Answered step by step

Verified Expert Solution

Question

1 Approved Answer

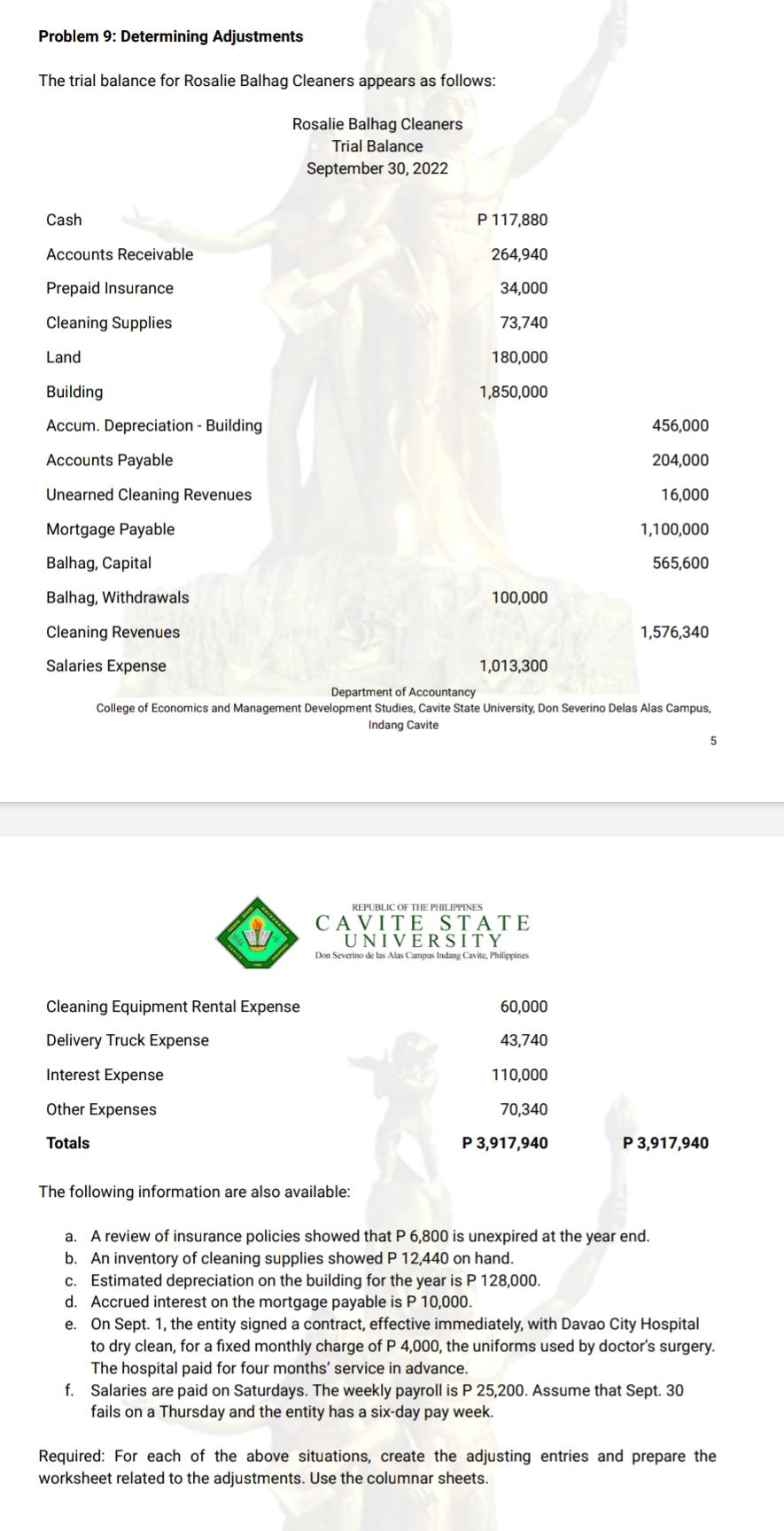

Problem 9: Determining Adjustments The trial balance for Rosalie Balhag Cleaners appears as follows: Rosalie Balhag Cleaners Trial Balance September 30, 2022 Cash Accounts

