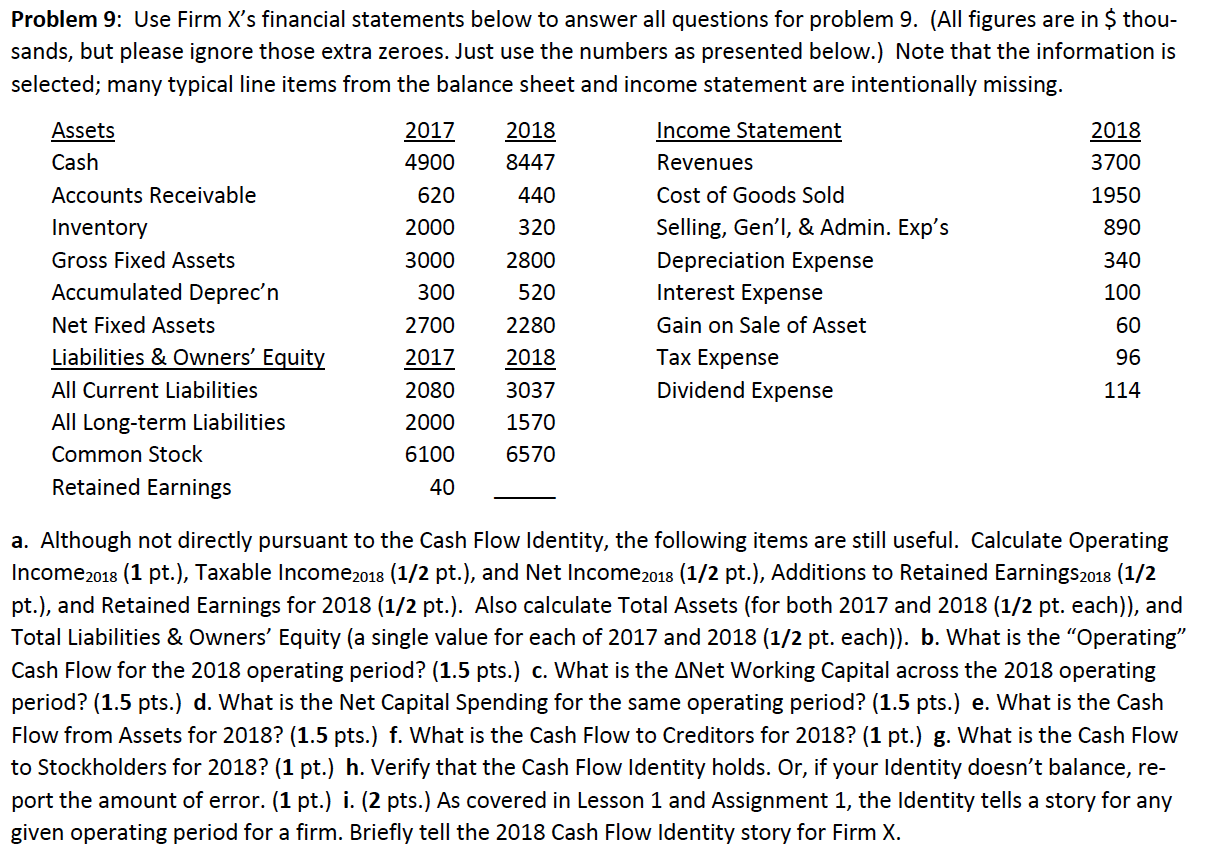

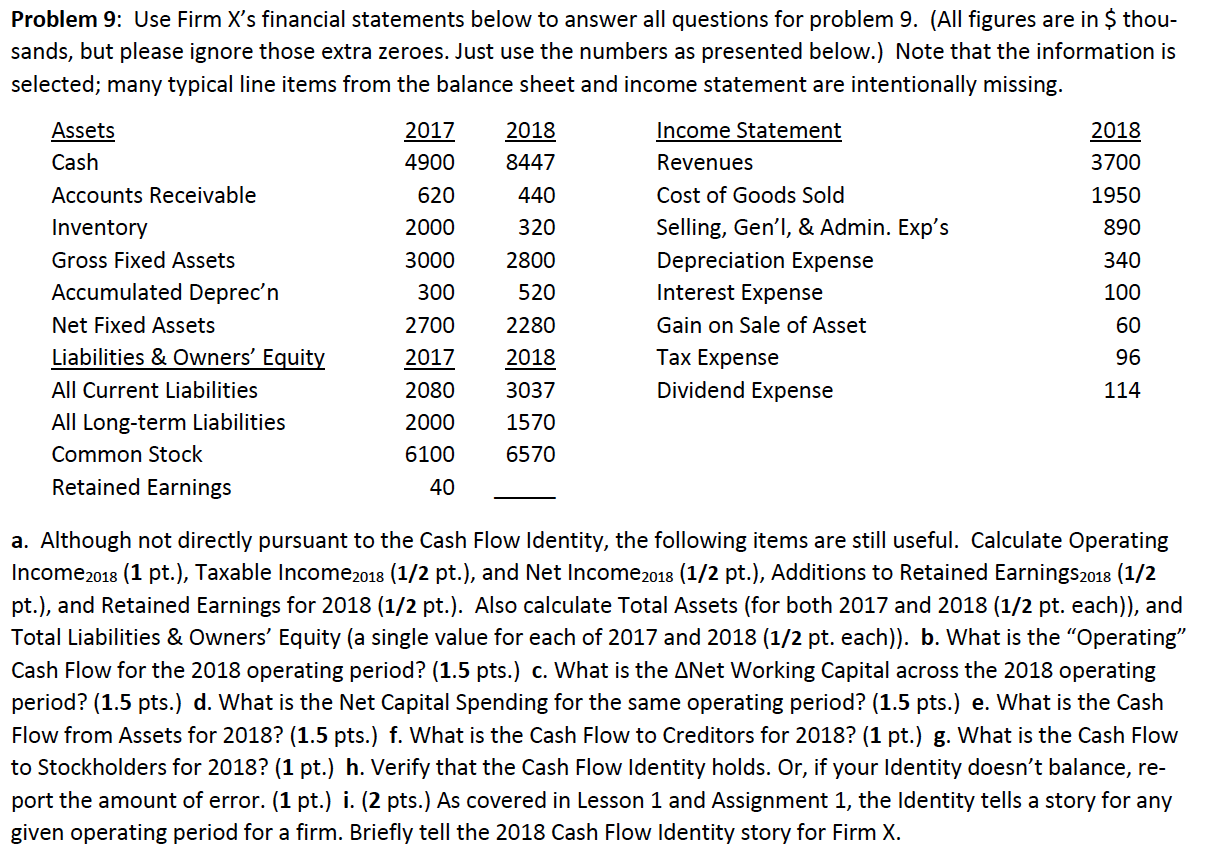

Problem 9: Use Firm X's financial statements below to answer all questions for problem 9. (All figures are in $ thou- sands, but please ignore those extra zeroes. Just use the numbers as presented below.) Note that the information is selected; many typical line items from the balance sheet and income statement are intentionally missing. Income Statement 2017 Assets 2018 2018 Cash 4900 8447 Revenues 3700 Accounts Receivable Cost of Goods Sold 620 440 1950 Selling, Gen'l, & Admin. Exp's Inventory 2000 320 890 2800 Gross Fixed Assets 3000 Depreciation Expense Interest Expense 340 Accumulated Deprec'n 300 520 100 Net Fixed Assets 2700 Gain on Sale of Asset 2280 60 Liabilities & Owners' Equity 2018 x Expense 2017 96 Dividend Expense All Current Liabilities 2080 3037 114 All Long-term Liabilities 1570 2000 Common Stock 6100 6570 Retained Earnings 40 a. Although not directly pursuant to the Cash Flow Identity, the following items are still useful. Calculate Operating Income2018 (1 pt.), Taxable Income2018 (1/2 pt.), and Net Income2018 (1/2 pt.), Additions to Retained Earnings2018 (1/2 pt.), and Retained Earnings for 2018 (1/2 pt.). Also calculate Total Assets (for both 2017 and 2018 (1/2 pt. each)), and Total Liabilities & Owners' Equity (a single value for each of 2017 and 2018 (1/2 pt. each)). b. What is the "Operating" Cash Flow for the 2018 operating period? (1.5 pts.) c. What is the ANet Working Capital across the 2018 operating period? (1.5 pts.) d. What is the Net Capital Spending for the same operating period? (1.5 pts.) e. What is the Cash Flow from Assets for 2018? (1.5 pts.) f. What is the Cash Flow to Creditors for 2018? (1 pt.) g. What is the Cash Flow to Stockholders for 2018? (1 pt.) h. Verify that the Cash Flow Identity holds. Or, if your Identity doesn't balance, re- port the amount of error. (1 pt.) i. (2 pts.) As covered in Lesson 1 and Assignment 1, the Identity tells a story for any given operating period for a firm. Briefly tell the 