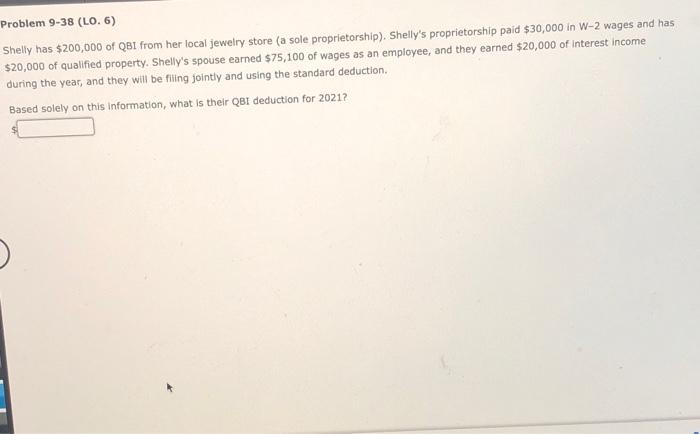

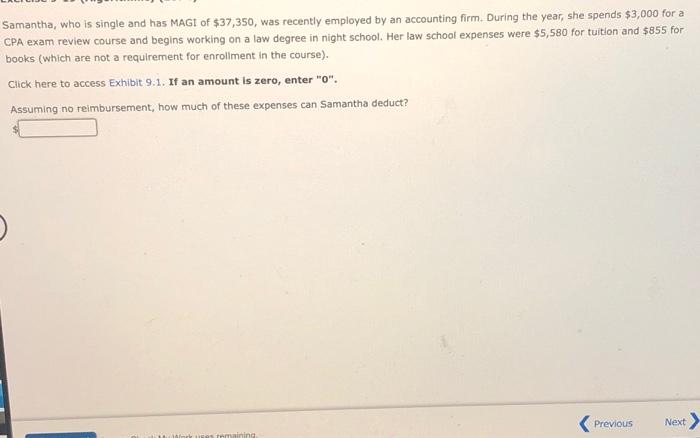

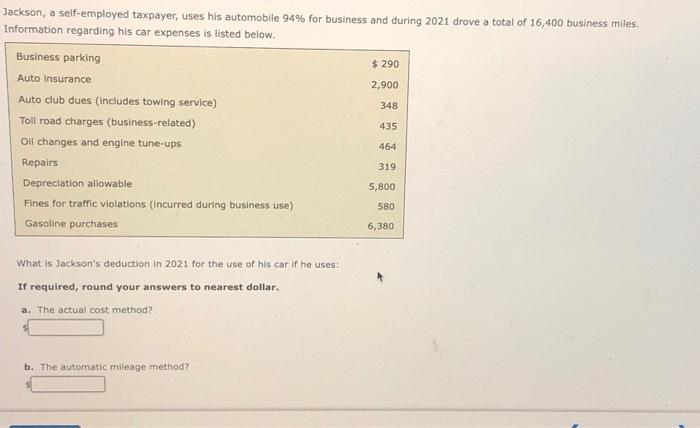

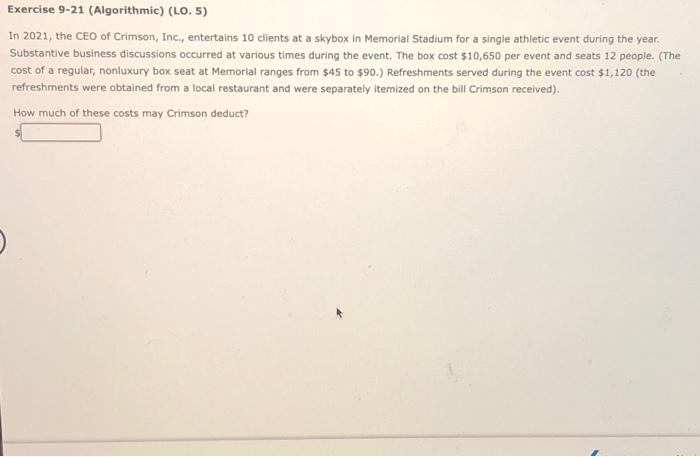

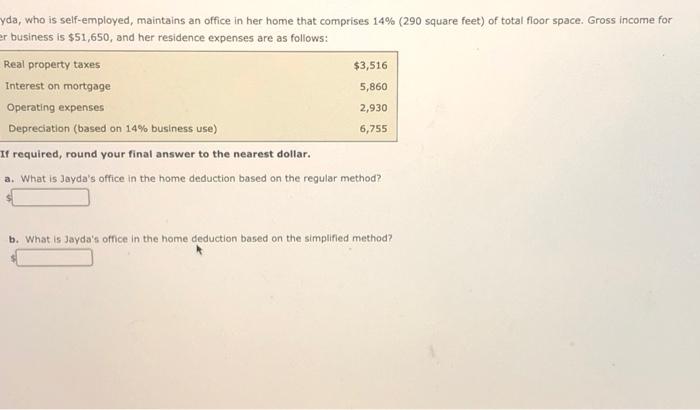

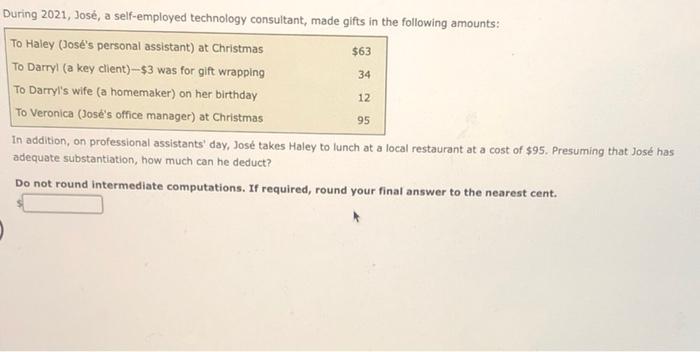

Problem 9-38 (LO. 6) Shelly has $200,000 of QBI from her local jewelry store (a sole proprietorship). Shelly's proprietorship paid $30,000 in W-2 wages and has $20,000 of qualified property. Shelly's spouse earned $75,100 of wages as an employee, and they earned $20,000 of Interest income during the year, and they will be filing jointly and using the standard deduction Based solely on this information, what is their Qer deduction for 2021? Samantha, who is single and has MAGI of $37,350, was recently employed by an accounting firm. During the year, she spends $3,000 for a CPA exam review course and begins working on a law degree in night school. Her law school expenses were $5,580 for tuition and $855 for books (which are not a requirement for enrollment in the course). Click here to access Exhibit 9.1. If an amount is zero, enter "O". Assuming no reimbursement, how much of these expenses can Samantha deduct? Previous Next mining 348 Jackson, a self-employed taxpayer, uses his automobile 94% for business and during 2021 drove a total of 16,400 business miles. Information regarding his car expenses is listed below. Business parking $ 290 Auto insurance 2,900 Auto club dues (includes towing service) Toll road charges (business-related) Oil changes and engine tune-ups Repairs Depreciation allowable 5,800 Fines for traffic violations (incurred during business use) Gasoline purchases 6,380 435 464 319 580 What is Jackson's deduction in 2021 for the use of his car if he uses: If required, round your answers to nearest