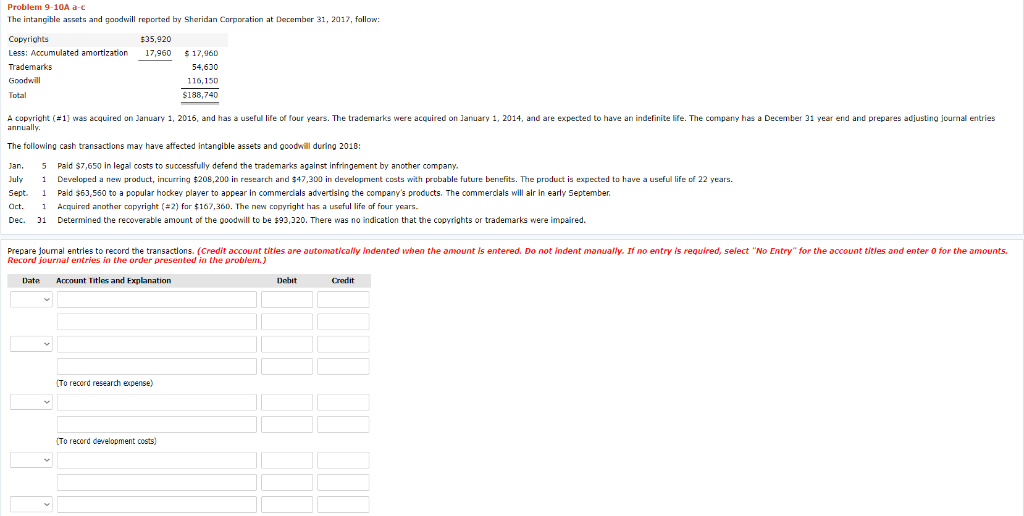

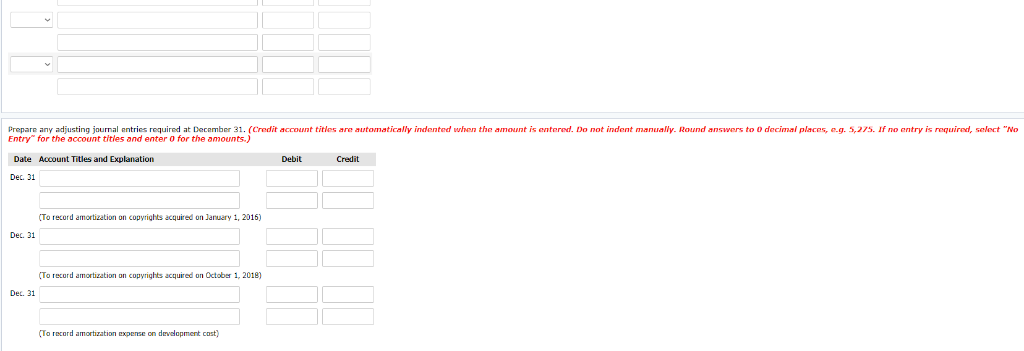

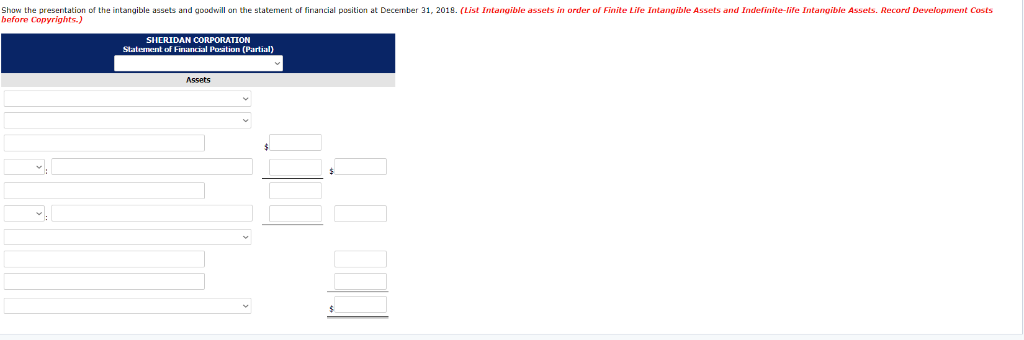

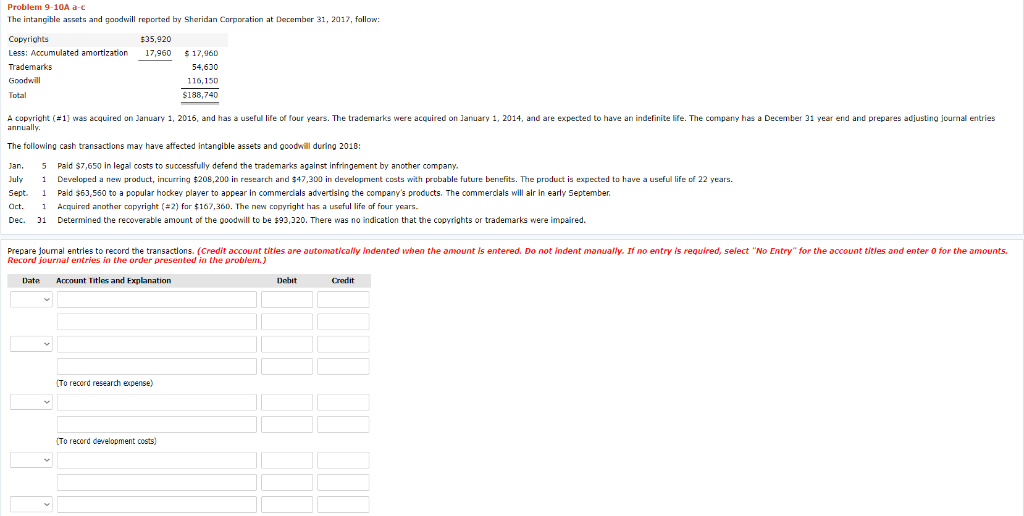

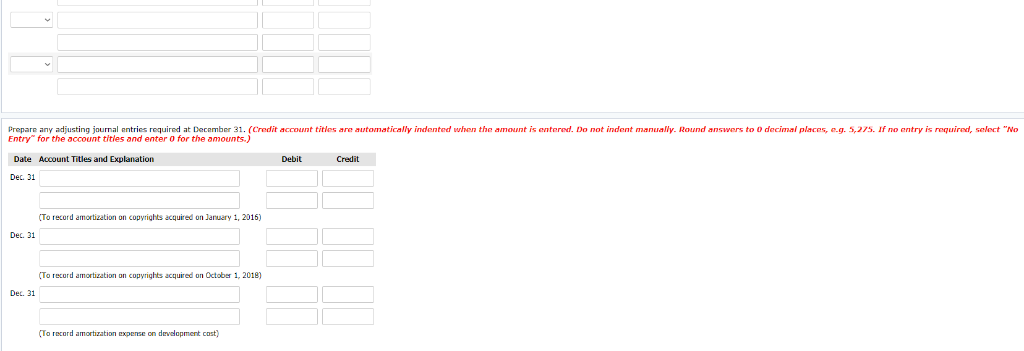

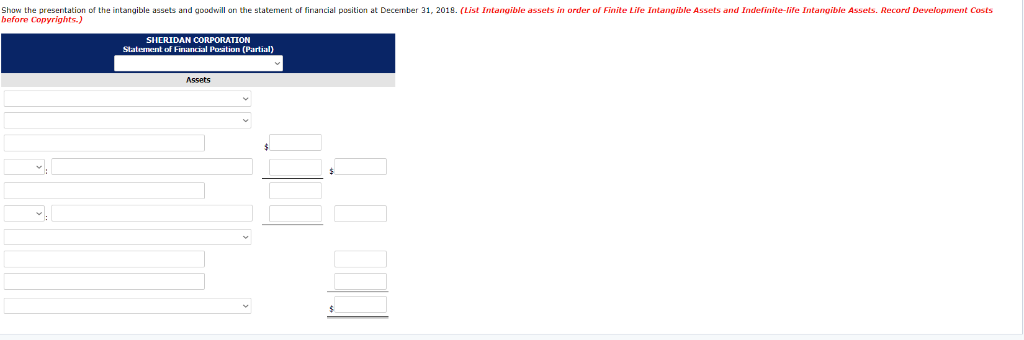

Problem 9-10A a-c The intangible assets and goodwill reported by Sheridan Corporation at December 31, 2017, follow: $35,920 17,960 Copyrights Less: Accumulated amortization Trademarks Goodwill $ 17,960 54,630 116,150 $188,740 Total A copyright (=1) was acquired on January 1, 2016, and has a useful life of four years. The trademarks were acquired on January 1, 2014, and are expected to have an indefinite life. The company has a December 31 year end and prepares adjusting journal entries annually. The following cash transactions may have affected intangible assets and goodwill during 2018: Jan. July Sept. Oct. Dec. 5 Paid $7,650 in legal costs to successfully defend the trademarks against infringement by another company. 1 Developed a new product, incurring $209,200 in research and $47,300 in development costs with probable future benefits. The product is expected to have a useful life of 22 years. 1 Pald $63,550 to a popular hockey player to appear in commerdals advertising the company's products. The commercials will air in early September 1 Acquired another copyright (+2) for $167,360. The new copyright has a useful life of four years. 31 Determined the recoverable amount of the goodwill to be $93,320. There was no indication that the copyrights or trademarks were impaired. Prepare joumal entries to record the transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account tities and enter o for the amounts. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit (To record research expense) (To record development costs) Prepare any adjusting journal entries required at December 31. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to decimal places, e.g. 5,275. If no entry is required, select "No Entry for the account tities and enter for the amounts.) Date Account Titles and Explanation Debit Debit Credit Dec 31 (To record amortization on copyrights acquired on January 1, 2016) Dec. 31 (To record amortization on copyrights acquired on October 1, 2018) Dec. 31 (To record amortization expense on development cost) Show the presentation of the intangible assets and goodwill on the statement of financial position at December 31, 2018. (List Intangible assets in order of Finite Life Intangible Assets and indefinite-life Intangible Assets. Record Development Costs before Copyrights.) SHERIDAN CORPORATION Statement of Financial Position (Partial) Assets