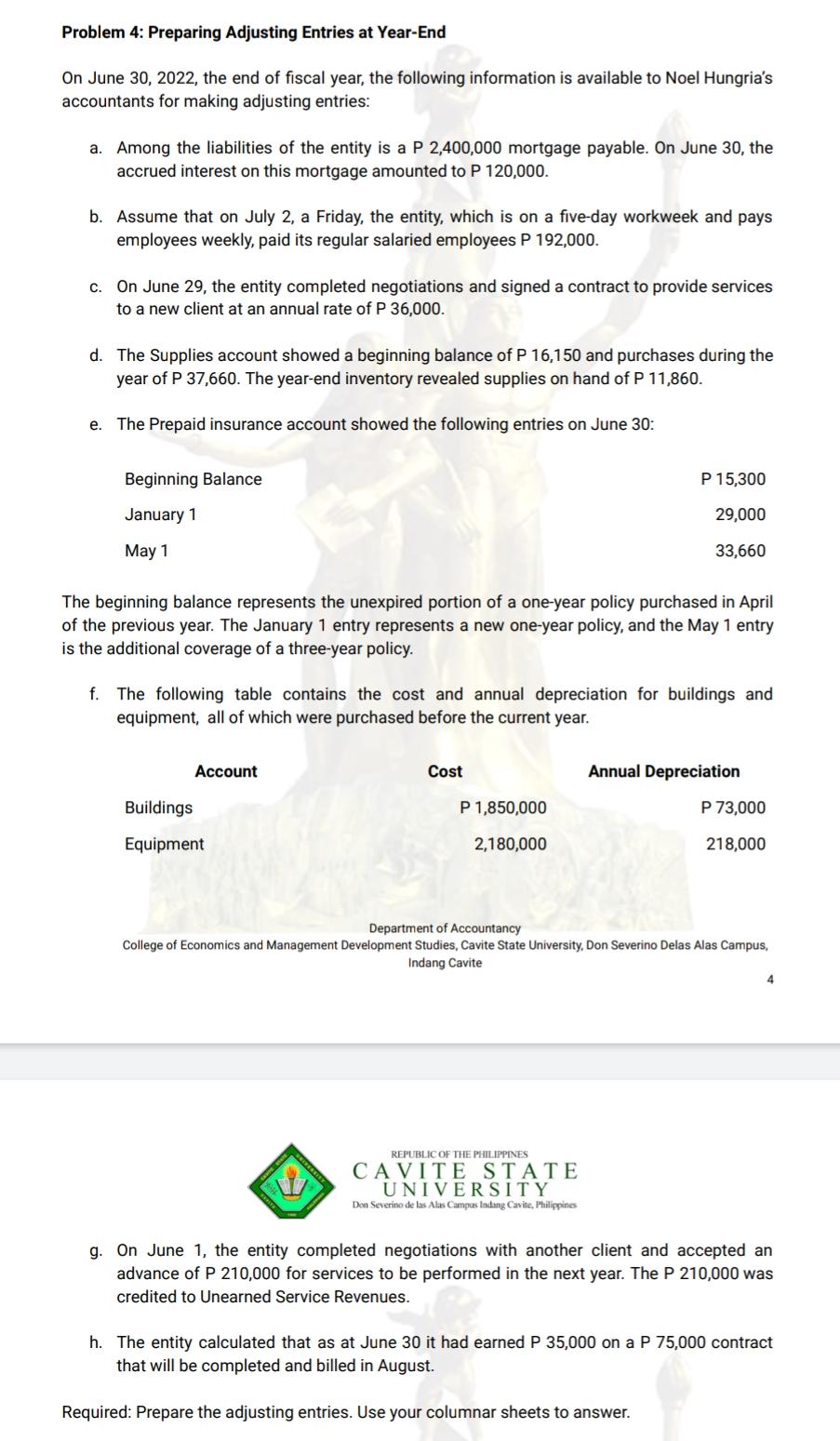

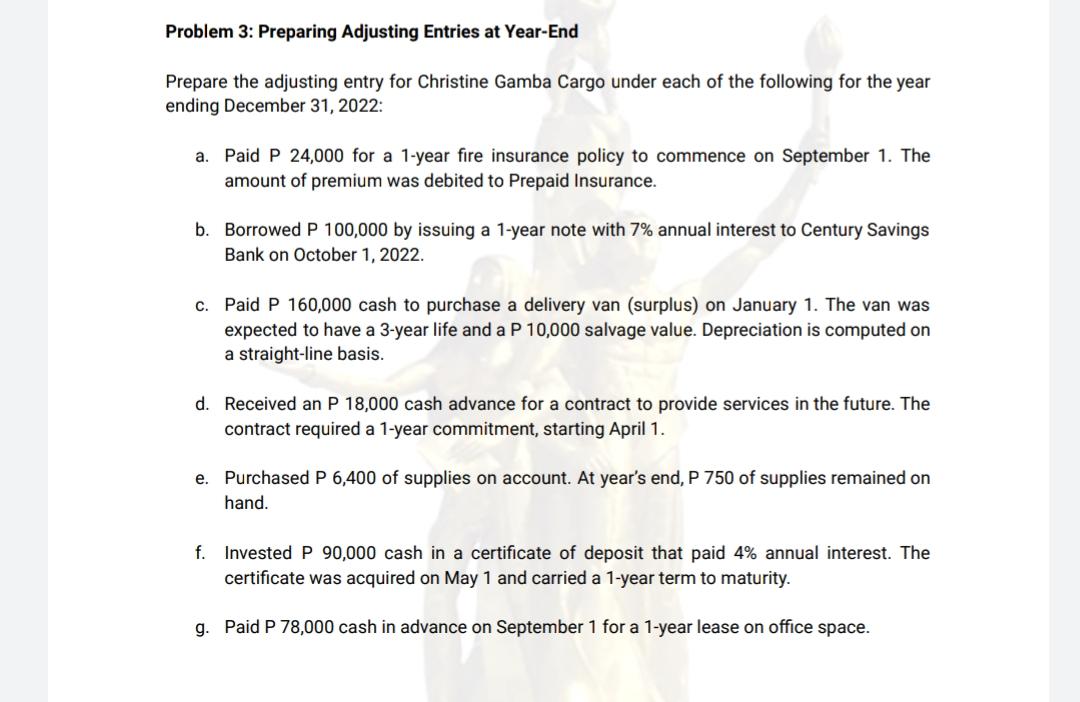

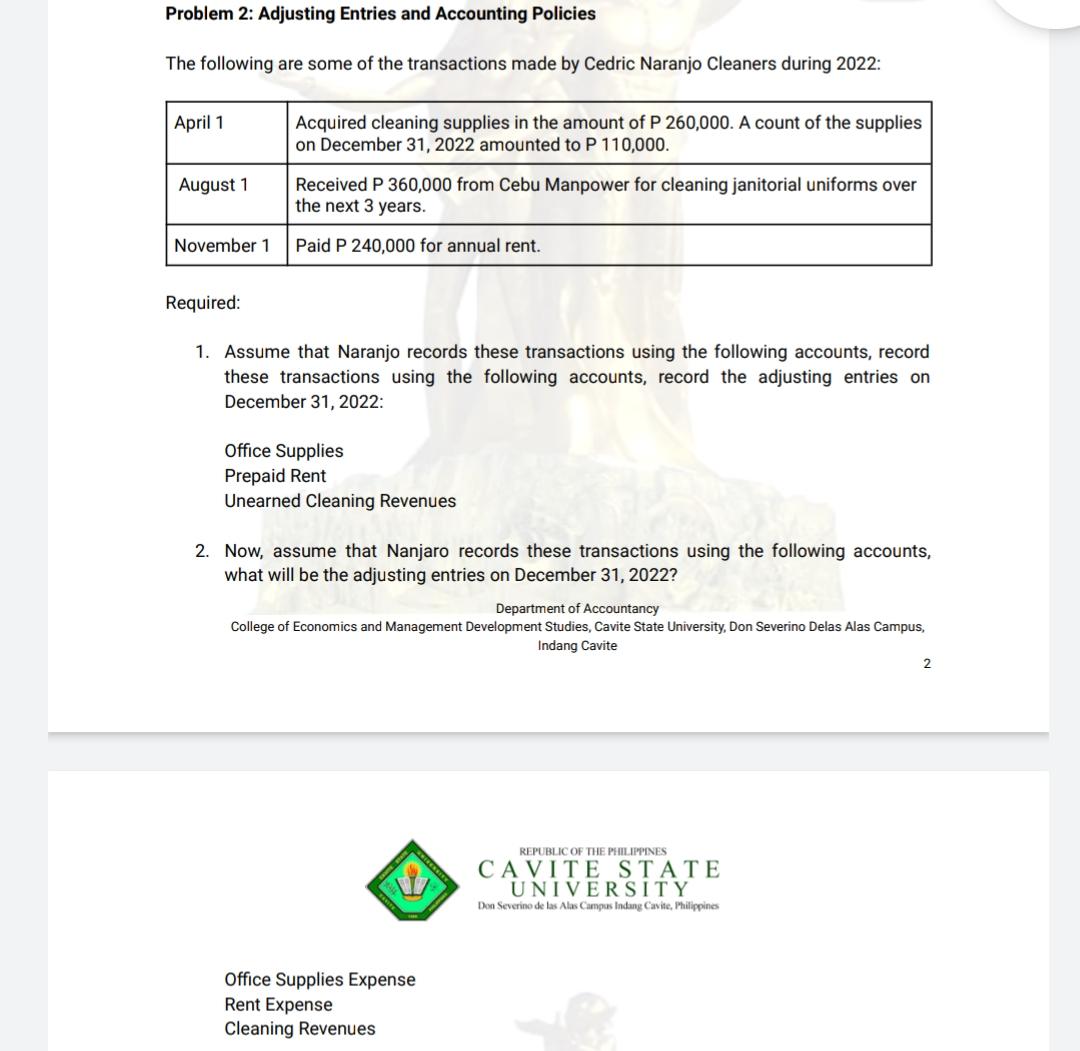

Problem 9: Determining Adjustments The trial balance for Rosalie Balhag Cleaners appears as follows: Rosalie Balhag Cleaners Trial Balance September 30, 2022 Cash Accounts Receivable Prepaid Insurance P 117,880 264,940 34,000 Cleaning Supplies 73,740 Land 180,000 Building 1,850,000 Accum. Depreciation - Building 456,000 Accounts Payable 204,000 Unearned Cleaning Revenues 16,000 Mortgage Payable Balhag, Capital Balhag, Withdrawals Cleaning Revenues 1,100,000 565,600 100,000 1,576,340 Salaries Expense 1,013,300 Department of Accountancy College of Economics and Management Development Studies, Cavite State University, Don Severino Delas Alas Campus, Cleaning Equipment Rental Expense Delivery Truck Expense Interest Expense Other Expenses Totals Indang Cavite REPUBLIC OF THE PHILIPPINES CAVITE STATE UNIVERSITY Don Severino de las Alas Campus Indang Cavite, Philippines 60,000 43,740 110,000 70,340 P 3,917,940 P 3,917,940 5 The following information are also available: a. A review of insurance policies showed that P 6,800 is unexpired at the year end. b. An inventory of cleaning supplies showed P 12,440 on hand. c. Estimated depreciation on the building for the year is P 128,000. d. Accrued interest on the mortgage payable is P 10,000.. e. On Sept. 1, the entity signed a contract, effective immediately, with Davao City Hospital to dry clean, for a fixed monthly charge of P 4,000, the uniforms used by doctor's surgery. The hospital paid