dollar. a. The actual cost method? b. The automatic mileage method? Exercise 9-21 (Algorithmic) (LO.5) In 2021, the CEO of Crimson, Inc., entertains 10 clients at a skybox in Memorial Stadium for a single athletic event during the year. Substantive business discussions occurred at various times during the event. The box cost $10,650 per event and seats 12 people. (The cost of a regular, nonluxury box seat at Memorial ranges from $45 to $90.) Refreshments served during the event cost $1,120 (the refreshments were obtained from a local restaurant and were separately itemized on the bill Crimson received). How much of these costs may Crimson deduct? yda, who is self-employed, maintains an office in her home that comprises 14% (290 square feet) of total floor space. Gross income for er business is $51,650, and her residence expenses are as follows: Real property taxes $3,516 Interest on mortgage 5,860 Operating expenses 2,930 Depreciation (based on 14% business use) 6,755 If required, round your final answer to the nearest dollar. a. What is Jayda's office in the home deduction based on the regular method? b. What is Jaydo's office in the home deduction based on the simplified method? 34 During 2021, Jos, a self-employed technology consultant, made gifts in the following amounts: To Haley (Jose's personal assistant) at Christmas $63 To Darryl (a key client)--$3 was for gift wrapping To Darryl's wife (a homemaker) on her birthday To Veronica (Jose's office manager) at Christmas In addition, on professional assistants' day, Jos takes Haley to lunch at a local restaurant at a cost of $95. Presuming that Jos has adequate substantiation, how much can he deduct? Do not round Intermediate computations. If required, round your final answer to the nearest cent. 12 95