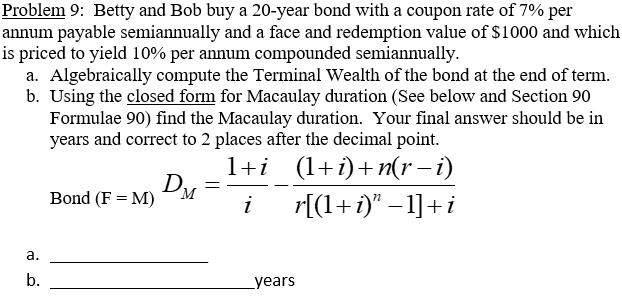

Problem 9: Betty and Bob buy a 20-year bond with a coupon rate of 7% per annum payable semiannually and a face and redemption value of $1000 and which is priced to yield 10% per annum compounded semiannually. a. Algebraically compute the Terminal Wealth of the bond at the end of term. b. Using the closed form for Macaulay duration (See below and Section 90 Formulae 90) find the Macaulay duration. Your final answer should be in years and correct to 2 places after the decimal point. 1+i (1+i)+n(r - i) i r[(1+i)" -1]+i a. b. Bond (F= M) D M years

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The answer provided below has been develope...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Investing

Authors: Scott B. Smart, Lawrence J. Gitman, Michael D. Joehnk

12th edition

978-0133075403, 133075354, 9780133423938, 133075400, 013342393X, 978-0133075359

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App