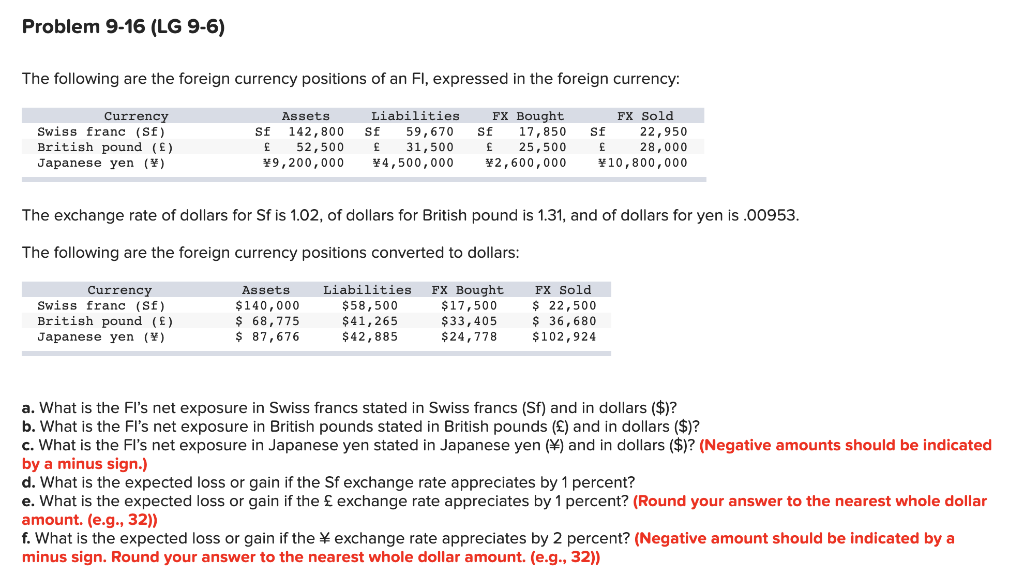

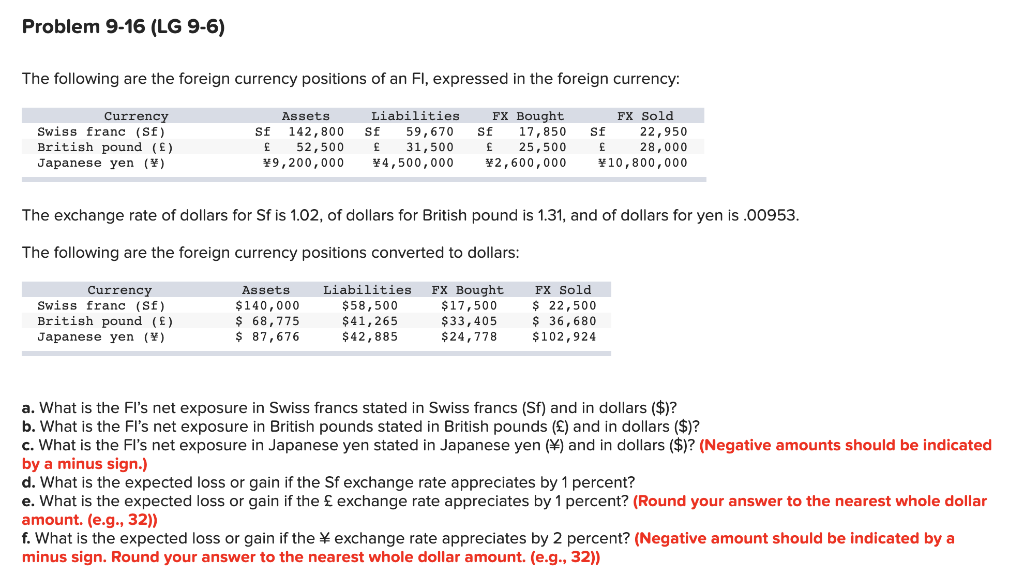

Problem 9-16 (LG 9-6) The following are the foreign currency positions of an FI, expressed in the foreign currency: Currency Swiss franc (Sf) British pound () Japanese Yen () Assets Liabilities Sf 142,800sf 59,670 52,500 31,500 9,200,000 4,500,000 FX Bought SE 17,850 25,500 2,600,000 FX Sold sf 22,950 28,000 10,800,000 The exchange rate of dollars for Sf is 1.02, of dollars for British pound is 1.31, and of dollars for yen is .00953. The following are the foreign currency positions converted to dollars: Currency Swiss franc (Sf) British pound () Japanese yen () Assets $140,000 $ 68,775 $ 87,676 Liabilities FX Bought $58,500 $ 17,500 $41, 265 $33,405 $42,885 $24,778 FX Sold $ 22,500 $ 36,680 $102,924 a. What is the Fl's net exposure in Swiss francs stated in Swiss francs (Sf) and in dollars ($)? b. What is the Fl's net exposure in British pounds stated in British pounds () and in dollars ($)? c. What is the Fi's net exposure in Japanese yen stated in Japanese yen () and in dollars ($)? (Negative amounts should be indicated by a minus sign.) d. What is the expected loss or gain if the Sf exchange rate appreciates by 1 percent? e. What is the expected loss or gain if the exchange rate appreciates by 1 percent? (Round your answer to the nearest whole dollar amount. (e.g., 32)) f. What is the expected loss or gain if the exchange rate appreciates by 2 percent? (Negative amount should be indicated by a minus sign. Round your answer to the nearest whole dollar amount. (e.g., 32)) Problem 9-16 (LG 9-6) The following are the foreign currency positions of an FI, expressed in the foreign currency: Currency Swiss franc (Sf) British pound () Japanese Yen () Assets Liabilities Sf 142,800sf 59,670 52,500 31,500 9,200,000 4,500,000 FX Bought SE 17,850 25,500 2,600,000 FX Sold sf 22,950 28,000 10,800,000 The exchange rate of dollars for Sf is 1.02, of dollars for British pound is 1.31, and of dollars for yen is .00953. The following are the foreign currency positions converted to dollars: Currency Swiss franc (Sf) British pound () Japanese yen () Assets $140,000 $ 68,775 $ 87,676 Liabilities FX Bought $58,500 $ 17,500 $41, 265 $33,405 $42,885 $24,778 FX Sold $ 22,500 $ 36,680 $102,924 a. What is the Fl's net exposure in Swiss francs stated in Swiss francs (Sf) and in dollars ($)? b. What is the Fl's net exposure in British pounds stated in British pounds () and in dollars ($)? c. What is the Fi's net exposure in Japanese yen stated in Japanese yen () and in dollars ($)? (Negative amounts should be indicated by a minus sign.) d. What is the expected loss or gain if the Sf exchange rate appreciates by 1 percent? e. What is the expected loss or gain if the exchange rate appreciates by 1 percent? (Round your answer to the nearest whole dollar amount. (e.g., 32)) f. What is the expected loss or gain if the exchange rate appreciates by 2 percent? (Negative amount should be indicated by a minus sign. Round your answer to the nearest whole dollar amount. (e.g., 32))