for four months' service in advance. f. Salaries are paid on Saturdays. The weekly payroll is P 25,200. Assume that Sept. 30 fails on a Thursday and the entity has a six-day pay week. Required: For each of the above situations, create the adjusting entries and prepare the worksheet related to the adjustments. Use the columnar sheets. Problem 4: Preparing Adjusting Entries at Year-End On June 30, 2022, the end of fiscal year, the following information is available to Noel Hungria's accountants for making adjusting entries: a. Among the liabilities of the entity is a P 2,400,000 mortgage payable. On June 30, the accrued interest on this mortgage amounted to P 120,000. b. Assume that on July 2, a Friday, the entity, which is on a five-day workweek and pays employees weekly, paid its regular salaried employees P 192,000. c. On June 29, the entity completed negotiations and signed a contract to provide services to a new client at an annual rate of P 36,000. d. The Supplies account showed a beginning balance of P 16,150 and purchases during the year of P 37,660. The year-end inventory revealed supplies on hand of P 11,860. e. The Prepaid insurance account showed the following entries on June 30: Beginning Balance January 1 May 1 P 15,300 29,000 33,660 The beginning balance represents the unexpired portion of a one-year policy purchased in April of the previous year. The January 1 entry represents a new one-year policy, and the May 1 entry is the additional coverage of a three-year policy. f. The following table contains the cost and annual depreciation for