2018 Cash Flow Identity story for Firm X Problem 9: Use Firm X's financial statements below to answer all questions for problem 9. (All figures are in $ thou- sands, but please ignore those extra zeroes. Just use the numbers as presented below.) Note that the information is selected; many typical line items from the balance sheet and income statement are intentionally missing. Income Statement 2017 Assets 2018 2018 Cash 4900 8447 Revenues 3700 Accounts Receivable Cost of Goods Sold 620 440 1950 Selling, Gen'l, & Admin. Exp's Inventory 2000 320 890 2800 Gross Fixed Assets 3000 Depreciation Expense Interest Expense 340 Accumulated Deprec'n 300 520 100 Net Fixed Assets 2700 Gain on Sale of Asset 2280 60 Liabilities & Owners' Equity 2018 x Expense 2017 96 Dividend Expense All Current Liabilities 2080 3037 114 All Long-term Liabilities 1570 2000 Common Stock 6100 6570 Retained Earnings 40 a. Although not directly pursuant to the Cash Flow Identity, the following items are still useful. Calculate Operating Income2018 (1 pt.), Taxable Income2018 (1/2 pt.), and Net Income2018 (1/2 pt.), Additions to Retained Earnings2018 (1/2 pt.), and Retained Earnings for 2018 (1/2 pt.). Also calculate Total Assets (for both 2017 and 2018 (1/2 pt. each)), and Total Liabilities & Owners' Equity (a single value for each of 2017 and 2018 (1/2 pt. each)). b. What is the "Operating" Cash Flow for the 2018 operating period? (1.5 pts.) c. What is the ANet Working Capital across the 2018 operating period? (1.5 pts.) d. What is the Net Capital Spending for the same operating period? (1.5 pts.) e. What is the Cash Flow from Assets for 2018? (1.5 pts.) f. What is the Cash Flow to Creditors for 2018? (1 pt.) g. What is the Cash Flow to Stockholders for 2018? (1 pt.) h. Verify that the Cash Flow Identity holds. Or, if your Identity doesn't balance, re- port the amount of error. (1 pt.) i. (2 pts.) As covered in Lesson 1 and Assignment 1, the Identity tells a story for any given operating period for a firm. Briefly tell the 2018 Cash Flow Identity story for Firm X