buildings and equipment, all of which were purchased before the current year. Account Buildings Equipment Cost Annual Depreciation P 1,850,000 P 73,000 2,180,000 218,000 Department of Accountancy College of Economics and Management Development Studies, Cavite State University, Don Severino Delas Alas Campus, Indang Cavite REPUBLIC OF THE PHILIPPINES CAVITE STATE UNIVERSITY Don Severino de las Alas Campus Indang Cavite, Philippines g. On June 1, the entity completed negotiations with another client and accepted an advance of P 210,000 for services to be performed in the next year. The P 210,000 was credited to Unearned Service Revenues. h. The entity calculated that as at June 30 it had earned P 35,000 on a P 75,000 contract that will be completed and billed in August. Required: Prepare the adjusting entries. Use your columnar sheets to answer. Problem 3: Preparing Adjusting Entries at Year-End Prepare the adjusting entry for Christine Gamba Cargo under each of the following for the year ending December 31, 2022: a. Paid P 24,000 for a 1-year fire insurance policy to commence on September 1. The amount of premium was debited to Prepaid Insurance. b. Borrowed P 100,000 by issuing a 1-year note with 7% annual interest to Century Savings Bank on October 1, 2022. c. Paid P 160,000 cash to purchase a delivery van (surplus) on January 1. The van was expected to have a 3-year life and a P 10,000 salvage value. Depreciation is computed on a straight-line basis. d. Received an P 18,000 cash advance for a contract to provide services in the future. The contract required a 1-year commitment, starting April 1. e. Purchased P 6,400 of supplies on account. At year's end, P 750 of supplies remained on hand. f. Invested P 90,000 cash in a certificate of deposit that paid 4% annual interest. The certificate was acquired on May 1 and carried a 1-year term to maturity. g. Paid P 78,000 cash in advance on September 1 for a 1-year lease on office space. Problem 2: Adjusting Entries and Accounting Policies The following are some of the transactions made by Cedric Naranjo Cleaners during 2022: April 1 August 1 November 1 Acquired cleaning supplies in the amount of P 260,000. A count of the supplies on December 31, 2022 amounted to P 110,000. Received P 360,000 from Cebu Manpower for cleaning janitorial uniforms over the next 3 years. Paid P 240,000 for annual rent. Required: 1. Assume that Naranjo records these transactions using the following accounts, record these transactions using the following accounts, record the adjusting entries on December 31, 2022: Office Supplies Prepaid Rent Unearned Cleaning Revenues 2. Now, assume that Nanjaro records these transactions using the following accounts, what will be the adjusting entries on December 31, 2022? Department of Accountancy College of Economics and Management Development Studies, Cavite State University, Don Severino Delas Alas Campus, Office Supplies Expense Rent Expense Cleaning Revenues Indang Cavite REPUBLIC OF THE PHILIPPINES CAVITE STATE UNIVERSITY Don Severino de las Alas Campus Indang Cavite, Philippines 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started